The operation of the Register of Assessors for the loans of the National Recovery and Sustainability Plan “Greece 2.0” has started, following a decision signed by the Deputy Minister of Finance responsible for the Program, Mr. Thodoros Skylakakis, according to a relevant announcement.

In particular, the participants in the Register undertake the evaluation of the investment projects for which financing is requested from the loan funds of the Recovery and Resilience Fund. Their selection, from the participating in “Greece 2.0” credit institutions, is done through an electronic lottery.

Cooperation with banks

In the context of control of eligibility, the evaluators will cooperate with the banks and the bodies implementing the investment plans, ensuring the observance of EU and national legislation, with special sensitivity to environmental issues.

To be included in the Register, prospective evaluators must have a team of experienced staff. This includes, inter alia, environmentalists who review and ensure that plans comply with the Do No Significant Harm principle (DNSH), as well as legal advisors, who ensure compliance with State Aid rules.

A “scan” of the project teams

Each project team consists of at least 20 members, which contributes to the evaluation of projects in terms of transparency and speed. The structure of the team is as follows:

1. Project Manager: Certified Public Accountant, who has the overall responsibility for the work of the evaluator, the administration, the progress and the coordination of all the members of the project team. He is responsible for ensuring the quality of the project, as well as for the observance of all the completeness standards set by the competent Special Coordination Service of the Recovery Fund.

2. Deputy Project Manager: Certified Auditor – Accountant, who assists and replaces the Project Manager in his duties.

3. Evaluation staff: Certified public accountants (at least four people).

4. Business plan evaluation staff (at least five people).

5. Environmental Impact Assessment / Study Executives (at least five people)

6. Legal advisers, specialized in state aid issues (at least two people)

7. Evaluation staff of digital transformation projects (at least one person)

8. Secretarial Support (at least one person)

The contribution of evaluators

The contribution of the evaluators is necessary for the efficient utilization of the loan resources of the Recovery and Resilience Fund, which is in the process of implementation. Already, potential investors, who wish to utilize the 12.7 billion euro loan arm of “Greece 2.0” have begun to submit their plans. It is recalled that the first approved investment – by a bank cooperating with the Fund – amounting to 10 million euros has been announced, which will be made by the “Grecian Magnesite S.A.” mining industry.

It is clarified that the transitional legislation provided for a process of evaluation of the projects, until the creation of the Register. Now, with the publication of the Minister’s decision, the transitional provision ceases to be valid and the Register is put into full operation.

Disbursement of funds

In the meantime, out of the total amount of 12.7 billion euros, funds amounting to 1.57 billion euros are disbursed immediately, for the implementation of investments within Greek territory, according to the operational agreements of the Ministry of Finance with the domestic Banks (National Bank, Piraeus Bank, Alpha Bank, Eurobank, Optima Bank, Pancretan Bank and Hellenic Development Investment Bank) and international banks (European Investment Bank and European Bank for Reconstruction and Development), which participate in the Program.

The cooperating banks have sent an official invitation to investors – with relevant invitations that they published on their websites – for their participation in “Greece 2.0”.

The loans of the Recovery and Resilience Fund cover up to 50% of the total eligible investment costs, with a fixed interest rate at this stage of 0.35%. The private participation of the companies (investment body) covers at least 20%, while the co-financing loan from the Bank cooperating with the Program at least 30% of the total eligible costs of the investment project.

Latest News

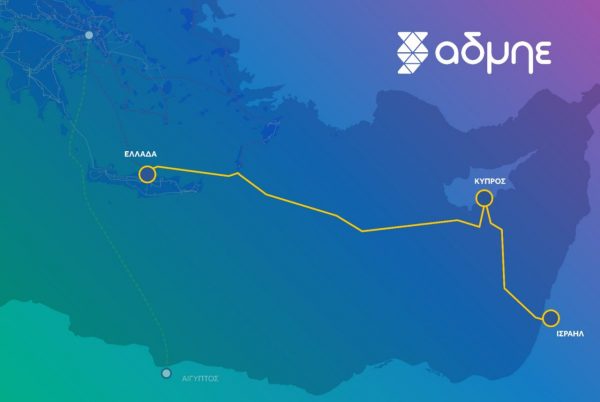

Critical Week for Greece-Cyprus Cable

The study concluded that the social benefits of the interconnection, totaling 8 billion euros, far outweigh its 1.9 billion euros construction cost, resulting in a net social benefit exceeding 6 billion euros.

Roberta Metsola Re-elected President of European Parliament

Her second term will be for a period of two and a half years

ELSTAT: 1.5% Increase in Business Turnover in May 2024

The most significant increase in turnover in May 2024 compared with May 2023 was recorded from the enterprises of the Accommodation and Food Service Activities, sector which grew by 14.8%.

Cosco: Container Traffic Decline at Piraeus Port Continues

This strategic shift has diminished Piraeus's standing as a prominent Mediterranean port and a key transshipment hub post-Suez Canal.

Gov’t Eyes Return of Power Subsidies Amid Spike in Rates

According to reports, the government will resume an electricity subsidization program, given that forecasts cite disruptions – i.e. higher rates

ELSTAT: 6.3% Increase in Output Price Index for Agriculture and Livestock

The 6.3% rise in May 2024 is largely driven by an 8.8% increase in the crop output group, particularly due to changes in olive oil prices, and a 0.5% increase in the animal output group.

Balkans Blackout Highlights Climate Threats to Power Grids

The surge in electricity demand during the heat wave and the power deficit in Balkan markets have driven up prices in the Greek wholesale electricity market.

Greece in Top 4 Destinations Favored by European Tourists

Greece was selected by 5.9% of respondents who were asked where they would vacation this year, up from 5.4% in the same survey last year

Scope Affirms Greece’s BBB- Ratings; Revises Outlook to Positive

The international ratings firm raised Greece to investment grade in early August 2023

First Seaplane Test Flights to Skopelos, Alonissos, Skyros

After decades of on-again, off-again efforts to schedule regular seaplane routes to Greece's numerous island and coastal destinations the prospect now appears within sight

![Τουρισμός: Ποιες χώρες ηγούνται της παγκόσμιας ανάπτυξης – Στην 9η θέση η Ελλάδα [πίνακας]](https://www.ot.gr/wp-content/uploads/2024/05/02tourismos10-90x90.jpg)

Αριθμός Πιστοποίησης Μ.Η.Τ.232433

Αριθμός Πιστοποίησης Μ.Η.Τ.232433