The return of the debt to GDP ratio to a downward trajectory following the coronavirus shock, the improvement of the medium-term growth prospects after the pandemic, and the recent progress in the improvement of the quality of the banks’ assets are leading to the upgrade of Greece’s creditworthiness, according to a new Fitch report.

In anticipation of the next Greek ratings report by Fitch on July 16 and after the upgrade of S&P, which raises expectations for moves by other rating agencies, analysts confirm their forecasts for growth of 3% this year and 7.6% for 2022.

As the agency notes, the current assessment of Greece, BB with stable prospects, reflects the relatively high per capita income and the high “scores” of governance in the relevant Fitch list.

This contrasts with the weak growth potential, an extremely high level of non-performing loans in the banking sector and the very high stock of public and external debt.

Strong resurgence in the next 2 years

Fitch also stresses that it expects a strong economic recovery in Greece over the next two years despite last year’s recession, estimating that there will be a significant easing of the global pandemic crisis after the start of vaccination programs and the disbursement and absorption of funds from the EU Recovery Facility.

In the medium term, effective structural reforms and continued higher EU funding could boost the growth of the Greek economy, the agency said, adding that risks include the long-term effects of the pandemic, of business bankruptcies, and higher job losses compared to what it expects.

The greatly reduced tourist arrivals had a significant impact on the current account with the deficit widening to 6.7% of GDP in 2020 from 1.5% in 2019. However, the agency, as it states, expects a gradual reduction of the deficit in the next two years .

Deficit reduction

According to Fitch, political support and lower economic activity suggest that the general government balance has shifted from a surplus in 2019 to a deficit of 9.7% in 2020.

The recovery over the next two years will reduce the deficit to 4% in 2022. It also estimates that general government debt to GDP will fall to 192.5% by the end of 2022 after rising to 206.3%. of GDP in 2021. In terms of growth, it maintains its estimate for the rise of the Greek economy by 7.6% in 2022 from 3% growth this year.

Pressure in Greece will be exerted by the possible failure to reduce the debt to GDP ratio, the negative developments in the banking sector that will increase the risk to public finances and the real economy, as well as indications that the pandemic will ultimately have a long-term impact on the Greek economy and its medium-term development.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

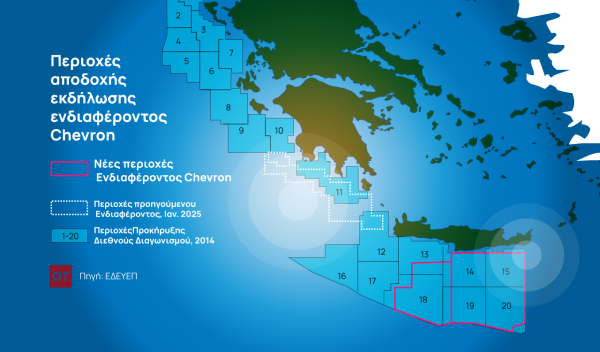

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης