Sales volume trends for Titan Cement International were positive in all product lines in the first half of the year. Group cement and clinker sales, including exports, increased by 11% supported by higher demand across most markets. Aggregates and ready-mix sales volumes increased by 4% and 5% respectively.

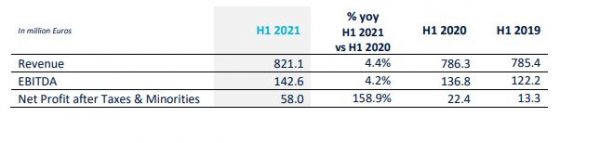

Consolidated revenue reached €821.1m, up 4.4% versus the first half of 2020, reflecting growing demand in most markets and a supportive pricing environment. Top line growth was held back by weaker US$ and US$-linked currencies. In local currencies, growth was 11.7%. EBITDA reached €142.6m, up 4.2% (and +10.3% in local currencies), held back by the spike in energy costs and freight rates.

Net profit after taxes and minority interests more than doubled reaching €58.0m vs €22.4m aided by a significant decline in finance costs. To put those figures in context, it should be noted that – as most of the Group’s countries of operation were not among those hard hit in the early days of the pandemic – in H1 2020 the group had been resilient and ahead of H1 2019.

As Dimitri Papalexopoulos, Chairman of the Group Executive Committee noted : “Looking ahead we see continuing top line growth, with gains in both volumes and prices. In the short term, the spike in freight rates and energy costs is not allowing us to enjoy the kind of impact in margins which top line growth would imply.”

USA

Revenue in the USA recorded a 10.2% increase in US $ terms in the first half of 2021 but was almost flat in Euro terms (+0.8%) at 479.3m. EBITDA reached €81.2m, (1.9% growth in US $) in Euro 6.8% below the first half of 2020. The discrepancy is due to higher maintenance costs in H1 as well as increased logistics and labour costs.

Greece and Western Europe

Total revenue for region Greece and Western Europe in the first half of 2021 grew by 17.4% to €133.5m while EBITDA came in at €17m versus €8.2m in the first half of 2020.

Southeastern Europe

Revenue for the region as a whole increased by 14.1% to €132.3m while EBITDA increased by 7.5% to €42m in the first half of 2021.

Eastern Mediterranean

Total revenue in the Eastern Mediterranean reached €75.9m, a decline of 6.4% year on year, though there was a +8.6% growth in local currencies. EBITDA reached €2.4m posting a 1.4% increase versus the first half of 2020.

Brazil (Joint venture)

In the first half of the year Apodi posted an increase in Revenue to €36.7m (vs €29.9m in H1 2020) as well as in EBITDA at €8.8m vs €3.5 m in 2020, enhancing its contribution to the Group’s net results.

Financial Results of the second quarter of 2021

Trading in the second quarter provided further evidence of the positive effect of improving market fundamentals, returning confidence and pent-up demand. As was mentioned at the announcement of Q1 2021 results, on a comparable basis Q2 2021 EBITDA would be about €10m higher to account for the estimated maintenance cost deferred to Q2 in the current year.

Group consolidated revenue for the second quarter of 2021, reached €450.3m, a 12.2% increase over the second quarter of 2020. EBITDA declined by 10.1% mainly due to the deferral of maintenance shutdown and related costs at the Pennsuco plant in the US to Q2 2021 vs Q1 in 2020,- but also due to cost headwinds related to rising energy and freight prices impacting different geographies. Net Profit after Tax (NPAT) for the quarter reached €42.7m versus €38.2m in the second quarter of 2020.

Outlook

Construction activity has proved resilient to the challenging circumstances posed by COVID. With the worst of the global pandemic hopefully behind us, market fundamentals and the key drivers of demand are in place to support growth in 2021 and beyond. At the same time, operating profitability is held back by the spike in energy and freight costs, as well as by broader supply bottlenecks, in part a reflection of the sudden buoyancy of activity.

Latest News

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

Why Greece’s New Maritime Spatial Plan Is a Geopolitical Game-Changer

This landmark development is more than just a bureaucratic step — it's a strategic declaration about how Greece intends to use, protect, and assert control over its seas

Eurozone Inflation Eases to 2.2% in March

Compared to February, inflation decreased in 16 member states, remained unchanged in one, and rose in ten.

Bank of Greece: Primary Gov. Surplus €4.1b Jan.-March 2025

The data released today by the Bank of Greece revealed that the central government’s overall cash balance recorded a surplus of €1.465 billion in the first quarter of 2025, compared to a deficit of €359 million in the corresponding period of 2024.

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης