Deposits continued their upward race in August, with tourism revenues being the driving force behind the rest of households and businesses in banks.

According to the official data of the Bank of Greece, they have now reached 173.64 billion euros, which is a ten-year record.

In the last month of the summer, the domestic deposit base (legal entities and individuals) increased by € 1.5 billion, of which € 1.02 billion came from non-financial corporations, € 110 million from individuals and balances from other categories.

According to a banking source, the explosion of tourism in the two months of July – August, which in terms of revenue approached the levels of 2019, loaded banks with fresh money, largely coming from the expenses of foreign visitors, who are paid in the majority electronic means.

This is an expected development, the same executive claims, after the first estimate of ELSTAT for the growth rates in the third quarter, which exceeded 16.20%.

Now, from the beginning of the year until the end of August, private sector deposits record an increase of 9.92 billion euros compared to 8.75 billion euros in the corresponding period last year.

The rise of the pandemic

On the other hand, after the outbreak of the pandemic, the relative figures have increased by 30.9 billion euros (comparison 8/2021 with 2/2020), recording within 1.5 years a cumulative increase of more than 20%.

Most of this may be due to government transfers, but now the income is included in the equation, which is likely to return to 2019 levels at the end of this year.

It is no coincidence that despite the withdrawal of most support measures for businesses and employees from the State, deposits continue to grow rapidly.

In August, for example, the annual rate of change increased to 13.9% from 13.2% the previous month.

In businesses it was 25.9% from 24.8% in the previous month respectively, while in households it remained essentially unchanged at the level of 9.70%.

I. Financing of the domestic economy

The monthly net flow of total funding was positive by 954 million euros, compared to a positive net flow of 687 million euros last month.

I.1 General government funding

The monthly net flow of funding to general government in August 2021 was positive by € 1,291 million, compared to a positive net flow of € 1,219 million last month. The annual rate of change in general government funding fell to 54.9% from 55.5% last month.

I.2 Private sector financing

In August 2021, the annual rate of change in total private sector financing fell to 0.8% from 1.2% the previous month. The monthly net flow of total funding to the private sector was negative by € 337 million, compared to a negative net flow of € 532 million last month.

I.2.1 Business financing

The monthly net flow of financing to businesses in August 2021 was negative by 190 million euros, compared to a negative net flow of 313 million euros in the previous month, while the annual rate of change decreased to 3.7% from 4.4 % last month. In particular, the annual rate of change in the financing of non-financial corporations (non-financial corporations) decreased to 3.2% from 4.2% in the previous month. The monthly net flow of their funding was negative by 228 million euros, compared to a negative net flow of 16 million euros last month. The annual rate of change in the financing of insurance companies and other financial institutions increased to 8.4% from 6.5% in the previous month. The monthly net flow of their funding was positive by € 38 million, compared to a negative net flow of € 297 million last month.

I.2.2 Financing of freelancers, farmers and sole proprietors

In August 2021, the monthly net flow of funding to the self-employed, farmers and sole proprietorships was positive by € 2 million, compared to a negative net flow of € 47 million the previous month. The annual rate of change in their funding fell to 2.2% from 2.5% last month.

I.2.3 Financing of private and private non-profit institutions

The negative net flow of funding to individuals and private non-profit institutions in August was € 148 million in August 2021, against a negative net flow of 173 million euros in the previous month. The annual rate of change of their financing remained unchanged at -2.6% compared to the previous month.

II. Deposits of the domestic economy in domestic credit institutions

The monthly net flow of total deposits was positive by € 1,622 million, compared to a positive net flow of € 1,110 million in July 2021.

II.1 Deposits from the general government

In August 2021, general government deposits increased by 142 million euros, compared to a decrease of 730 million euros in the previous month and the annual rate of change was -15.7% from -19.2% in the previous month .

II.2 Deposits from the private sector

Private sector deposits increased by 1,480 million euros in August 2021, compared to an increase of 1,840 million euros in the previous month, while the annual rate of change increased to 13.9% from 13.2% in the previous month.

II.2.1 Deposits from companies

In August 2021, corporate deposits increased by 1,386 million euros, compared to an increase of 1,053 million euros in the previous month, while the annual rate of change increased to 25.9% from 24.8% in the previous month. In particular, MXE deposits increased by € 1,011 million, compared with an increase of € 560 million last month. Deposits from insurance companies and other financial institutions rose by 375m euros, up from 493m euros last month.

II.2.2 Deposits from households and private non-profit institutions

In August 2021, the deposits of households and private non-profit institutions increased by 94 million euros, compared to an increase of 787 million euros in the previous month, while the annual rate of change was 9.7% from 9.8 % last month.

Latest News

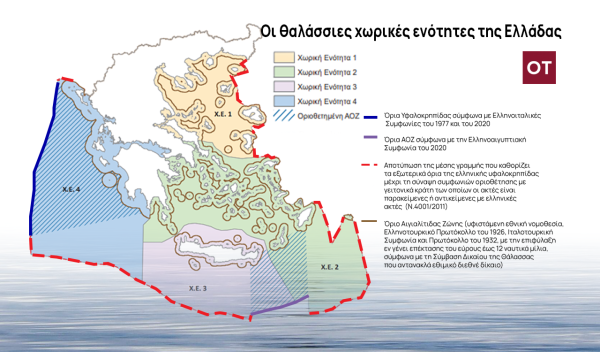

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Green Getaway Ideas for Easter 2025 in Greece

Celebrate Easter 2025 in Greece the sustainable way with eco-farms, car-free islands, and family-friendly getaways rooted in nature and tradition.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης