![DBRS: The resilience of the Greek real estate market [charts]](https://www.ot.gr/wp-content/uploads/2021/07/akinita-1.jpg)

The real estate market in Greece showed resilience in 2020, despite the economic shock caused by the pandemic crisis.

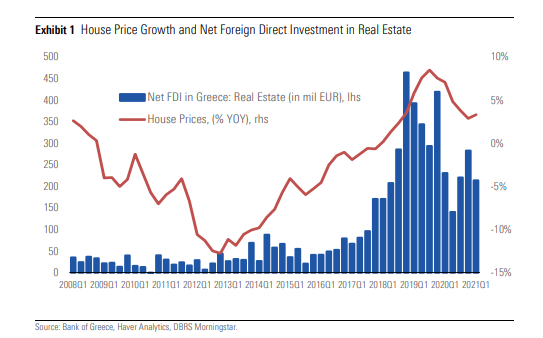

As DBRS comments in its analysis, after the cumulative increase of 9.2% in the period 2018-2019, the increase in house prices slowed down in 2020 due to travel restrictions and other measures for the coronavirus, but price performance remained positive, at 4.6%.

See the study here.

Despite the imposition of restrictive measures in the first quarter of 2021, preliminary data from the Bank of Greece show that house prices continued to rise at a rate of 3.3% per year.

The Greek real estate market is highly dependent on foreign investment, resulting in large price increases in Athens and other popular tourist destinations.

In contrast, prices and transactions in other areas of Greece that are of limited investment interest, although likely to benefit from the effects of “overflow”, are still low.

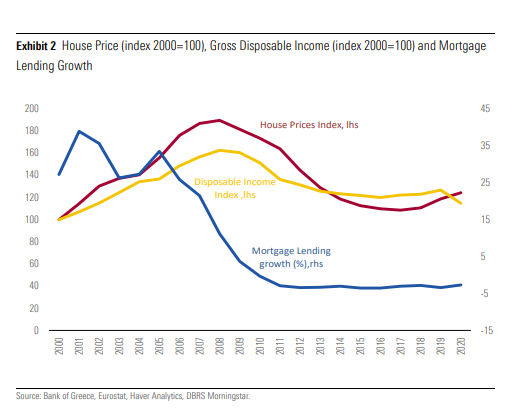

DBRS estimates in the long run that the development of the real estate market as a whole will depend on Greece’s ability to create jobs and promote policies to support real income growth, while maintaining a stable macroeconomic environment to attract foreign investment.

Specifically, prices in the housing market increased by an average of 4.6% in 2020 and by 3.3% on an annual basis in the first quarter of 2021.

The increase in prices in Athens and Thessaloniki was more intense, reaching 7.6% and 4.8% in 2020 and 5.4% and 3.7% in the first quarter of 2021, respectively, while prices in other cities remained unchanged, according to preliminary data published by the Bank of Greece.

Despite travel restrictions in 2020, increased demand from foreign buyers before the pandemic and the expectation that COVID-19 pandemic restrictions would be temporary prevented a further decline. The construction activity, as measured by the number of building permits, continued with an upward trend, increasing by 8% in 2020 and by 13.7% in the first quarter of 2021.

Prices in areas of the country with low investment interest remain in recession. Clear and strong government support is evidenced by recent legislative interventions, which include reduced taxes on renovation costs, a three-year VAT suspension on new building permits, an adjustment to fair values that could efforts to reduce bureaucracy and improve efficiency in public administration, which could improve planning and speed up sales.

Other policies include the Non-Dom scheme, which was introduced last year and provides tax incentives to those willing to move their tax residence to Greece. In addition, banks’ efforts to clear their balance sheets will boost credit expansion and, therefore, demand. However, mortgages remain low and are likely to remain so.

DBRS estimates that the long-term prospects for the market as a whole will depend on Greece’s ability to recover from the COVID-19 crisis and maintain a stable macroeconomic and political environment

Latest News

Eurozone Inflation Eases to 2.2% in March

Compared to February, inflation decreased in 16 member states, remained unchanged in one, and rose in ten.

Bank of Greece: Primary Gov. Surplus €4.1b Jan.-March 2025

The data released today by the Bank of Greece revealed that the central government’s overall cash balance recorded a surplus of €1.465 billion in the first quarter of 2025, compared to a deficit of €359 million in the corresponding period of 2024.

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

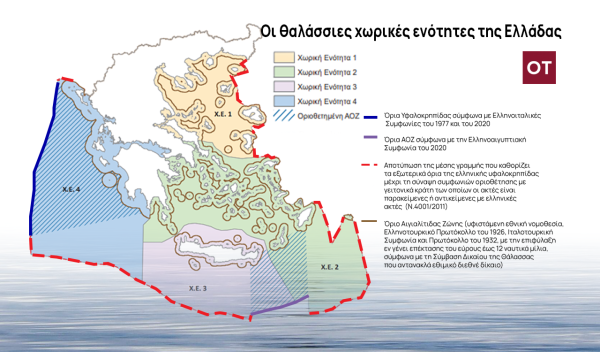

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης