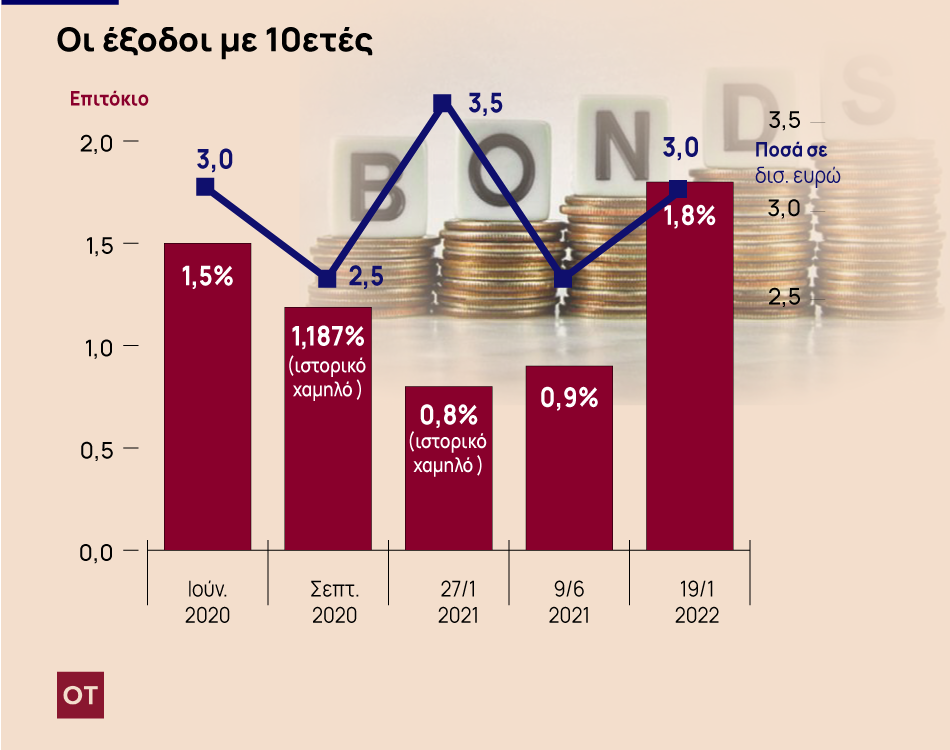

The Eurozone is saying goodbye to the environment of very low interest rates with Greece making its debut in the markets with a higher interest rate, but recording strong demand. The offers for the new ten-year bond exceeded 15 billion euros and the Greek government raised 3 billion euros with the yield reaching 1.8%, from the low 0.88% of last June. According to Public Debt Management Agency (P.D.M.A.), the composition of investors was 84.5% from abroad, 15.5% from Greece and 87.2% institutional.

Last year’s interest rates are a thing of the past and German bonds, which “went through” a positive performance for the first time in three years, are characteristic of the upward trend. The Greek 10-year bond issued in 2021 was trading at over 1.6% when during its last year entry in the markets the interest rate was at the historically low of 0.807%. However, the interest rate margin against the German rate has shrunk significantly compared to 2019 and the new borrowing in Greece cost less than half compared to the corresponding issue of March 2019 when the interest rate was at 4%.

Following the jump by 5% in year-on-year inflation in December, Germany seems to be nearing the end of a period of negative interest rates with the Bund yielding -0.02% while at a 12-month low they had still reached and at -0.50%. In Britain, interest rates have risen to 1.20%, rising by 90 basis points in recent months. The US Federal Reserve’s clear signal that it intends to proceed with at least three dollar rate hikes in 2022 has caused dominoes around the world. The ECB, for its part, may be firm in its forecasts that there will be no increase in borrowing costs in the Eurozone this year, but a barrage of increases by the Fed would not leave much room for the single currency area either.

Most of the next releases in the first half

Despite the conditions of higher yields, the key for the exit time this year remains the interest rate level and the goal for this year is to raise 12 billion euros. Most of the loan program this year is expected to take place in the first half, while the issuance of the first green bond is scheduled for after the spring. It is noted that Greece in 2021 entered the markets with 5-year, 10-year and 30-year bonds, raising a total of over 15 billion Euros through the private placement of the 30-year bond.

Satisfaction prevails in the financial staff and according to the strategy, the goal is to be present in the international markets, to reduce the debt / GDP ratio, as well as to preserve the large capital cushion that reaches 36-37 billion euros). The main goal of the Ministry of Finance for this year is, among other things, the exit from the enhanced supervision, maybe even earlier than June, the early repayment of loans of the first Memorandum – IMF (around 7 billion euros), the recovery of the investment level by 2023 and at the same time to implement effectively the plan from the Recovery Fund and the gradual return to surpluses with simultaneous support to vulnerable households and businesses.

According to the Minister of Finance, Christos Staikouras, the issue was crowned with success, as it gathered high demand and quality of funds and added that the cost of borrowing is considered very satisfactory, taking into account the current, international situation. “International bond yields are rising internationally due to the high level of uncertainty caused by the ongoing health crisis, rising inflation and the imminent shift of central banks towards a more restrictive monetary policy,” he said. He stressed that the country continues the proven successful publishing strategy and the effective economic policy of the last 2.5 years, manages, in an international environment of intense liquidity, to move unwaveringly, under any circumstances, to the regularity of a classic issuer-country of the Eurozone, “Locking” the borrowing costs of the decade at low levels.

Latest News

PM Mitsotakis to Chair New Democracy’s Committee Meeting

Today’s meeting is seen as a crucial opportunity to halt internal disputes within ND and reaffirm unity within the party.

Trump Tariffs Jeopardize Growth: Piraeus Chamber of Commerce

The tariffs, aimed at reducing the U.S. trade deficit, are expected to have both direct and indirect effects on the European economy

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης