Non-systemic Attica Bank on Wednesday afternoon confirmed that it has received non-binding offers for investors’ participation in a planned 240-million-euro share capital increase.

An announcement issued by the bank said board members received confidential expressions of interests, adding: “…upon the conclusion of the relevant procedures, reputable investors have sent confidential letters of interest, on a non – binding offer basis, a fact that confirms the support to the business plan of the Bank and its implementation by the Management.”

No information was given on the number of offers submitted, nor the names of the investors.

Attica Bank said it will now proceed with the evaluation and further clarification of the non-binding offers and their components, in cooperation with its consultants, in order to form the forthcoming share capital increase, which will be approved by the relevant supervisory authorities.

According to banking sources in the Greek capital on Wednesday, if the share capital increase proceeds as planned, the most probable scenario is for Attica Bank to emerge as a multi-shareholder financial institution.

The same sources added, however, that even in a “worst-case scenario” of no agreement or serious interest by investment funds, a “Plan B” prospect holds that the Hellenic Financial Stability Fund (HFSF) will immediately provide the necessary investment to ensure the bank’s continued sufficient capital needs. If the latter scenario materializes then another attempt at privatization of the non-systemic lender will be attempted.

Latest News

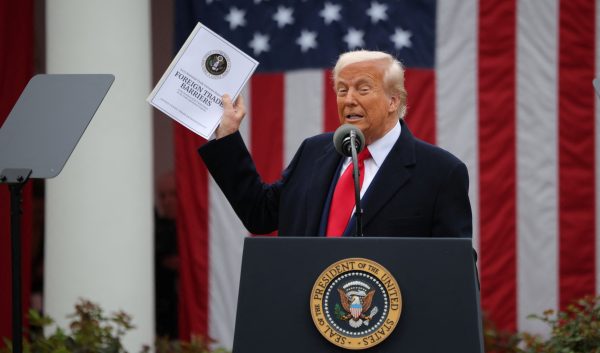

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

Santorini Safe and Ready for a Dynamic Tourism Season

Authenticity, cultural heritage, and genuine experiences at the center of Santorini's new promotional campaign

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης