Greece ranks 29th among the 37 OECD countries in this year’s Index of International Tax Competitiveness published today by the Center for Liberal Studies Markos Dragoumis KEFIM in our country in collaboration with the Tax Foundation. Greece’s ranking compared to last year remained unchanged.

Specifically, our country garnered 57.5 in the total score of the Index for 2021, marking a small improvement from last year’s total score of 57.2. In terms of the sub-categories of the Index, Greece is ranked 22nd in terms of corporate taxes, 10th in terms of corporate taxation, 32nd in terms of consumption taxation, 29th in terms of property taxes, and in 25th place in terms of taxation of profits abroad.

In this year’s Index, the following weaknesses of the Greek tax system are pointed out:

- Companies face severe restrictions on the amount of net operating losses with which they can hedge future profits. Also, they can not use losses to reduce previous taxable income.

- Greece has a relatively limited number of tax contracts (57 contracts compared to 75 of the OECD average).

- Our country has one of the highest VAT rates in the OECD (24%) with one of the most limited tax bases.

- Among the positive points of the Greek tax system on the other hand, the authors of the research distinguish the following:

- The net tax rate of individuals on dividends at 5% is significantly below the OECD average (24.1%).

- The complexity of the labor tax is lower than the OECD average.

- The regulations of Audited Foreign Companies in Greece are moderate and apply only to passive income.

Among other notable changes compared to last year, Greece reduced the corporate income tax rate from 24% in 2020 to 22% in 2021, extending tax subsidies for research and development and slightly reducing the maximum statutory personal income tax rate.

For the seventh consecutive year, the country with the highest rated tax code in the OECD is Estonia (1st). The countries among which our country was in this year’s ranking are Denmark (28th) and Spain (30th), with Portugal in 34th place and last country in the Index Italy (37th).

The Executive Director of KEFIM, Nikos Robapas, made the following statement: “Despite the significant reduction of the tax burden, our country has not marked a corresponding improvement in the Index of International Tax Competitiveness. This is due to the fact that many OECD countries have taken similar measures to address the economic impact of the pandemic, the fact that the Index has a negative view of providing targeted tax incentives in the sense that they reduce neutrality and increase the complexity of the tax system, but also that a part of the data, such as the amount of ENFIA, on the basis of which the Index is calculated are collected from secondary sources and therefore relate to previous years “.

“Competition is what drives innovation, investment and ultimately wages. It is therefore vital that we know where countries are today as discussions on the world stage move forward, “said Daniel Bunn, Vice President of International Programs at the Tax Foundation and lead author of the Index.

The International Tax Competitiveness Index measures the degree to which a country’s tax system adheres to the two fundamental principles of fiscal policy, competitiveness and neutrality, using over 40 variables in five categories: corporate income tax, corporate income tax, excise tax, property and international taxation rules. This year’s Index uses the latest available data for July 2021.

The Tax Foundation is a leading tax policy research organization. Since 1937, its research, analysis and expertise have contributed to the implementation of more effective tax policies around the world.

Latest News

Trump Tariffs Jeopardize Growth: Piraeus Chamber of Commerce

The tariffs, aimed at reducing the U.S. trade deficit, are expected to have both direct and indirect effects on the European economy

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

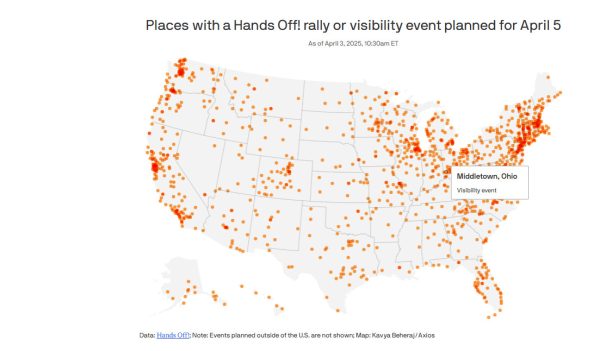

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης