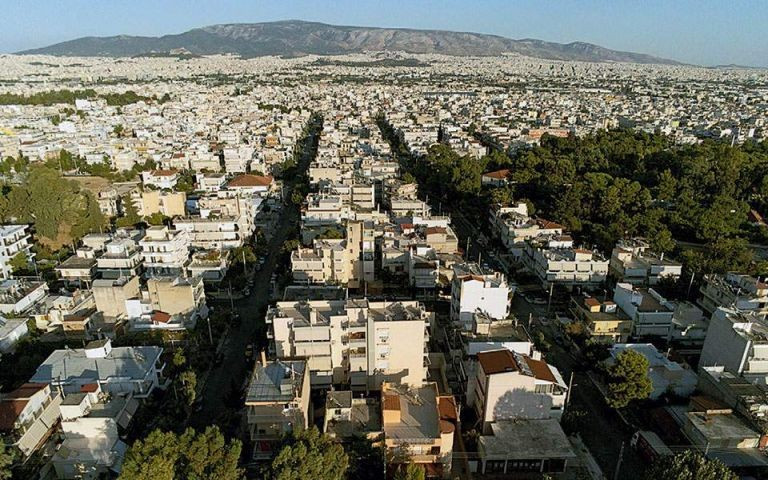

Banks have taken battle positions to maximize the goodwill that will arise from the upward cycle in which the domestic real estate market has entered.

The large stock of approximately 20,000 properties they currently have in their portfolios after a three-year consolidation period of balance sheets, which will grow as auctions increase, will be a significant source of boosting their profitability in the coming years.

Banking sources point to a white hole, which can provide high returns to the industry, provided there is effective asset management of these assets, either directly or indirectly through loan and credit management companies.

In addition, there are high expectations for financing opportunities for small and large transactions, at a time when the liquidity of systemic groups is high.

The strategy

According to the same cycles, despite the climate of uncertainty and the pressures that household and business incomes will face due to the energy crisis, demand is expected to remain high in the coming years. In this context, they predict an annual increase in prices around 5% – 6% by 2025.

The goal of the banking administrations is to make available to both Greeks and foreign investors, a number of properties each year that will not upset the balance between supply and demand, negatively affecting values.

For the same reason, banks are not, at least at this stage, willing to liquidate residential and commercial real estate at significantly discounted prices. Therefore, they promote those for which there is a strong market interest.

Moreover, in addition to sales, additional income can arise from the utilization of the real estate they have in their portfolios. That is, their lease, at a time when rents are at a high of many years.

Jobs from new loans

However, in addition to direct revenues from the sale and operation of real estate, banks also have to benefit from the financing of related transactions.

It is estimated that by 2026 the relevant works could even reach 20 billion euros, significantly enhancing their sound assets and contributing significantly to the increase in interest income.

In particular, the following funding opportunities are presented:

– The properties purchased during the auction process by the accelerators themselves, ie the investors who acquired non-performing mortgage openings

– The final buyers who acquire real estate either through auctions or directly from funds and banks that they own

Also, great prospects for strengthening the work for the banks are opened in the field of financing the transfer transactions of non-performing portfolios.

These relate to either secondary movements for the sale of doubtful receivables outside of bank balance sheets or primary movements for the transfer of NPEs.

![Ελαιόλαδο: Ανάκαμψη στην παραγωγή, πίεση στην κατανάλωση – Τι αλλάζει έως το 2035 [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/07/elaiolado.2023-1.jpg)