Fitch Ratings has affirmed Greece’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘BB’ with a Positive Outlook.

Greece has high income per capita that far exceeds both the ‘BB’ and ‘BBB’ medians. Governance scores and human development indicators are among the highest of sub-investment grade peers. These strengths are set against still very high levels of non-performing loans (NPL) and very large stocks of public and external debt. The Positive Outlook reflects a sustained expected decline in public sector indebtedness, in the context of still low average borrowing costs, despite the sharp rise in government bond yields this year. Greek banks have made substantial progress on asset quality improvement, sharply reducing the level of NPLs in the banking sector.

High Public Indebtedness, Mitigants: Government debt as a share of GDP declined to 193.3% by end-2021, and is projected to fall further to 171.6% by 2024, driven by improving primary balances and favourable growth-interest costs dynamics. Despite this decline, the debt ratio in 2024 is still forecast to be among the highest of Fitch-rated sovereigns, and more than 3x the ‘BB’ median. At the same time, there are mitigating factors that support debt sustainability. Greece’s liquid asset buffer is substantial (forecast to be 14.5% of GDP at year-end). The concessional nature of the majority of Greek sovereign debt means that debt-servicing costs are low and amortisation schedules are manageable.

Government bond yields have risen sharply this year, with the 10-year bond yield increasing from around 1.3% at end-2021 to average around 4.0% in June 2022. However, the interest-to-revenue ratio should rise only moderately (to 6% in 2024) and remain well below the ‘BB’ median (forecast at 10% in 2024). The average maturity of Greek debt is among the longest of any sovereign, at around 20 years. Moreover the debt is mostly fixed rate, limiting the impact of market interest rate rises.

Deficit Decline, Government Support: The government deficit declined to 7.4% of GDP in 2021 from 10.2% in 2020, a faster decline than we expected at the time of the last review (when we expected a deficit of 9.7%). We expect the deficit to fall further this year, to 4.5% of GDP, but at a slower pace than previously forecast. The decline in the deficit will be slowed by the worsened macroeconomic outlook and government support to mitigate the impact of the rise in energy prices, which the government assumes will add around 1.4% of forecast GDP to the deficit in 2022 (around two-thirds of the support in gross terms will be recouped by the Emission Trading System and a windfall tax on utilities). The deficit will decrease at a sharper pace over the following two years, on the assumption that government support related to energy prices is unwound to 1.8% of GDP by 2024 (‘BB’ median forecast: 3.0%).

War Worsens Macroeconomic Outlook: The Greek economy expanded by 8.3% in real terms in 2021. However, the macroeconomic outlook has worsened considerably in recent months, with the Russian invasion of Ukraine exacerbating the rise in energy prices and affecting business and consumer confidence, and high inflation impacting real incomes and consumption dynamics. Direct trade links (including tourism) between Greece and Russia and Ukraine are small. However, Greece relies on Russia for around 40% of overall gas imports, and is vulnerable to further price rises and potential energy supply disruptions.

Other factors will support the economic outlook. The deployment of funds related to Greece’s National Recovery and Resilience Plan will accelerate this year, boosting government investment and overall demand, and tourism indicators point to a further recovery in the sector. We have revised down our real GDP growth forecast for this year to 3.5%, from 4.1% at the January review, and our forecast for 2023 (3.2% compared with 4.0% previously). For 2024, we expect a further, moderate slowdown in economic growth to 2.8%.

Latest News

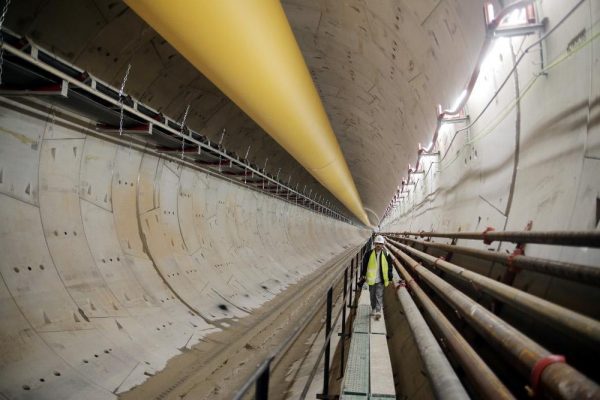

Study Shows Athens Traffic Congestion Up

On average, car drivers and their passengers who venture out onto Greater Athens’ roads will spend roughly half an hour in the vehicle to cover a distance of 10 kilometers

Judge Blocks Elon Musk’s Team from Accessing Treasury Payment System

Judge blocks Elon Musk’s team from Treasury access over security risks and potential misuse of federal payment data.

Make Europe Great Again in Madrid

Far-right leaders rally in Madrid to 'Make Europe Great Again

Seismologists Cautiously Optimistic as Aegean Earthquake Activity Evolves

Seismologists grow increasingly optimistic as Aegean earthquake activity shows signs of decline

Earthquakes Continue to Shake the Cyclades, Experts Monitor Declining Activity

Ongoing earthquakes rattle Greece's Cycladic islands, but experts believe activity may be slowing.

Santorini Earthquakes Might Affect Greek Tourism Revenue: NBG Report

The areas directly affected by the tremors account for approximately 4% of both the country's annual tourism revenues and the total annual turnover in the accommodation and food service sectors

Greek Trade Deficit Surges to €34.6 Billion in 2024 Amid Export Decline

Conversely, numbers indicate that exports declined, totaling to 49.90 billion euros in 2024, down from 51.02 billion euros in 2023 marking a 2.2% decrease.

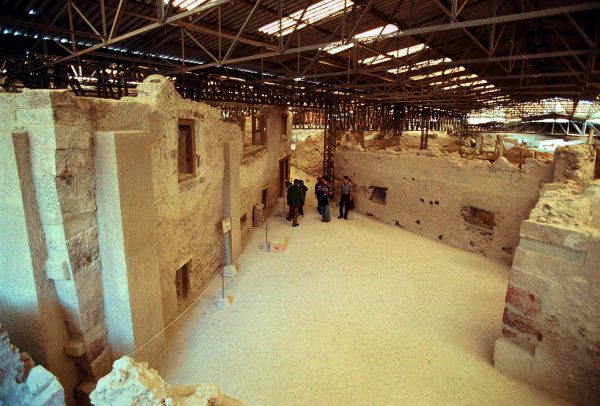

Culture Ministry Takes Action to Protect Santorini’s Antiquities

So far, no damage has been reported to the island’s cultural heritage, with exhibits already safeguarded. Meanwhile, the Greek Ministry of Culture held an emergency meeting on February 6.

How Many Tourists Visit Santorini Each Year?

As Santorini continues to shake with earthquakes, one big concern is what these quakes will mean for the island’s tourist season.

Santorini Earthquakes Might Affect Greek Tourism Revenue: NBG Report

The areas directly affected by the tremors account for approximately 4% of both the country's annual tourism revenues and the total annual turnover in the accommodation and food service sectors

![Λογαριασμοί ρεύματος: Φθηνότερα τα μπλε και από τα επιδοτούμενα πράσινα τιμολόγια [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/02/07_02_ot_reyma_epid_ΕΧΟ-90x90.png)

![Αεροδρόμια: Οι πιο δημοφιλείς προορισμοί για τους ξένους τουρίστες [γράφημα]](https://www.ot.gr/wp-content/uploads/2023/05/el.venizelos_aerodromio_680562846-1-90x90.jpg)

![Τουρισμός: Ιούλιος, ο «καλύτερος» μήνας του 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/01/tourismos-90x90.jpg)

![Σαντορίνη: Πόσο μπορούν να πλήξουν τα Ρίχτερ τα τουριστικά έσοδα της χώρας [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/02/07_02_ot_toyrist_ESODA_EXO-90x90.png)

![Aκίνητα: Οι top περιοχές στην Ελλάδα για «πλούσια πορτοφόλια» [πίνακες]](https://www.ot.gr/wp-content/uploads/2023/09/akinitaagora-1-600x337.jpg)

![Επενδύσεις: Πόσο στηρίζουν το ελληνικό ΑΕΠ – Τι δείχνει μελέτη της Alpha Bank [γραφήματα]](https://www.ot.gr/wp-content/uploads/2023/12/ot_artificial_ependyseis-600x352.png)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433