Banks are gradually shaping their new role, with the aim of boosting their revenues, which is a necessary condition for a return to viable and sustainable profitability.

Interest on loans may continue to be the main source of revenue for the industry, but they are not enough in the new, more complex and competitive financial environment.

In this context, a dominant position in their business plans is to increase their commission revenue. The first steps in this direction have already been reflected in the figures of the last quarters.

However, this is only the beginning. In the coming years, the four systemic groups are called upon to close the gap with the rest of Europe on this front.

According to recent data from the European Central Bank (ECB), the ratio of commission income to the total income of domestic banks is below 15% compared to more than 30% in the EU.

The strategy

Covering this distance, in addition to the increased commissions from the acceleration of credit expansion, necessarily goes through the provision of third party services through their networks, both physical and digital. In other words, they will cease to be vertical units.

It is something that is already happening on a large scale with the sale of bank insurance products to their customers, such as hospital plans, life products and damage insurance for vehicles and houses.

What is required at this stage, however, is a change in the way customers are approached. In particular, banks will not sell products, but will cover all kinds of needs.

“Instead of the client coming and asking us for a mortgage, he will come and tell us ‘I want to get a new home’. And we will be there to meet the specific need from A to Z”, emphasizes a banking source.

As he typically says, banks in cooperation with realtors and real estate companies will find for their client a series of options in the real estate market, which on the one hand will meet his wishes and on the other hand can be financed, based on his credit profile. Something similar can be done with the purchase of a car.

Integrated business support

On the other hand, business and professional loyalty presents significant revenue generating opportunities. Systemic groups have already created a service ecosystem, which will be continuously enriched, in collaboration with companies from a variety of industries.

In this way, they help their customers, especially small and medium-sized businesses, to modernize, better organize, digitize and become greener, under the guidance of their banking advisors.

Typical examples are the transition to the cloud, the computerization of accounting, the creation of e-shops and digital marketing to promote e-sales.

In this way everyone is won. On the one hand, the banks that receive commissions from the cooperating companies and on the other hand, their customers who meet their needs with better prices.

The same applies to development programs, such as the actions of the Recovery Fund and the NSRF. The banks present to their customers all their options and then their implementation is done by their specialized partners.

In this way, both the planning of investment actions and the provision of the necessary resources for their implementation are supported.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

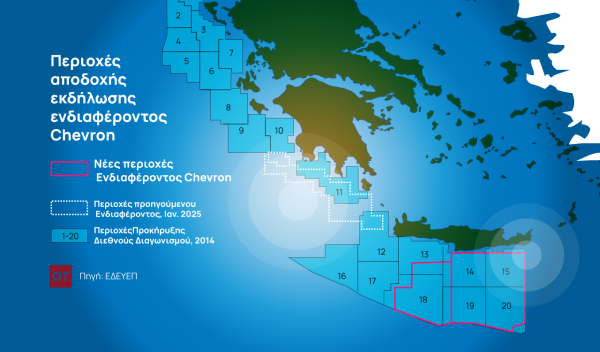

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης