The revenues of the Lampsa Group, which owns, among others, the hotels “Great Britain”, “King George” and “Athens Capital Hotel – Mgallery” in Syntagma, recovered to some extent, in the first half of 2021 compared to the corresponding period of 2020, while EBITDA returned to positive trajectory.

Also, the flagship of the Group the hotel “Grande Bretagne” not only “withstood” the epidemiological crisis but showed in the first half of 2021 sales increase of 41.19% compared to the corresponding period last year 2020.

However, the pandemic is always here and significantly affects the entire hotel industry and especially continuous hotels and city hotels.

Therefore, the Lampsa group estimates that for the year 2021 it will record revenues reduced by 75% compared to 2019, when the turnover peaked. It is noted that in 2019 the Lampsa group recorded revenues of 77.815 million euros, which means that in 2021 revenues will not exceed 20 million euros. It is reminded that in the fiscal year 2020 the revenues of the Group amounted to 17.735 million euros.

In other words, in the two years (2020 and 2021) the Lampsa group lost due to a pandemic a total potential revenue of over 110 million euros!

The management of the Group also estimates that during the second half of the year it will lose revenues of 10 million euros while the company will lose 8 million euros, due to the pandemic of covid 19 and its impact on the tourist hotel market.

According to the semi-yearly financial report for the first half of 2021, countries worldwide, in their efforts to reduce the spread of the pandemic, are implementing a number of restrictive measures, including the suspension of hotels, which has a direct impact on the activity of the Group. Conference tourism has also been hit by bans on large gatherings, and cruises that also catered to hotels have been virtually nullified.

However, the Hotel “Grande Bretagne”, as mentioned above, recorded in the first half of 2021 sales increase of 41.19% compared to the corresponding period last year 2020.

It is noted that the King George Hotel remained closed for most of the first half of 2021 and reopened on 14 June 2021. The Athens Capital Hotel remained closed for most of the first half of 2021 and reopened on 10 May 2021. Sheraton Rhodes (seasonal) hotel opened for the summer season on May 22, 2021.

Thus, the restriction on the Group’s activity is reflected in the financial figures of the luxury hotel market of Athens and consequently of the Group during the first half of 2021.

The occupancy of rooms in the market of luxury hotels in Athens decreased by 52.0% compared to the corresponding period of 2020, setting the index at 19.8% compared to 41.3% in 2020 (for the period before their suspension).

The average room rate in hotels increased by 8.5% compared to 2020, reaching € 149.71 compared to € 137.93 in 2020. As a result, revenue per available room decreased in luxury hotels in Athens by 47.9% (€ 29.70 against € 57.01 in 2020), while total room revenues decreased by 9.6%.

The Hotel “Great Britain” showed an increase in sales of 41.19% compared to the corresponding period last year in 2020, while the Hotel “King George” showed a decrease in sales of 77.37%.

Regarding the Group Hotels in Serbia, the “Hyatt Regency Belgrade” recorded an increase of 15.06%, and the “Mercure Excelsior” an increase of 82.37%.

More specifically, in the first half of this year, the Turnover amounted to a consolidated level of € 9.99 million compared to € 8.35 million in the same period of 2020, showing an increase of 19.67%. The turnover of the parent company (Hotels “Great Britain”, “King George” and “Sheraton”)) amounted to € 6,412 million from € 5,880 million in the corresponding period of 2020, increased by 9.05%.

The Group’s operating results before taxes, financial, investment results and depreciation- (EBITDA) amounted to profits of € 0.073 million against losses of € 3,181 million in 2020, increased by 102%. Respectively, for the parent company they amounted to losses of 0.94 million euros from losses of 2.79 million euros in 2020, increased by 66%. Also the EBITDA margin amounted to 1% from -38% in 2020 for the Group and -15% from -47% for the company respectively. The results before taxes of the Group amounted to losses of € 8,077 million, against losses of € 10.23 million of the comparative period 2020.

The parent company registered losses of € 6.42 million, compared to losses of € 7.92 million in the comparative period 2020. The Income Tax of the Company and the Group includes the calculation of deferred tax.

The amount of tax for the Group and the Company amounted to expenses of € 0.19 million and 0.8 million against tax revenue of € 2.39 million and € 1.41 million in Group and Company during the comparative period.

The Net Results (profits / losses) after taxes and minority interests of the Group amounted to losses of € 8.26 million, compared to losses of € 7.8 million of the comparative period 2020. To the parent company amounted losses of € 7.2 million, as against losses of € 6.5 million in the comparative period 2020.

To deal with the consequences of the pandemic, the Management of the Group secured an additional liquidity of 25 million euros through a loan with the guarantee of the European Development Bank for the smooth continuation of the Group’s activity.

Latest News

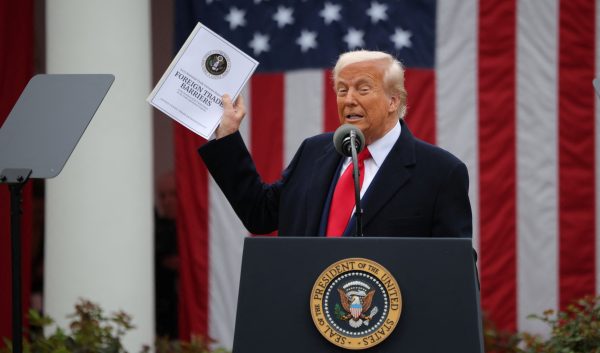

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

Santorini Safe and Ready for a Dynamic Tourism Season

Authenticity, cultural heritage, and genuine experiences at the center of Santorini's new promotional campaign

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης