The Turnover of the Plastics Thrace Group amounted to € 428.4 million, increased by 26.1% compared to 2020, from ongoing activities, according to the financial statements of 2021.

Earnings before interest, taxes, depreciation and amortization (EBITDA) from continuing operations amounted to € 103.8 million, increased by 43.2%, compared to the previous year. Also, Earnings before Taxes (EBT) from continuing operations amounted to € 83.9 million, increased by 61.1% compared to 2020.

It should be noted that according to Management estimates, for 2021, the Profit before Taxes at Group level, related to the products of the existing portfolio used in personal protection and health applications, amount to € 51.8 million.

In terms of liquidity levels, the Group achieved the further strengthening of its liquidity, recording Net Cash of € 9.3 million, as cash and cash equivalents exceeded its loan liabilities.

The total Equity on 31.12.2021 amounted to € 252.3 million, compared to € 176.1 million on 31.12.2020.

It is pointed out that the interrupted activities concern the cessation of the productive operation of the Group’s subsidiary in the USA, Thrace Linq Inc.

According to management, 2021 was a year of strong financial performance, as the Group achieved an increase in its profitability, successfully offsetting the negative effects mainly from the significant increase in the cost of Raw Materials and fluctuations in demand.

More specifically during the year the following were observed:

Increased demand for products in the construction industry.

Significant demand in the infrastructure and agricultural sectors.

Significant demand for products related to personal protection and health, especially during the first months of the year, but with a significant decrease in the second half.

Gradual increase of the prices of raw materials and their maintenance at high levels throughout the year, while in individual cases additional increases were observed, depending on the type of raw material and the geographical area.

Constantly increasing energy costs, especially in the last quarter of the year, in all the countries of the Group’s activity.

Significantly increased transport costs with significant shortages of both available ground transport and containers.

Significantly increased cost of secondary materials & packaging materials.

Assessment of the impact of the pandemic on the future and prospects of the Group

Regarding the first quarter of 2022, the Management of the Group remains optimistic for its satisfactory course, given the difficult conditions prevailing in the current period, as it is estimated that significantly better profitability will be achieved, compared to the corresponding period before the pandemic. will fall short of the profitability of the corresponding period of the previous year.

However, the correlation with the previous year becomes extremely difficult, due to the extraordinary circumstances of both that period and the current one.

Regarding the course of 2022 as a whole, the difficult and volatile macroeconomic environment described above makes it very difficult to make relevant and reliable forecasts.

However, the great effort made by the Management of the Group and the Management of the subsidiaries in all the countries of activity, creates conditions of restrained optimism that the Group will be able to implement its plans and to maintain to a significant degree the profitability of the traditional portfolio. formed in 2021, demonstrating that it has entered a new era, with significantly higher profitability, compared to pre-pandemic levels.

It should be emphasized, however, that although the implementation of this plan is a fundamental goal of management, there are concerns about the course of global economies, especially in Europe, as well as the course of consumption due to the significant price increases that have taken place, as well as high inflation, which may redefine annual performance estimates in the coming months.

Regarding the financial results, Mr. Dimitris Malamos, CEO of the Group, noted: “2021 was a milestone year for the Group, as we achieved high financial performance, strengthening our financial position, along with its ongoing implementation of our investment planning.

The strong financial performance of the last two years, enable us to continuously implement an extensive investment program, which will exceed€ 100 million, for the period 2020-2022 while at the same time special emphasis has been given to issues of environment and social contribution.

Despite the fact that the current developments at a global level, create conditions of intense concern, we are convinced that the course of the Group to date has laid the foundations for the Group to be able to achieve significantly higher profits than pre-pandemic levels, confirming that is on a path of growth and development. “

Latest News

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

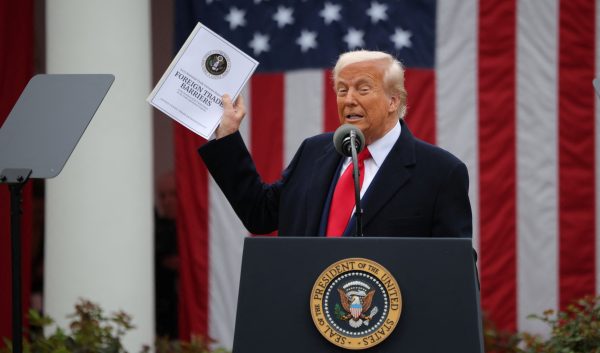

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

Santorini Safe and Ready for a Dynamic Tourism Season

Authenticity, cultural heritage, and genuine experiences at the center of Santorini's new promotional campaign

Electricity Bills: Greece Announces Reduced Tariffs Schedule

Greece will now offer lower electricity rates between 11:00-15:00 and 02:00-04:00

Chevron Confirms Eyeing Natural Gas Exploration South of Crete

Chevron recently declared its intent to explore a third area, south of the Peloponnese.

![Τουρκία: Μεγάλες βλέψεις για παραγωγή ηλεκτρικών οχημάτων [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/03/ot_turkish_autos-90x90.png)

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης