Today is the deadline for submitting binding offers for the “Ariadni” portfolio. “Ariadni” includes non-performing loans banks that were liquidated in the past 10 years as part of the consolidation of the domestic system, after the bankruptcy of Greece. The NPLs have a gross book value of 5.2 billion euros.

These are exposures that are currently under the management of PQH, appointed by the Bank of Greece.

Starting price

According to information, the minimum price that will be accepted in the binding offers, based on the EY report, amounts to 750 μιλλιον euros. In addition, the tender stipulates that in addition to their loans and pledges, the buyer will have to hire 180 PQH employees.

Market circles say that after the outbreak of the pandemic and the months-long energy crisis, the conditions do not justify a price of this amount.

As they say, it should have been at least 10% lower. “In the current financial environment and especially for such a large portfolio, rising borrowing costs and the general risk aversion trend due to uncertainty make it difficult to sell,” the same sources argue.

However, they estimate that eventually the process of selling the 5.2 billion euro package will go ahead. However, if there are no offers of at least 750 million euros, the tender will be declared barren and it is unknown when it will be scheduled again.

It is noted that the consortium of Bain, Fortress, Davidson Kempner, doValue and Cepal have passed through the phase of binding offers, while Ellington was previously looking for co-investors.

There is a rumor that the latter will ally with Intrum, however sources in the NPL industry note that the management of the latter is not interested in this job.

The profile of loans

The project concerns total receivables with a gross book value of 5.2 billion euros, the majority of which concern loans from the former Agricultural Bank and the Postal Savings Bank.

These are exposures of 53,000 debtors, which come from 13 credit institutions under special liquidation and concern all credit categories, while a large part of them are secured by real estate.

In particular it includes:

• 2.1 billion euros of debts from large companies

• 1.2 billion euros of debts from SMEs

• 1.5 billion euros in mortgage debt

• 400 million euros of debts from consumer loans

The value of collaterals has been calculated at 7.4 billion euros, of which 3.7 billion euros concern 44,000 residences, 2.3 billion euros 9,800 commercial properties and 1.4 billion euros 30,000 plots.

Latest News

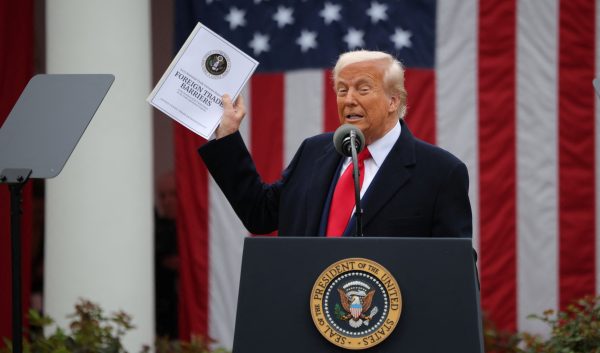

EU Condemns Trump Tariffs, Prepares to Retaliate

As tensions escalate, the EU is expected to continue negotiations with Washington while preparing for potential economic retaliation.

The Likely Impact of Trump Tariffs on Europe and Greece

Trump tariffs are expected to negatively affect economic growth in the Eurozone while Greece's exports could take a hit.

Motor Oil Results for 2024: Adjusted EBITDA of 995 mln€; Proposed Dividend of 1.4€ Per Share

Adjusted EBITDA for 2024 was down 33% yoy. The adjusted profit after tax for 2024 stood at 504 million euros, a 43% decrease from the previous year

Cost of Living: Why Greece’s 3% Inflation Is Raising Alarm

Greece appears to be in a more difficult position when it comes to price hikes, just as we enter the era of Trump’s tariffs.

Fitch Ratings Upgrades the Four Greek Systemic Banks

NBG’s upgrade reflects the bank’s ongoing improvements in its credit profile, Fitch notes in its report, including strong profitability, a reduction in non-performing exposures (NPEs), and lower credit losses

Trump to Announce Sweeping New Tariffs Wednesday, Global Retaliation Expected

With Trump's announcement just hours away, markets, businesses, and foreign governments are bracing for the fallout of one of the most aggressive shifts in U.S. trade policy in decades.

Inflation in Greece at 3.1% in March, Eurostat Reports

Average inflation in the eurozone settled at 2.2%, compared to 2.3% in February

Greece’s Unemployment Rate Drops to 8.6% in February

Despite the overall decline, unemployment remains higher among women and young people.

Jerry Kalogiratos Highlights Key Role of Energy Transition and Data Demand in LNG Outlook

Energy transition and the prospects of LNG were discussed at Capital Link’s 19th Annual International Maritime Forum, during a panel discussion with Jerry Kalogiratos (Capital Clean Energy Carriers Corp.)

Santorini Safe and Ready for a Dynamic Tourism Season

Authenticity, cultural heritage, and genuine experiences at the center of Santorini's new promotional campaign

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης