The Eurogroup on Thursday officially opened the way for an end of Greece’s enhanced surveillance status, while confirming the release of further tranches of debt measures for the thrice bailed-out country.

According to a closely watched press release, Eurozone finance ministers participating in the Eurogroup cited Greece’s progress with reform implementation and the country’s macro-economic outlook, based on the 14th enhanced surveillance report composed by the European Commission.

“The Eurogroup welcomed the assessment by European institutions that the necessary conditions are in place to confirm the release of the seventh tranche of policy-contingent debt measures, worth € 748 million,” the statement read.

Eurogroup ministers also welcomed, as they said, the European Commission’s intention not to prolong the enhanced surveillance framework after its expiration on Aug. 20.

“This, combined with the earlier abolition of capital controls and the full repayment of the IMF loans, would restore conditions of normality in Greece for the first time since 2010,” the statement added.

Earlier, European Commissioner for the Economy, Paolo Gentiloni, announced that the Commission will propose the end of the enhanced surveillance regime for the Greek economy.

He made the statement while attending a Eurogroup meeting in Luxembourg.

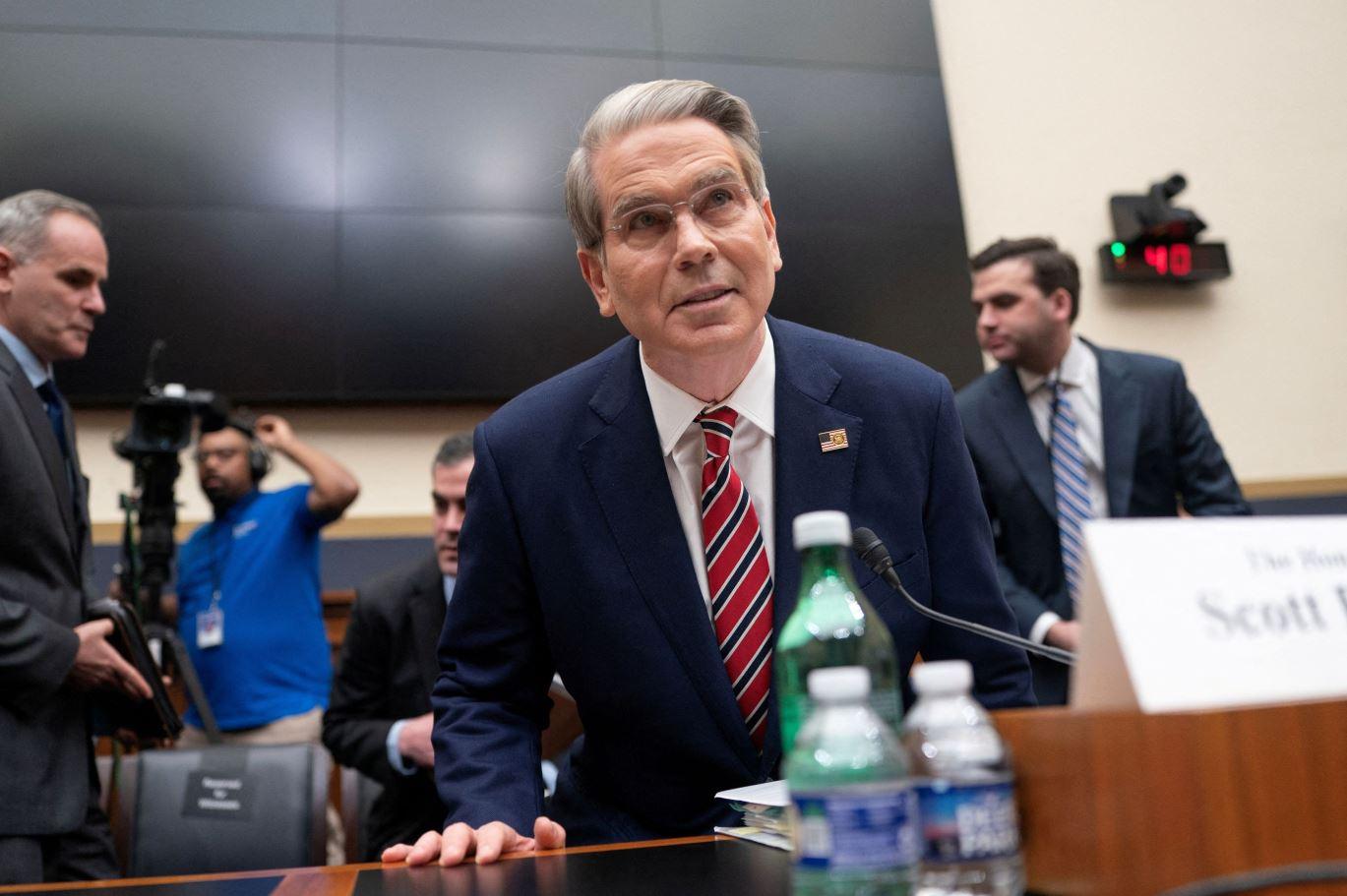

Mitsotakis

“Greece and Greeks today are welcoming a significant national success, with the Eurogroup’s seal: our economy is freed from the enhanced supervision regime. As such, a painful cycle that opened 12 years ago is now closed. At the same time, a new era of independent decisions for the country’s development and prosperity for its citizens begins,” Greek Prime Minister Kyriakos Mitsotakis commented after the decision was announced.

He said the next goal is none other than an upgrade of the country’s creditworthiness to investment grade, something that will create even more opportunities for prosperity for all.

“All this was achieved, three years now, as the country’s helm remains unwavering, even in the face of outside crises and consecutive challenges. Greece is no longer Europe’s ‘black sheep’, but a reliable partner,” he said.

In his reaction, and in directly echoing the Greek premier, Finance Minister Christos Staikouras said the country was returning to “European normalcy” and ceases to be a Eurozone exception.

“Today is a historic day for Greece; a major national goal has been achieved: Greece’s exodus from the enhanced supervision regime this summer. A difficult chapter for Greece now closes, along with the early payment of IMF loans and the lifting of capital controls; a chapter that that opened in 2010. Greece is returning; Greece is returning to European normalcy and ceases to be an exception in the Eurozone,” Staikouras’ said.

The complete Eurogroup statement is found here.