By 2023, the Craft Beverage Modernization Act (CBMA) will take a new turn, with new restrictions, but also so many other opportunities for wine exporters.

Alison Leavitt, director of the Wine & Spirits Shippers Association, explained at ProWein how foreign operators can benefit from the unexpected financial gain provided by this law.

For exporters wishing to enter the US market, CBMA opens up interesting possibilities, Sectoral National Agricultural Cooperative Of Vineyard Products KEOSEO points out in a relevant post.

Unbeknownst to both exporters and importers, the Craft Beverage Modernization Act aims to put large entities and small entities on an equal footing by offering tax breaks to the latter. “This law, originally requested by breweries, went into effect on January 1, 2018. No one suspected it would have such a significant impact on the industry,” explained Alison Leavitt, director of Wine & Spirits Shippers Association (WSSA), which is responsible for facilitating the transportation of wines and spirits for its approximately 700 members, during the ProWein exhibition.

Until now, the law has been temporary in nature, undermining its effectiveness. American professionals, including the WSSA, pressured public authorities to make it permanent, a request that was now accepted, but with some significant modifications.

Saving thousands of dollars

From 1 January 2023, importers will have to pay the taxes due and then claim a refund. In addition, the order will no longer be under customs supervision, but will be administered by the US Alcohol and Tobacco Tax Bureau (TTB). The latter is in the process of setting up two management addresses, one for foreign suppliers and the other for importers. In particular, in order to benefit from the tax advantage, exporters must draw up a formal letter in the form of a letter of acceptance, granting the rebate to their importers. “The foreign supplier is the one who decides to whom he will allocate the largest amounts, knowing that we generally choose our main importer. Amounts are reduced depending on the volume of imported wines and spirits. For wine, for example, the discount is $ 1 per gallon (3.79 liters) for the first 30,000 gallons (113,700 liters). Savings on alcohol taxes is very important,” explains Alison Leavitt. “In one container they represent $ 36,000.”

An unknown law

The changes made for the beginning of 2023 will not change the foreseen amounts, except for the registration system in TTB. “There is a high probability that the two addresses that are being prepared will not be ready at the beginning of next year, but in any case the statements will be made from the end of the first quarter onwards.” Until then, WSSA will continue to raise awareness of the various actors in the supply chain about the existence of this tax advantage. “At least 25% of importers are not aware of this possibility. Some find it very complicated and even customs brokers do not necessarily want to bother. We have to assign the hard work to them!”

And yet, the consequences are obvious, especially in the context of price spikes. This tax cut could even encourage American entrepreneurs to relocate their branded wines to their advantage. Or the benefits could simply be shared between the two. ” Alison Leavitt sees another non-monetary benefit in this: “For producers who are aware of this, CBMA can help them penetrate the US market. It gives a clear advantage to foreign producers. Everyone should be aware of its existence, we need to convey this message loudly and clearly.”

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

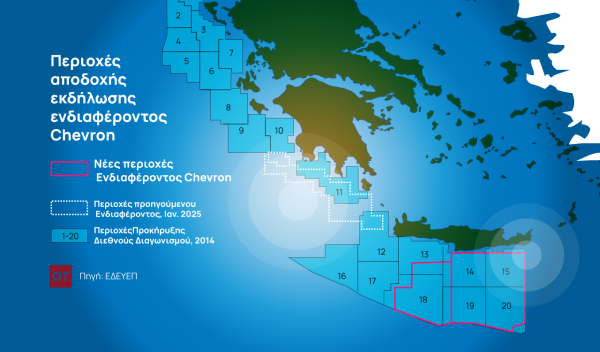

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης