It is well known that Ireland is one of the few countries that has not signed the agreement on the imposition of the global minimum corporate tax of 15%. In the same category are two other EU member states – Hungary and Estonia – two African countries (Kenya and Nigeria), as well as some tax havens.

OT.gr addressed the person in charge of this issue: the Minister of Finance of Ireland, Pascal Donahue, who was in Athens as the President of the Eurogroup, in order to participate in the Economist conference.

He himself agreed to answer, but clarified that he will do so in his ministerial capacity – “the Eurogroup has no authority to decide on tax issues”, as he told us. From his answer, in any case, it seemed once again that Dublin would not easily back down.

“It is true that as a country we have reservations about the current situation and the proposals that are being formed for tax policy internationally. However, we want an agreement and we believe that there will be an agreement “, he said and added:” We support the right to have a legal tax competition. Just as the Greek government will have issues to set using the Greek economy as a criterion, so there are important issues for the other economies. So I believe that there will be an agreement and we will work to make it happen, but it must be implemented consistently across Europe.”

Can the EU and the euro exist without a single tax?

We insisted on this point, asking our interlocutor the following question: Is he in favor of introducing uniform tax rates across the EU and the eurozone? A question that should be taken for granted, as it is clear that European integration cannot proceed without including a number of elements, including a common tax policy.

At the same time, however, it is a question that is politically difficult to answer, as shown by the reaction of Ireland and the other two countries. Here, then, is how our interlocutor chose to answer, essentially trying to kick the can down the street.

“I think we must first let the ongoing process in the OECD come to an end, because it is trying to establish the principles on the basis of which this could be done globally. We can answer what needs to happen in Europe by first seeing what happens around the world.”

However, he reiterated his position: “In the debate on taxation in Europe at international level, we must recognize that small and medium-sized countries must also be competitive. And not all countries have the advantages that their position or size implies, which means that they can use legal competition as part of their overall proposal to grow their economies.”

The numbers tell the truth

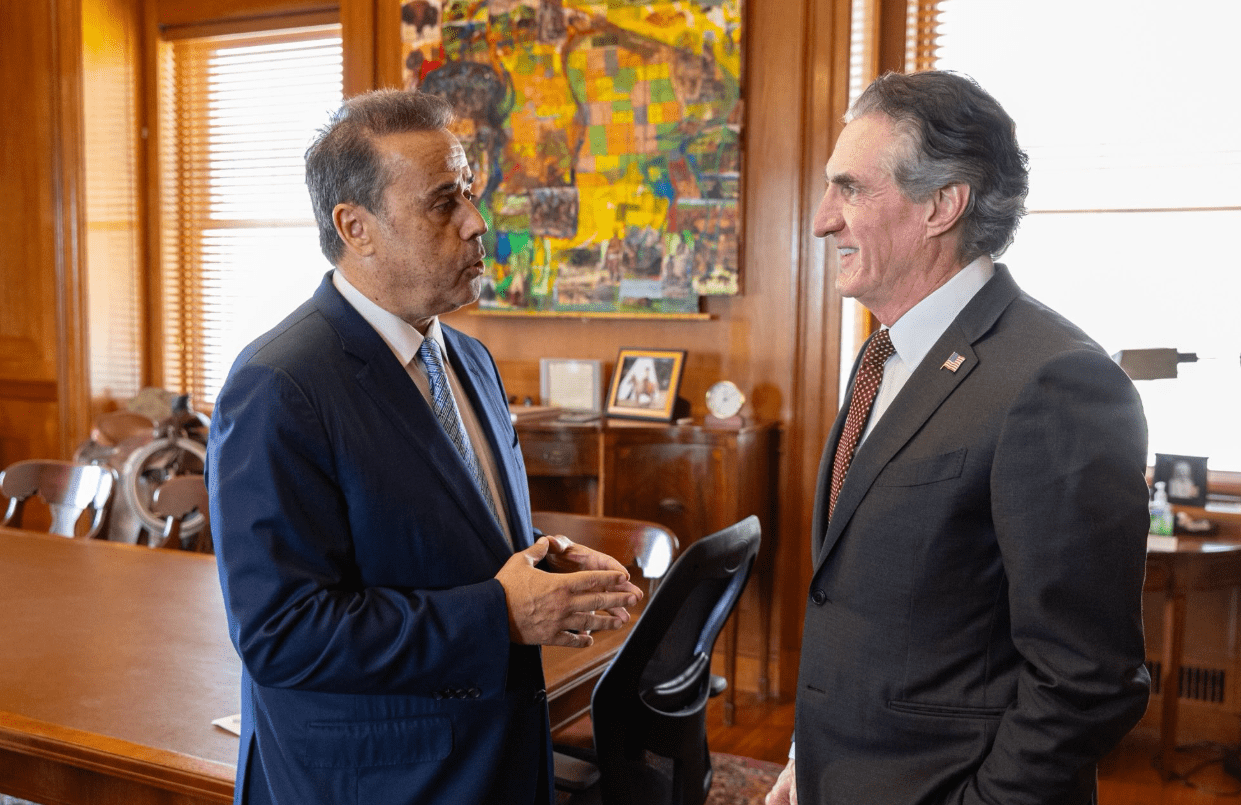

There is no doubt, then, that the debate within the EU will be “hot”. Ireland, after all, sees the 12.5% tax rate as a “cornerstone” of its overall economic policy and as one of the main reasons why it is considered one of the most investor-friendly countries in the world – including for “giants” like Apple, Google, and Facebook.

According to the US Chamber of Commerce, more than 800 American companies employ more than 180,000 people in Ireland, offering them quite high wages, while the country’s coffers receive about $ 4.5 billion annually from US investments.

Also, despite the low tax rate, Ireland’s corporate tax revenue is estimated at € 11.8 billion, accounting for around 20% of the total.

It is unlikely, then, that any Dublin government would jeopardize all these “privileges.”

![Γραφείο Προϋπολογισμού: Το κατά κεφαλήν ΑΕΠ της Ελλάδας θα επιστρέψει στα επίπεδα του 2007 το…2033 [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/05/ot_greek_economy799-1024x600-1.png)