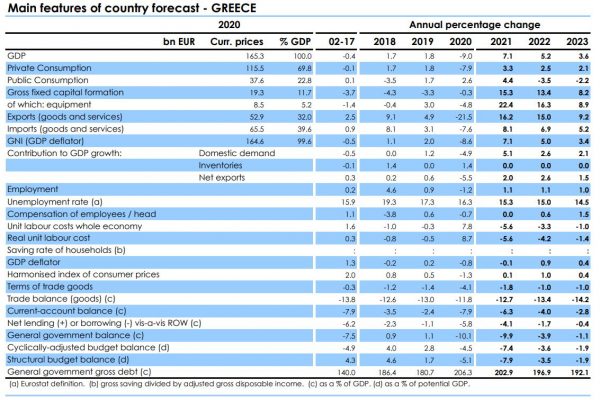

Strong growth of 7.1% in 2021 and 5.2% in 2022, has been forecast by the European Commission for Greece in its autumn economic forecasts, which it published today, revising upwards its forecasts for 2021, compared to forecasts in July (4.3%) and slightly downwards for 2022 (6%).

According to the Commission report, the recovery of the Greek economy is gaining ground, mainly due to domestic demand and the better-than-expected tourist season.

The impact of the pandemic is expected to gradually subside, while facilitative fiscal and monetary policy, combined with strong impetus from the Recovery and Sustainability Plan, are set to maintain momentum in the future. Emergency support measures are being adapted to the evolving needs of the economy and are expected to be largely abolished by the end of 2021, supporting the reduction of the general government deficit.

The recovery of the economy

“The recovery of the Greek economy gained momentum in 2021”, the Commission emphasizes. In the second quarter of 2021, the Greek economy recovered significantly by 3.4% compared to the previous quarter. Real GDP reached pre-pandemic levels in the second quarter of 2021. The recovery is due to domestic demand, especially investment, and stockpiling, while continued fiscal stimulus has played a critical role in supporting the economy. The authorities continue to provide targeted and temporary support to the economy, in particular to maintain employment. The unemployment rate fell in the summer, supported by more recruitment in the tourism sector.

Economic activity in the second half of 2021 is also expected to be supported by the start of implementation of projects presented in the Recovery and Sustainability plan of Greece. Overall, GDP is projected to recover by 7.1% in 2021 and increase by 5.2% and 3.6% in 2022 and 2023, respectively. Growth in 2022 and 2023 is expected to be driven by public and private investment, as project development under the Recovery and Sustainability Plan is expected to maintain momentum.

In terms of the foreign sector, the resumption of tourism earlier in May, supported later by the lifting of mobility restrictions across the EU over the summer, managed to support exports in the services sector. Along with gains in market share for Greek exports, the foreign sector is expected to continue to support growth in the future.

Support measures

Employment support measures are expected to continue to help employment in vulnerable sectors, while the economic recovery is expected to accelerate job creation. The unemployment rate is projected to fall to 15.3% in 2021 and continue to fall to 15.0% and 14.5% in 2022 and 2023 respectively.

Despite the current rise in energy prices, headline inflation is likely to remain slightly positive in 2021, largely due to low demand in the first half of the year. Inflation is expected to peak in 2022, reaching 1.0%, also due to the projected increase in demand for services. As the temporary effects of energy prices weaken, inflation is projected to fall to 0.4% in 2023.

The Commission’s forecasts remain risky, especially in relation to the uncertainty of the pandemic and its potential impact on the tourism sector, or the potential negative effects of the large number of emergency measures extended to the private sector.

This also applies to the rate at which employment support programs are being phased out. External geopolitical factors also remain a source of uncertainty.

The general government deficit of Greece is expected to be -9.9% of GDP in 2021 due to the budgetary implications of the economic downturn and the cost of measures taken to tackle the coronavirus epidemic.

The fiscal impact of the measures is expected to reach 6.5% of GDP in 2021 and most of them are expected to be phased out by the end of the year.

The cost of relief and support measures taken to deal with the widespread forest fires in August further contributes to the deficit.

The government also announced measures to offset the effects of the energy price spike, which will be combined with increased revenue from emissions trading scheme for energy-related expenditure.

The general government deficit is expected to fall to -3.9% of GDP in 2022 and to -1.1% in 2023. The improvement is mainly due to the economic recovery and is reinforced by the phasing out of most emergency measures. The budgetary impact of the support measures adopted in 2021 and extended until 2022 is 1.5% of GDP, namely: lower social security contributions, suspension of the social solidarity tax in the private sector, extension of the recruitment subsidy program and reduced VAT rates for tickets transport, beverages and cinema by mid-2022.

The Commission forecasts take into account the additional package of tax relief measures announced by the government with an expected annual cost of around 0.1% of GDP. The government’s decision to reschedule part of the defense spending program deliveries from 2023-2025 to 2022 also leads to a 0.1% decline in GDP in 2022. The economic recovery and the expiration of the emergency measures are expected to further reduce the nominal deficit to 1.1% of GDP in 2023.

Government debt is expected to fall to 203% of GDP in 2021 and further decline to around 197% in 2023, supported by the economic recovery.

Finally, the Commission notes that the financial risks remain significant. The possible activation of state guarantees issued as part of the support measures could lead to an increase in budgetary costs. Additional risks are posed by court cases against the State Real Estate Company and the pending decision of the Council of State for retroactive compensation for cuts in supplementary pensions and seasonal benefits. Further risks relate to the statistical classification of recent or planned financial policy arrangements, including the sale and lease system for properties owned by vulnerable debtors.

Latest News

Trump Tariffs Jeopardize Growth: Piraeus Chamber of Commerce

The tariffs, aimed at reducing the U.S. trade deficit, are expected to have both direct and indirect effects on the European economy

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης