The net interest income consolidation program will also hit the net interest income in 2022. This is an inevitable pressure, as last year a record was registered in the denationalization transactions of non-performing exposures.

The first compound securitizations of green loans made in the previous year will have a similar effect, although to a much lesser extent, in order to strengthen the capital adequacy ratios.

The forecasts published by AlphaBank and Eurobank for the results of 2022 are indicative. The relevant price will of course be paid by all systemic groups, depending on the degree of adjustment of arrears achieved in the previous quarters.

The reason is that red loans also contribute to a certain extent to net interest income. Thus, any transfer of assets to third parties nullifies or reduces the relevant benefit, depending on the method used (sale or securitization).

For example, AlphaBank completed trading in troubled portfolios totaling € 16 billion in the previous twelve months, reducing its non-performing exposure ratio from 42.5% to 13%.

Its management predicts for this year a reduction of net interest income by up to 17% or 285 million euros compared to 2021.

On the other hand, Eurobank expects a drop of its respective figures by 3% or 40 million euros. Of course, the bank’s consolidation transactions last year were significantly lower than AlphaBank (3.2 billion euros).

Estimates for the above losses would be worse if we did not expect a net increase in loan balances from new operations, but also an organic reduction of bad debts through successful arrangements.

Overcovering losses

However, this is a pressure that will be offset by other sources and eventually the repeated pre-tax profit in the worst case will be formed in 2022 at the same levels as the previous year.

Specifically:

An increase in commission income is expected, which will come both from the rise of operations in all categories of credit, and from the management of customer funds, which will increase as deposit rates are at zero levels.

The cost of credit risk will be reduced, due to the reduction of the stock of red loans, but also the improvement of the income of households and businesses, if the country remains on a growth trajectory, which will limit the creation of new bad debts. Forecasts at AlphaBank are expected to fall by € 100 million and at Eurobank by € 170 million, with the risk-weighted ratio of assets falling to 70 and 65 basis points respectively from 85 and 110 points in 2021.

The positive effects of the voluntary exit programs and the moves to reduce the network of stores that were completed in 2021 will be visible. For example, Alpha Bank expects a reduction of its operating costs by 180 million euros on an annual basis, as last year its employees decreased by 1,580 and its units by 26 in Greece.

Latest News

PM Meloni Meets Vice President Vance in Rome Signalling Optimism on Ukraine Talks

Meloni emphasized the strength and strategic value of the Italy-U.S. partnership.

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

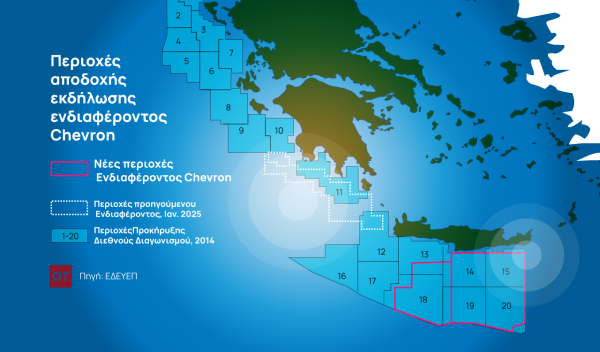

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης