The roadmap for the strengthening of Alpha Bank at all levels was presented on Monday by CEO Vassilis Psaltis, after the announcement of the bank that it is proceeding with a capital increase of 800 million euros.

We are talking about the project codenamed “Project tomorrow”, the main objectives of which are the complete consolidation of the bank’s balance sheet, enhancing revenue and profitability and finally the distribution of dividends from 2023 to its shareholders.

Specifically, with its completion by 2024, the following is expected to be achieved:

Annual net profits of 600 million euros

Yield to tangible book value at 10%

Reduction of non-performing loans ratio to 2%

The whole plan

To achieve these goals, Alpha Bank’s plan consists of 5 main pillars:

Reduction of NPLs

Based on the revised plan to reduce red loans, by the end of 2022 transactions of 8.1 billion euros will have been made, reducing the NPE index to 5%.

An additional 1.1 billion euros will be traded by 2024, reducing the index to 2%.

Rationalization of operating costs

The goal is to reduce operating expenses by 15% by 2024, so that the cost-to-income ratio falls below 45%.

This will be possible by reducing the cost of core activities, but also by reducing by 75% the management costs associated with NPLs

Increase in revenue from fees and commissions

Their annual growth rate is projected until 2024 of the order of 9% of income from fees and commissions, with significant support from sales in the field of investment management and insurance products.

Revenue boost by increasing assets

The goal is for the net new loans, under the Recovery Fund, to reach 10 billion euros by 2024, leading to an increase in the bank’s assets and net income.

Development of international activities

Great emphasis is given to the development of activities in the Romanian market, where Alpha Bank has a presence, as the percentage of loans in terms of GDP in the country reaches only 24% compared to 79% in Greece.

In this way it is estimated that the group’s revenues from abroad will correspond to 10% of total revenues, having a catalytic effect on its profitability.

NPEs trades

According to the bank’s presentation, the transactions through which 8.1 billion euros of non-performing loans will be derecognized are the following:

Cosmos: 3.50 billion euros – Completion of the second half of 2021 (securitization)

Orbit: 1.30 billion euros – Completion of the second half of 2021 (sale)

Sky: 2.20 billion euros – Completion of the first half of 2022 (sale of loans in Cyprus)

Solar: 0.4 billion euros – Completion of the first half of 2022 (securitization)

Other transactions: 0.7 billion euros – Completion of the first half of 2022

Digital transformation

Alpha Bank’s plan also envisages significant investments in IT infrastructure, with the aim of increasing online sales. This will reduce operating costs and free up human resources for its use in promoting high value-added products for the bank. For this reason, the project budget envisages investments of 270 million in digital infrastructure. Thus, it will be possible for even a loan to be approved exclusively through electronic transactions.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

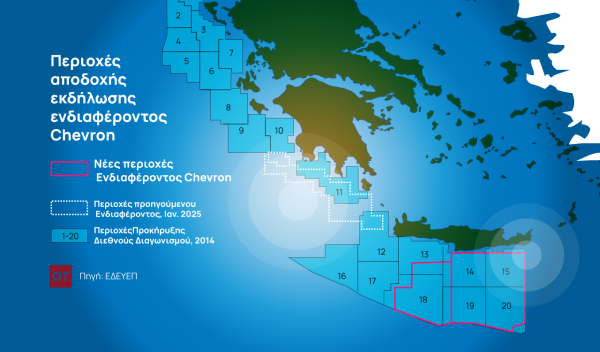

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης