The European Commission gave a vote of confidence in the dynamic recovery of the Greek economy, through yesterday’s report of the autumn European forecasts, sending an optimistic signal for a strong recovery in 2021. It revises the growth rate to 7.1% of GDP, compared to 4.3% in the summer estimates of the Commission and 6.1% in the preliminary draft of the Greek budget. It cuts estimates for next year, estimating growth of 5.2%, from 6% in the previous year – and from 4.5%, which is the backbone of the financial staff – while in 2023 it will be limited to 3.6%.

The report also includes budgetary risks, citing the possible activation of state guarantees as part of the support measures. Also the court cases against the State Real Estate Company and the pending decision of the Council of State for the retroactive compensation for cuts in supplementary pensions and seasonal allowances. Further risks relate to the statistical classification of recent or planned financial policy arrangements, including the sale and lease system for properties owned by vulnerable debtors.

“Social dividend” and budget revelations

The double-edged sword, on the health and energy fronts, puts the government and finance staff in a position to recalculate the margins for additional support measures, just days before the final draft budget is submitted to Parliament. Despite the forecasts for strong Greek growth in 2021 – and the information that the Ministry of Finance wants to also revise the growth of 2021 over 6.1% – the new data brought by the threat of inflation in household incomes lowers expectations for surprises in November, concerning scenarios for the social dividend or new measures. The window is still not completely closing. The government expects to evaluate the November data and the course of revenues in order to decide on a possible lump sum payment, such as an intervention in the National Health System, such as health bonuses or facilities for affected sectors, if necessary.

The financial budget forecasts will be reflected in the submission of the final budget, at a time when the Commission’s report is preparing the ground for the end of emergency support measures throughout the Eurozone. The impact of the pandemic, it says, is expected to ease gradually, while the facilitation policy, combined with the strong impetus from the Recovery and Resilience Plan, is set to maintain momentum in the future. The measures are adapted to evolving needs and are expected to be largely abolished by the end of 2021, supporting the deficit reduction.

The recovery of the Greek economy is gaining ground, as the Commission emphasizes, mainly due to domestic demand and the better than expected tourist season. At risk are the pandemic and its potential impact on the tourism sector. On inflation in Europe, it says that it could prove to be higher than expected if supply constraints last longer and wage growth – greater than productivity – is passed on to consumer prices.

The resilience of the Greek economy and investment

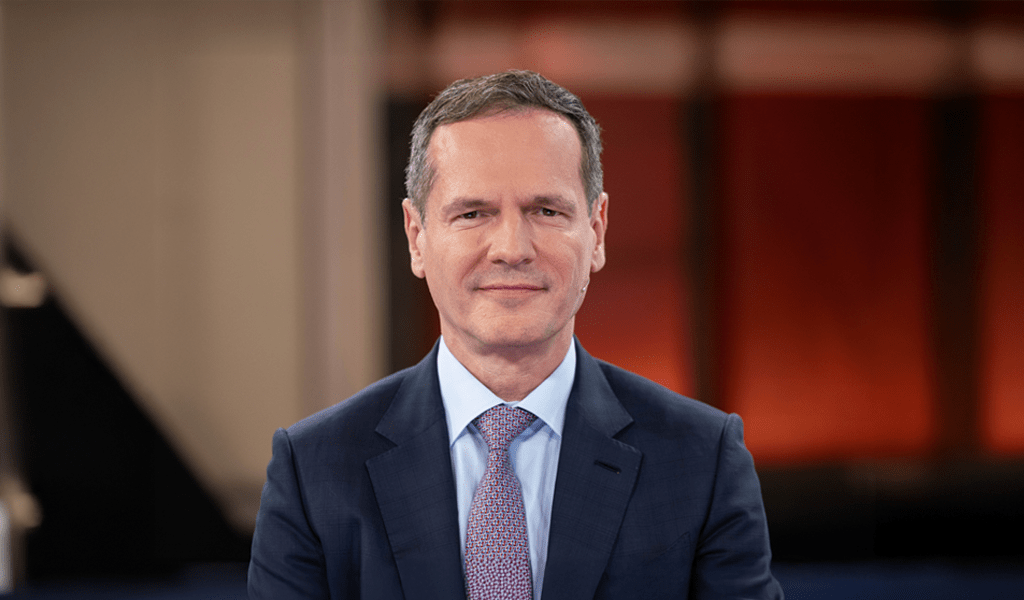

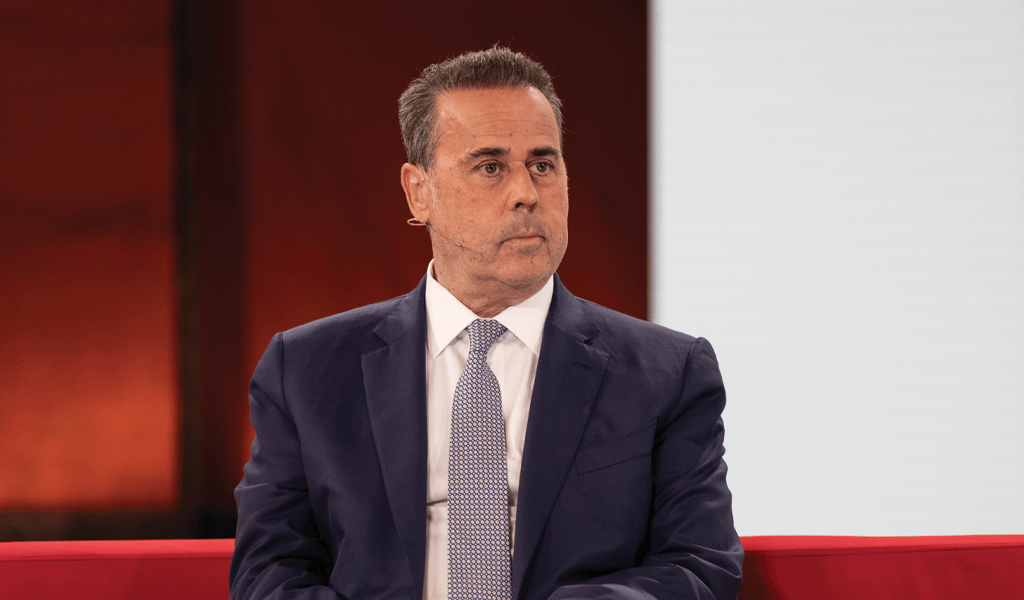

The forecasts of the Commission confirm the correctness and effectiveness of the economic policy pursued in our country, emphasized Minister of Finance Christos Staikouras. The country, according to the minister, is recovering strongly and developing sustainably, investments and exports are significantly increased, unemployment is shrinking, cash is kept at a safe level, public finances are managed responsibly. He emphasized that despite the prolonged uncertainty and the new challenges, the Greek economy has shown resilience and dynamism. For his part, the Minister of Development & Investment, Adonis Georgiadis, emphasizes that it is clear that the criticism leveled by the opposition and the misery, it exudes concerning the economic performance of the country, do not correspond to reality. “The European Commission, with its new – autumn – forecasts that raise the estimate for the growth of Greece in 2021 to 7.1% from 4.3% of GDP, emphasizes that the recovery of the Greek economy gained momentum in 2021, a fact due in particular to investment “. And he adds that in 2022 “we will do even better”.

The main points of the report of the Commission for Greece

FISCAL RISKS. The possible activation of state guarantees as part of support measures. The court cases against the State Real Estate Company and the pending decision of the Council of State for the retroactive compensation for cuts in the supplementary pensions and the seasonal allowances. Further risks relate to the statistical classification of recent or planned financial policy arrangements, including the sale and lease system for properties owned by vulnerable debtors.

UNEMPLOYMENT. Reduction to 15.3% in 2021, to 15.0% and 14.5% in 2022 and 2023 respectively.

INFLATION. Slightly positive in 2021, will peak in 2022 at 1% and fall to 0.4% in 2023.

DEFICIT – DEBT. Public debt will decrease to 203% of GDP in 2021 and 197% in 2023. The deficit from -9.9% in 2021, will decrease to -3.9% of GDP in 2022 and to -1.1% in 2023 .

MEASURES. The budgetary impact of the 2021 support measures (extended until 2022) is 1.5% of GDP. The additional package of tax relief measures costs 0.1% of GDP. The part of the deliveries of the defense expenditure program from the period 2023-2025 to 2022 is deteriorating by 0.1% in 2022.