Another strong vote of confidence for Greek banks, thanks to their performance in the ECB stress tests, was given by Moody’s and Standard & Poor’s rating agencies .

Moody’s positively assessed the results of the stress tests for Greek banks. As it emphasized, the adequacy of the supervisory funds will allow Greek banks to implement the restructuring plans, thus reducing the remaining problematic loans and improving their profitability.

Capital impairment in the exercise averaged 610 basis points (bp), above the European average (485 bp) but the completed and forthcoming capital raising moves would bring the impact closer to the European average.

For its part, Standard & Poor’s estimates that Greek banks will continue to improve their balance sheets through the Hercules Asset Protection Scheme, improving investor confidence, and bankruptcy law reforms.

The rate of disbursement of new loans, the recovery of profits and their still weak capital adequacy, on the other hand, are the main challenges, for which the agency “sees” increased risk costs for the next 12-18 months, because of Covid-19, with Non-performing loans (NPEs) expected to fall below 20% by the end of 2022, while for loans that are in arrears, the default rate is estimated at close to 25%.

New goals

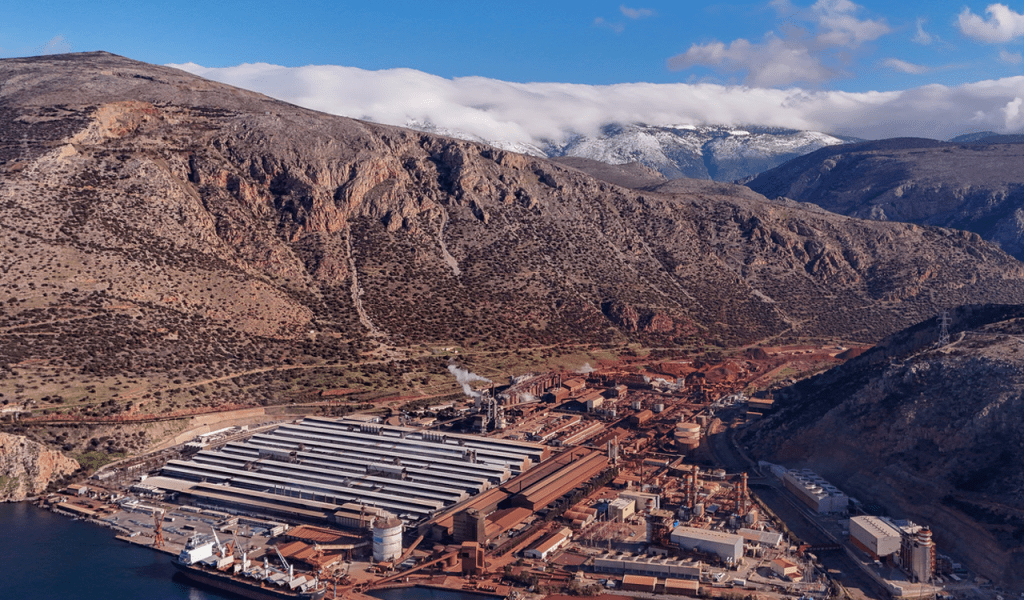

As OT.gr has written, Greek banks are preparing for the final round of consolidation of their balance sheets and the acceleration of credit expansion rates from next autumn, as the first actions of the Recovery Fund begin.

The results of the pan-European extremity simulation exercises and the agreement of the Ministry of Finance with the ECB to amend the law on deferred profitability, create additional flexibility in their administrations for the implementation of plans to return to full regularity.

All the systemic groups in the endurance tests kept the capital adequacy ratios well above the minimum limits set by the supervisor, even in the most unfavorable scenarios. This makes the domestic industry more investable and improves its access to international markets, as it demonstrates the reduction of risk that has occurred in recent years.

On the other hand, the way seems to be paved for the reduction of the minimum ratio of total equity (CAD) set for each bank separately by the supervisor. Given that the capital impairment in the adverse scenario has reached satisfactory levels, the ECB does not rule out reducing the relevant ratios for domestic credit institutions in the near future.