The average consensus of economists from international organizations, international ratings agencies and international banks may point to growth of 3.2% for Greece in 2022, but developments lead to an energy deficit in the eurozone, which will have an inflationary and recessionary impact, and the Greek economy will also be affected.

The official estimates for the growth rate

The war continues, the macroeconomic environment is deteriorating, inflation is expected to exceed 10% in April and estimates for this year’s growth rate are limited by the Ministry of Finance to 3.1% or 2.1% in the unfavorable scenario of the Stability Program, at a time when the government is running out of budget for measures to support households and businesses, with analysts pointing to the risk polls will bring.

With the eurozone moving in the direction of stagflation, as it will hardly grow in the coming quarters, while inflation will exceed 7%, Bank of America now predicts that the Greek economy will grow at a rate of 2.6% in 2022 and 2% in 2023.

End of the war in Ukraine still far off

Overall, the end of the war in Ukraine does not seem to be coming soon, with the result that energy costs will remain high, being an onerous burden for households and businesses for a long time.

At the same time, ING now forecasts growth of 2.9% for Greece in 2022 (from 3.9% previously) and 2.4% for 2023 (from 4% previously). An even greater slowdown is expected for 2024, with growth falling to 1.9%, with growth overall in the eurozone being sluggish as adverse factors continue to play a role.

Revisions

The Bank of Greece predicts a slowdown in the growth rate by 1 point this year compared to its pre-war estimate, to reach 3.8% of GDP, while in the unfavorable scenario the impact rises to 2 points and the rate growth is down to 2.8%, which shows that it is close to the forecasts of the financial staff, while maintaining optimism for the longer course.

At the same time, the IMF, in its report on the economy, forecasts growth of 3.5% for this year. At the same time, the two rating agencies that upgraded Greece’s debt rating by one step from the investment grade give a vote of confidence. DBRS, in a report released after the upgrade of Greece, estimated that economic growth will reach 4.3% this year and 4.4% in 2023.

Respectively, Standard & Poor’s estimated that the Greek economy will grow by 3.4% in 2022 and over 3% for the coming years. At the same time, according to Societe Generale, our country will be upgraded by Fitch on July 8.

Also, according to IOBE, in the basic scenario for 2022, in which the war will continue after the second quarter, energy costs will be particularly high (Brent oil + 30-35%), generalized, strong protection measures will not return. In the face of the pandemic, international tourism will increase significantly, but more mildly than expected at the beginning of the year and the resources of the Recovery Fund will be used to a large extent and effectively, the Greek economy is projected to grow at a rate of 2.5-3.0% .

In the alternative scenario for 2022, in which the war is expected to end within the second quarter, a significant increase in energy costs, however less than in the basic scenario (Brent oil + 20-25%), increase in international tourism, and utilization of the Fund Recovery similar to the baseline scenario, growth will be in the range of 3.5-4.0%. It is noted that the Ministry of Finance placed growth at 4.5% and economic think tank IOBE close to 5% before the developments.

The EBRD has proceeded with a manual revision of the estimate for growth in Greece by 1 percentage point, stating that the Greek GDP will strengthen by 2.9% this year, and by 3.5% in 2023.

Growing uncertainty and high costs of energy and raw materials temporarily slow growth to 3.0% in 2022 and drive inflation to a 25-year high, with the prospect of recovering, however, GDP losses by 2023.

This is the main conclusion of a relevant report of the National Bank.

At the same time, the bank’s analysts have prepared an extreme scenario, based on which, GDP records only a marginal increase of 0.2% in 2022, with a simultaneous decline in consumption and a contraction in private investment.

Inflation remains a “thorn”

At the same time, it remains the “thorn” of inflation which sweeps the incomes of citizens, while it also creates social reactions. The Ministry of Finance predicts, based on the Stability Program, that inflation will rise to 5.6% this year (from a forecast of 0.8% in the budget), a year in which there will be a peak, as for the year it forecasts an increase in the consumer price index. by 1.6%, while the years 2024 and 2025 by 1.7%. Therefore, the executives of the financial staff expect that there will be a gradual de-escalation of the phenomenon soon.

However, the available data show persistence, something that could -possibly- cause multiple problems in the Greek economy and in the management, which the government is doing. After all, “bleaker” assessments have seen the “light” of publicity.

At the same time in the eurozone inflation reached 7.5%.In the BoG’s baseline scenario, inflation is at 5.2% and in the unfavorable at 7%, while in April the harmonized index of consumer prices made a “jump” of 9.4% (7.5 the average in the eurozone) in April. This means that the data announced by ELSTAT on May 10 will reflect a double-digit percentage for April.

It is noted that estimates have been recorded for increases in 2022 even up to 11%. According to the Parliamentary Budget Office, in the basic scenario, inflation will rise to 6.99% in 2022 and growth to 3.58%. Under the mild scenario, growth will reach 2.75% and inflation at 7.43%. In the extreme scenario, growth reaches 2.21% and 11.01% inflation. It is worth noting that the IMF “sees” inflation of 4.5%.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

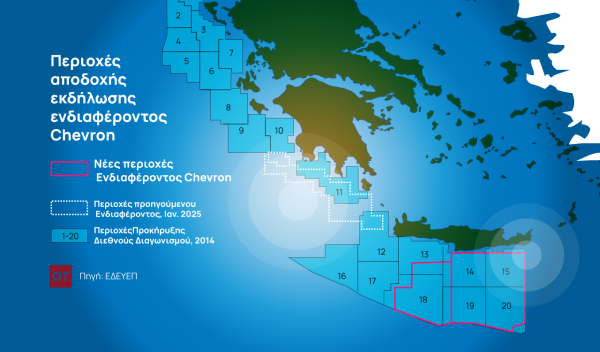

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης