“Now is the time to do it all.” This phrase – the gist of the recent meeting of the Prime Minister Mr. K. Mitsotakis with the Governor of the Bank of Greece Mr. I. Stournaras, on Holy Monday – summarizes the policy of the government of the coming months.

“We can achieve a robust recovery”

The impetus for a dynamic shift in the economy was provided by the successful, at times particularly uncertain, increase of the share capital of the long-suffering Piraeus Bank by approximately 1.4 billion euros and the certainty that the Recovery Fund now functions as a strong and internationally accepted guarantee for the upcoming renaissance of the Greek economy.

Mr. Mitsotakis, after reviewing and evaluating the domestic and international economic conditions with Mr. Stournaras, now states confidently that after the pandemic “we can achieve a robust recovery”, “capable of changing the entire structure of the Greek economy” and create the conditions for a strong ten-year growth leap.”

The Prime Minister, although he does not hide the weight of the current pandemic period, acknowledging that May will be a difficult month, firmly believes that “the health adventure, mainly through mass vaccinations, is coming to an end” and further estimates that “both society as well as the economy are now moving out of COVID-19 “, show, or rather, behave as if they have overcome any negative impact of the pandemic phenomenon and the dangers that it carries.

The government, insisting on full control of the health crisis, will undertake a dynamic reform shift in order to make the most of the Recovery Fund opportunities.

Reform shift

Based on these estimates, the government, insisting on the absolute control of the health crisis, will attempt a dynamic reform shift in order to make the most of the Recovery Fund opportunities, but also to take advantage of the endless financial possibilities currently offered by international markets, as proven by the easy over-coverage of the share capital increase of the most difficult Greek case.

The CEO of Piraeus Bank Chr. Megalou does not hide the fact that all the previous period he had engaged in a struggle to inform international investors exactly about the possibilities and opportunities offered by the Recovery Fund to the Greek economy. And he believes that many were judged by the reliability of this pan-European tool, but also by the bank’s plan for rapid impairment of non-performing loans.

When Mr. Megalou and the financial advisor of the Prime Minister Mr. Al. Patelis was inspired by the nationalization and rapid revitalization plan of Piraeus Bank, everything seemed precarious and dangerous. The result now showed the correctness of the choice. At this moment, Piraeus Bank has acquired the funds and the time it needed to unfold its ambitious consolidation plan, within the next twelve months.

Market financing

The systemic risk has subsided and other banks can also draw more resources from international markets to make it easier to finance the private investment projects envisaged by the Recovery Fund, but also the economy as a whole. Mr. F. Karavias of Eurobank has already taken the first step by raising about 500 million euros with an interest rate of only 2% from the international market, while Mr. V. Psaltis of ALPHA BANK is preparing his own plan to strengthen the bank. The aim of all of them is to consolidate quickly and to be endowed with sufficient funds, in order to start playing their main role again, which is none other than that of business financing and investments.

The Governor of the Bank of Greece believes that after the successful venture of Piraeus and the unexpected upgrade of the Greek economy by S&P, there is a great opportunity for the State, banks and companies “to shield themselves, raising significant funds from the markets on absolutely advantageous terms, with almost zero interest rates “. He adds with emphasis that “we have one year until March 2022, to take advantage of the opportunities offered by the European Central Bank and international markets, in order to adequately and cheaply finance our economy.” According to Mr. Stournaras, “the environment is suitable for large moves” and estimates that “it can become more favorable if the estimates for a rapid recovery in 2021 and 2022 are confirmed”. That is why he urges the government to “unfold the reforms now” in order to further strengthen the post-pandemic effort to rebuild and reorganize the country.

With a foot on the gas pedal

The Prime Minister, for his part, commends the plan tendered on Holy Tuesday to Brussels, a Greek plan for the Recovery Fund, considers its proposals realistic and costly and firmly believes that it creates the conditions for the claimed growth leap. That is why he pays tribute to the Deputy Minister of Finance, Mr. Th. Skylakakis, and seems to have fully absorbed the idea of accelerating everything, especially the reforms that support and strengthen his forecasts.

Mr. Mitsotakis considers the situation particularly favorable as the high public debt does not pose a threat and we are not expected to return to austerity policies. He also argues that the political dangers have almost vanished, the opposition has difficulty understanding the situation and therefore its influence, as shown in opinion polls, remains limited and incapable of raising major issues or forming important areas of controversy. He further states that he is committed to the work of post-pandemic reconstruction and will not be tempted by early elections, but will use the time at his disposal to reorganize the country.

Crucial bills in Parliament

Thus, the PM does not hide that in the next period, after the Easter holidays, critical bills will come to Parliament for consultation and voting, such as the labor bill and the one introduced by the capitalization system in supplementary pensions. Mr. Mitsotakis considers the criticism of the main opposition party for the changes in the labor force groundless, as he considers the labor market unregulated and de facto disorganized during the years of the great economic crisis and notes the need to face modern challenges, such as telework and of disconnecting home workers from computers. He also estimates that the capitalization system that will be offered as an option to new employees will immediately lead to an accumulation of savings funds which will be invested, with principles and rules, in the Greek economy and will add opportunities to try to fill the investment gap.

The tool we did not have…

It is clear from the above that the Prime Minister is trying to make combined use of the post-pandemic conditions in order to maximize the result. The PM supports the Recovery Fund, as he sees it as the tool we did not have and acquired because of the pandemic, and wants to make it more attractive through reforms and at the same time accelerate the consolidation of banks in order to regain their role, take risk again and be able to adequately finance growth, in particular to reconnect with the thousands of small and medium-sized enterprises that have survived on their own resources and forces all these years, as they have been excluded from the near-bankrupt banking system. This is the sequence of choices and this post-pandemic pattern of government policy. It remains to be seen whether he will adhere to it with due consistency and whether he will bring the expected results.

Latest News

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

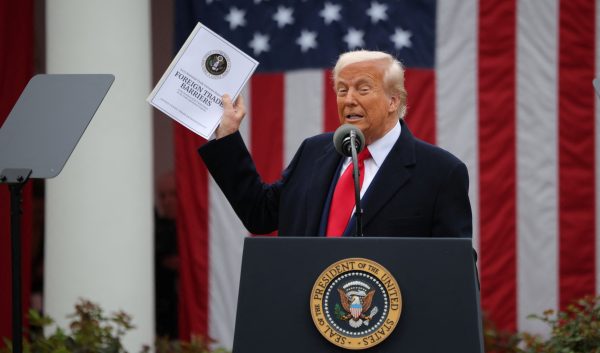

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

Santorini Safe and Ready for a Dynamic Tourism Season

Authenticity, cultural heritage, and genuine experiences at the center of Santorini's new promotional campaign

Electricity Bills: Greece Announces Reduced Tariffs Schedule

Greece will now offer lower electricity rates between 11:00-15:00 and 02:00-04:00

Chevron Confirms Eyeing Natural Gas Exploration South of Crete

Chevron recently declared its intent to explore a third area, south of the Peloponnese.

![Τουρκία: Μεγάλες βλέψεις για παραγωγή ηλεκτρικών οχημάτων [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/03/ot_turkish_autos-90x90.png)

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης