Greece’s finance and energy ministers have addressed a letter to Eurogroup president Paschal Donohoe over rising energy costs in the Union, which have also dramatically affected the east Mediterranean country.

According to FinMin Christos Staikouras and Energy Minister Costas Skrekas “…surging electricity prices across Europe are a source of great concern to EU citizens who are becoming unable to cover their energy costs resulting in an immediate increase in energy poverty in the EU. In particular, the additional energy cost to be incurred by consumers is likely to reach EUR 100 billion during the winter of 2021-22 in the 27 Member States.”

In two proposals, the two top Greek called for the possibility of an exceptional auctioning of additional allowances from the market stability reserve, as well as the possibility of establishing an EU hedging fund against gas price fluctuations in case of exceptional high gas price spikes, which may occur again in the future.

The letter, in full, reads:

Dear President,

Surging electricity prices across Europe are a source of great concern to EU citizens who are becoming unable to cover their energy costs resulting in an immediate increase in energy poverty in the EU. In particular, the additional energy cost to be incurred by consumers is likely to reach EUR 100 billion during the winter of 2021-22 in the 27 Member States.

The unprecedented spike in gas prices, and by extension in electricity prices, is a major challenge for all EU Member States that cannot be dealt with, solely, at national level. This is a pan-European problem and requires immediate action which should jointly be taken at EU level.

In fact, it constitutes not only a major setback in our efforts for a smooth economic recovery in the post–Covid-19 era, but also an alarm signal that the way towards a carbon-neutral economy will be subject to unexpected market shocks, hampering the effective implementation of the European Green Deal. We have a duty to prevent anything that may undermine public support or confidence regarding the EU’s climate goals.

Moreover, the current, unusually high, gas prices may not be a circumstantial incident, driven by one-off factors. The early stages of the transition towards carbon neutrality depend on gas supply and prices, since natural gas plays a key role until renewables and other carbon free sources dominate the EU energy mix. Therefore, consumers and markets must employ hedging instruments against extreme natural gas price spikes, as natural gas is still essential for and the main setter of electricity prices for the period until 2030. In this period, affordability concerns, may jeopardize and destabilize the transition towards achieving the climate target by 2030.

There are several reasons to believe that such crises will reoccur in the years to come, and therefore, the EU needs to adopt new tools aiming at reducing the exposure to gas market fluctuations, given the fact that the Social Climate Fund proposed by the European Commission will not be established before 2025.

Against this background, we invite the European Commission to explore possible short-term measures to tackle the additional energy cost, especially for low- and middle-income households, in combination with innovative long-term measures to protect the energy market from sharp fluctuations of gas prices.

To that end, we call on the European Commission to develop an emergency toolbox and blueprints providing Member States with a variety of pre-designed options and appropriate remedies in similar cases of market instability. These will increase certainty and predictability for both governments and consumers, sending a strong signal to the markets and discouraging potential speculators from manipulating energy prices.

More specifically, we suggest that the Council mandates the European Commission to:

(1) Put in place an effective short-term measure, potentially based on exceptional (before the end of 2021) auctioning of additional allowances from the Market Stability Reserve, so that extra revenues for Member States are generated through the EU ETS to, at least partially, cover the immediate extra burden to low- and middle-income households. The required amounts would result in an average increase of 10% in ETS revenues. The Member States will mainly use the additional revenues to finance compensation schemes of consumers’ electricity and gas prices during the winter 2021-2022.

(2) Explore the possible establishment of an EU Hedging Fund, which will hedge against gas price fluctuations in case of exceptional high gas price spikes, which may occur again in the future. The Fund could draw on advance payments of expected future EU ETS revenues and will be strictly limited to exceptional price volatility situations. The allocation to each Member State will be calculated on a pro-rata basis, considering the heating and electricity consumption and the national GDP per capita. Claw-back provisions could be put in place ensuring recovery of the Fund, based on a longer-run and smoothly applied consumer levy.

Moreover, the EU should act strategically by taking advantage of its collective bargaining power. Our current dependence on and exposure to market fluctuations undermines EU’s strategic autonomy and sovereignty, allowing third actors to use energy prices as political weapon against EU interests. The EU should collectively build up natural gas strategic reserves through a centralized European platform and develop strategic gas storage facilities across Europe.

We are at a critical crossroad. The current crisis will test EU’s reflexes and its decisiveness to do whatever it takes in order to meet our ambitious climate targets without losing sight of the need of a fair transition for all EU citizens and regions, especially the most vulnerable.

Hoping that this letter will contribute to the ongoing discussions on the issue, we are looking forward to a fruitful discussion in the upcoming Environment Council and Eurogroup/ECOFIN meeting.

Latest News

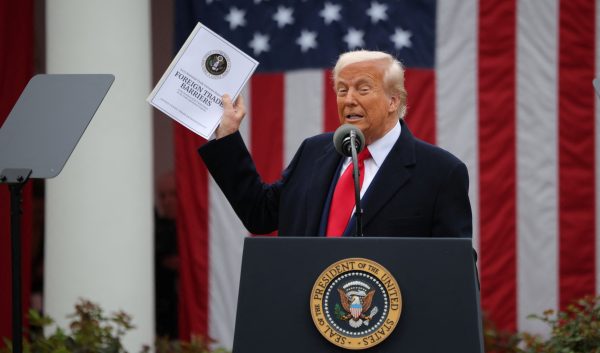

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

Santorini Safe and Ready for a Dynamic Tourism Season

Authenticity, cultural heritage, and genuine experiences at the center of Santorini's new promotional campaign

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης