2022 was not a very good year for the Greek dairy market and especially for yogurt, with sales declining significantly compared to 2021.

The increased household expenses for the service of fixed expenses, ie utility bills, loan servicing, rents and gasoline, the wave of price increases on the supermarket shelves, but also the lack of last year’s purchases, panic over the lockdown, have cut down turnover of even basic food items, such as dairy, say retailers.

Read also: Agno milk again on supermarket shelves: Sarantis brothers’ plans for the factory

According to data from NielsenIQ measurements, in the first two months of 2022, sales of yogurt show a decrease of 7.2% compared to the corresponding period of 2021, while in milk the decrease is 5.1%.

214 million euro market

The downward trend this year is a continuation of the declining sales recorded in 2021.

Based on the data from the market measurement carried out by IRI, for the year ending December 31, 2021, the Greek yogurt market, excluding sales for traditional yogurt (s.s. that with the characteristic “skin” on the surface area) was around 54,700 metric tons in volume and around 214 million euros in value.

In 2020, during the pandemic the quantities sold were higher (56,175 tons), while in 2019 the sales volume was a total of 55,005 tons. Respectively, sales in value in 2020 were 222 million euros, while in 2019 it was 219 million euros.

Read also: FAGE: The saga of a factory and the price of milk

It should be noted that yogurt is traditionally a key element of the Greek diet, while in contrast to other countries where yogurt is usually only a dessert or breakfast product, in Greece it is mainly consumed as a standalone snack or as part of a meal.

The competition and the “private label” player

The Greek yogurt market is very competitive with the big players resorting to aggressive pricing policy, in order to keep their shares intact.

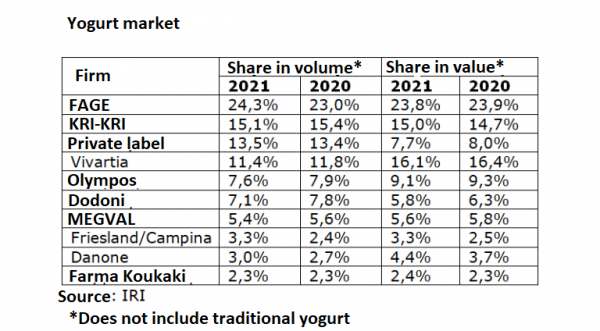

Even FAGE, which maintains the first place in terms of sales in volume and value, increased the offers to keep its position at the top. It is characteristic that the company of the Filippou family in 2021 has a higher share of sales in volume (24.3%) than sales in value (23.8%).

The second player in the industry, the Serrais dairy Kri-Kri, has increased its share in both volume and value, however, as it states in the financial statements for 2021, the increase in sales will not be easy this year, “as the overall market of yogurt in Greece seems weak and is declining in the first months of 2022 “.

In terms of sales value, the second place is occupied by Vivartia (DELTA) with 16.1%, with Kri-Kri in third place (market share 15%), followed by Olympus with 9.1%, the private label with 7.7%, Dodoni with 5.8%, Mevgal with 5.6%, Danone with 4.4%, Friesland / Campina with 3.3% and Koukaki Farm with 2.4 %.

It is interesting that the third largest player in the quantities of yogurt sold in Greece are the “anonymous” products (private label) that are essentially prepared by the large dairies on behalf of the supermarkets.

Latest News

Bank of Greece: Primary Gov. Surplus €4.1b Jan.-March 2025

The data released today by the Bank of Greece revealed that the central government’s overall cash balance recorded a surplus of €1.465 billion in the first quarter of 2025, compared to a deficit of €359 million in the corresponding period of 2024.

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης