The Greek economy has recorded a global record as it has the strongest support in dealing with the pandemic reaching a total of 32.1% of its GDP, if we take into account both fiscal interventions and the resources of the Recovery Fund, according to estimates by Bert Colijn, Senior Economist, Eurozone, ING.

Greece even leaves the USA in second place, as its interventions reach 25.5% of GDP (excluding the new measures), although the impact on the Greek economy will be much lower, as in the part of the national Recovery Plan that concerns Loans there are private financing commitments that are not guaranteed, while Italy ranks third with interventions corresponding to 21.9% of GDP.

However, US support has a direct impact on its economy compared to Greece or Italy, while overall Recovery Fund resources, together with national contributions, represent 12.4% of Eurozone GDP, which means funding is 50% lower than in the. USA. The Greek Recovery Plan is considered balanced, as it includes disbursements in other sectors besides the green and digital transition, which are the main pillars of the Next Generation EU. However, EU countries are not expected to use all the funds of the Recovery Fund, as so far 433 billion euros have been requested from the money they are entitled to (806 billion euros in current prices).

The end of the recession

Meanwhile, in a separate report, ING estimated that the end of the recession in the Eurozone (and Greece) has already come, predicting that after a technical recession in the first quarter of 2021, the economies of the euro area as well as the Greek economy will recover significantly in the coming quarters.

With the gradual opening of most of the eurozone economies expected in mid-May, in addition to the best expectations for travel and tourism, which are of interest to Greece, part of the savings accumulated due to lockdowns is projected to be directed towards consumption which will could also be the driving force behind the recovery in the euro area.

For ING, the first increase in euro interest rates is not expected before the second half of 2023, while it estimates that the ECB will not extend the “pandemic QE”, the emergency securities market program (PEPP) in which Greek bonds also participate, while it does not rule out that bond markets will take place under the “traditional” securities market program (APP) in order for the end of the quantitative easing to take place gradually.

However, Greece cannot participate in the APP (at least based on the current regulations), as it does not have the famous “investment grade” which it is expected to get by the end of 2022 or the beginning of 2023. However, making Greek debt eligible for long-term international capital officially (based on current statutes), something that will happen once the country acquires the “investment grade”, signifying among other things, that there will be no need to maintain the huge “Liquidity cushion” that it maintains and which costs about 500 million euros per year.

The chief economist of the ECB (P. Lane) expects that the strengthening of inflation in the euro area will not be excessive and estimates that the monetary support from the ECB will be necessary at least until March 2022, in order to maintain favorable financial conditions. Wood, meanwhile, forecasts 3.5% growth in 2021 and 5.3% in 2022 for the Greek economy, estimating that the domestic market could enter an upward cycle, finding support from the Recovery Fund resources, the stable political environment with a market-friendly government, the clearing of the banking sector’s balance sheets, but also the investment opportunities in non-financial sectors.

Latest News

PM Meloni Meets Vice President Vance in Rome Signalling Optimism on Ukraine Talks

Meloni emphasized the strength and strategic value of the Italy-U.S. partnership.

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

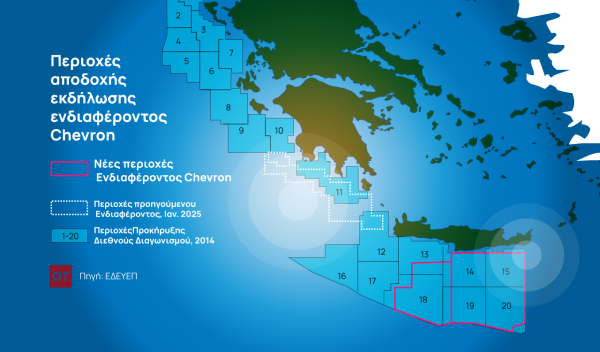

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης