The global bond markets recorded their worst year since 1999, according to the Financial Times, strongly influenced by the global rise in inflation.

Indicatively, shortly before 2021 ends, the Barclays aggregate bond index, which monitors government and corporate bonds worth 68 trillion dollars, shows a negative return of 4.8%. This is the worst performance for the index since 1999, when it had fallen by 5.2%, as investors fled the bond markets to the booming stock market in order to take advantage of the explosion of dotcom shares.

This year’s decline is attributed to two periods of massive liquidations, mainly of government debt. At the beginning of the year, investors “got rid” of long-term government bonds, estimating that the recovery from the pandemic would introduce a period of sustainable growth and high inflation. And then, around the fall, short-term debt was pounded by signs that central banks were preparing to shift course and enter an interest-rate trajectory in the face of persistent inflationary pressures.

In the US, where inflation reached its highest point in a decade, in November, at 6.8%, the 10-year yield has risen to around 1.49%, when it was just 0.93% at the beginning of the year, following reduced bond prices. The yield on the 2-year bond has risen from 0.12% to 0.65%.

“We should not be surprised that bonds have turned into bad investments when inflation ‘runs’ at 6%,” said James Athey from Aberdeen Standard Investments, explaining that next year is also going to be a difficult one. “There is a strong possibility of a second shock, if the central banks move faster than expected,” he added.

However, despite losses in 2021 and the prospect of tightening monetary policy next year by the Federal Reserve and other central banks, some fund managers say it’s premature to make any negative assessments.

Long-term bond yields peaked in March, but have since fallen sharply, despite markets anticipating a reversal of banks’ monetary policy. The US market, and other markets as well, expect that the Federal Reserve is heading for two or even three interest rate hikes, as well as that the Bank of England will raise interest rates by up to four, along with the cuts in European Central Bank asset purchases

As Nick Hayes from Axa Investment Managers explains, the recent strength of long-term debt is a sign that investors believe central bankers could derail economic recovery or even cause a stock market sell-off in the stock market, if they tighten monetary policy too quickly.

Latest News

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

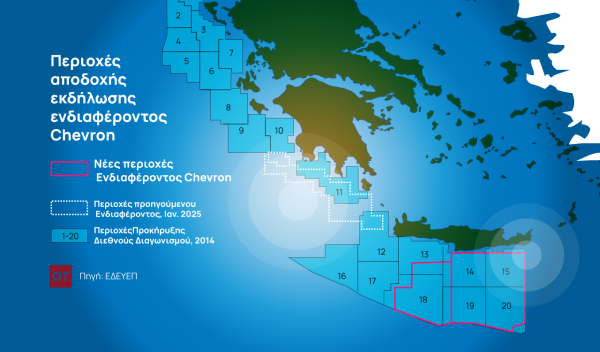

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

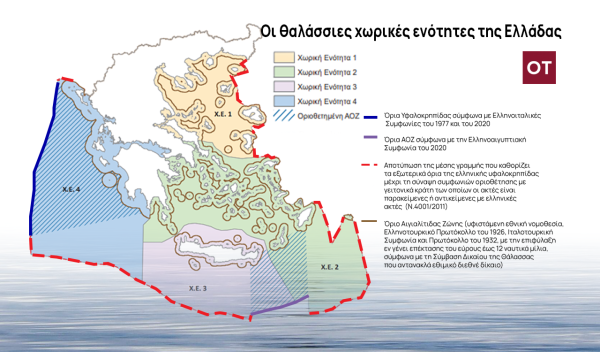

Why Greece’s New Maritime Spatial Plan Is a Geopolitical Game-Changer

This landmark development is more than just a bureaucratic step — it's a strategic declaration about how Greece intends to use, protect, and assert control over its seas

Eurozone Inflation Eases to 2.2% in March

Compared to February, inflation decreased in 16 member states, remained unchanged in one, and rose in ten.

Bank of Greece: Primary Gov. Surplus €4.1b Jan.-March 2025

The data released today by the Bank of Greece revealed that the central government’s overall cash balance recorded a surplus of €1.465 billion in the first quarter of 2025, compared to a deficit of €359 million in the corresponding period of 2024.

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης