Τhe revenues from Airbnb type properties, acquired by thousands of taxpayers in 2021, will be checked by the tax inspection mechanism.

In order for those who hide from the Tax Office the income they receive from the rental of their real estate to be identified, the Independent Public Revenue Authority (IAPR) is planning extensive cross-checks on short-term leases with the data that taxpayers will display in this year’s tax returns.

Taxpayers who have included their properties in short-term rental platforms, have until February 28, 2022 to finalize their real estate data on the special platform of IAPR, for the year of 2021. By the same date, they will have to correct any mistakes made in the provisional statements.

These data will be checked by the tax auditors and will be cross-checked with the data that IAPR will receive from Airbnb, Booking.com and VRBO platforms as provided in the cooperation protocol they have signed.

In cases where it is found that properties have not been declared in the “Register of Short-Term Residence Properties”, or were posted on digital platforms without an explicit indication of the Property Registration Number, the Short-Term Residence, the Special Operation Signal or the Unique Notification Number, then the real estate data or the details of the “Administrators” are sent to the Tax Office, while taxpayers are facing sanctions.

The fines

Violators face fines ranging from 5,000 to 20,000 euros. An independent fine of 5,000 euros is imposed for each of the following violations:

– Omission to register the aforementioned information in the “Register of Short-Term Residence Properties”‘.

– Not clear indication of the registration number in the “Register of Short-Term Residence Properties” on digital platforms, as well as on any other means of promotion.

– Not clear indication of the number of the Special Operation Signal or the Unique Notification Number on the digital platforms, as well as in any other means of promotion, by “Administrators” for whom there is no obligation to register in the “Register of Short-Term Residence Properties”.

The fine is imposed on the “Administrator” and, in case it does not appear that the “Administrator” is a lessor or a third party, the fine is imposed to the detriment of the owner or usufructuary of the property. From the finding of the violation, the “Administrator” is obliged, within 15 calendar days, to take the necessary compliance actions.

In case the same violation is found again within one year from the issuance of the act of imposition of the fine and, if the 15-day deadline for the completion of the compliance actions of the “Administrator” has passed, the fine is imposed in double and in case of same infringement the fine imposed is four times the amount originally imposed.

Finalization of tax returns

Those who do not correct and finalize the initial tax returns by February 28, 2022, they risk being taxed at 100% of the income declared with the initial tax returns, even if they are not the final beneficiary of all receipts.

The finalization of the Short-Term Residence Register is related to the obligation of the Property Manager to distribute the income obtained from all the Short-Term Residence Declarations that have been submitted in each tax year, to them and to the potential beneficiaries of income. The finalization of the Register can be done until the 28th of February of the year of submission of the income tax return in order to determine the taxable income per beneficiary of income. Until the finalization, the Property Manager can correct any wrong entries and modify data (other income beneficiaries, income rates, etc.) without changing the Real Estate Registration Number and without being penalised for any delays.

Latest News

PM Meloni Meets Vice President Vance in Rome Signalling Optimism on Ukraine Talks

Meloni emphasized the strength and strategic value of the Italy-U.S. partnership.

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

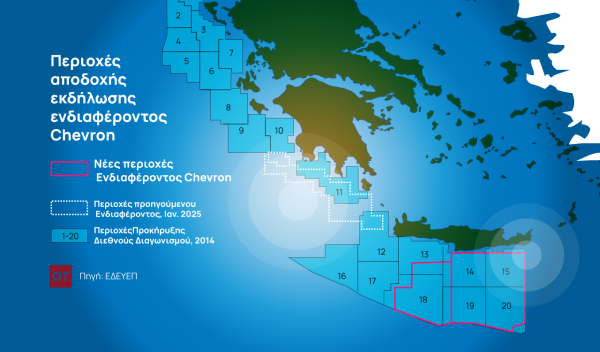

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης