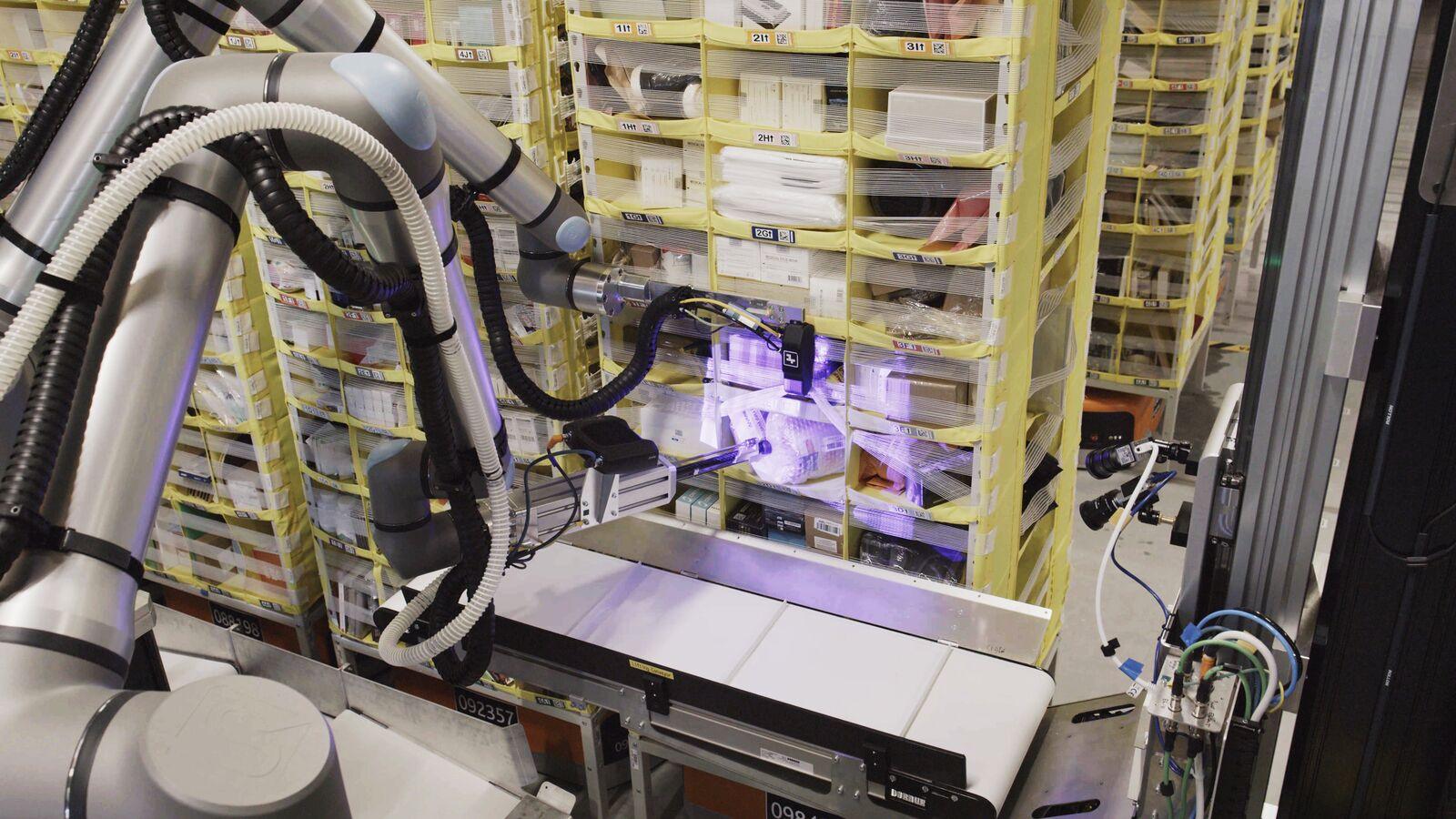

The rental income of BriQ Properties SA amounted to 4.4 million euros in the 9 months of this year. compared to 2.8 million euros in the corresponding period last year, recording an increase of 59% mainly due to the integration of revenues from the group’s new investments in logistics real estate.

This increase was achieved despite the decrease in revenues by 0.9 million euros due to the measures imposed due to COVID-19, while the corresponding decrease in 2020 was significantly lower (0.5 million euros), according to relevant information from the real estate investment company.

The significant shift of the company’s real estate portfolio in the field of logistics is reflected in the composition of the value of the real estate portfolio on 30.09.2021, which was 48% logistics, 30% offices, 17% hotels and 5% other uses while on 30.09.2020 it was 43% offices, 27% hotels, 14% logistics and 16% plots and other uses.

The Company recorded at a consolidated level an increase in its size in the nine months of the year compared to the corresponding period last year, in particular:

• On 30.09.2021 the group’s investments included investment properties with a total value of 116.7 million euros compared to properties worth 106.0 million euros on 31.12.2020 and 72.5 million euros on 30.09.2020.

• During the nine months of 2021, the Company made new investments totaling 9.6 million euros, which included 5.8 million euros in investments in the field of logistics and 3.2 million euros in the field of offices.

• Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased by 71% to € 3.2 million compared to € 1.8 million in the same period last year.

• Adjusted earnings before tax (EBT) increased by 76% and amounted to 2.6 million euros compared to 1.5 million euros in the corresponding period last year.

• Adjusted net profit after taxes increased by 78% and amounted to 2.5 million euros compared to 1.4 million euros in the corresponding period last year.

• The net profit from the revaluation of investments in real estate amounted to 2.1 million euros compared to 0.5 million euros in the corresponding period last year.

• The Internal Book Value of a Share (N.A.V / share) corresponding to the shareholders of the Company amounted to 2.42 against 2.37 euros on 31.12.2020, showing an increase of 2.1%.

Cash and cash equivalents on 30.09.2021 amounted to 4.3 million euros compared to 2.1 million euros on 31.12.2020. On 30.09.2021 the loan liabilities of the Group amounted to 29.1 million euros compared to 18.3 million euros on 31.12.2020.

The company on 30.09.2021 owned a total of 358,618 treasury shares with a total nominal value of 0.8 million euros and an acquisition value of 0.6 million euros (€ 1.74 / share) which corresponded to 1.0% of its share. capital.