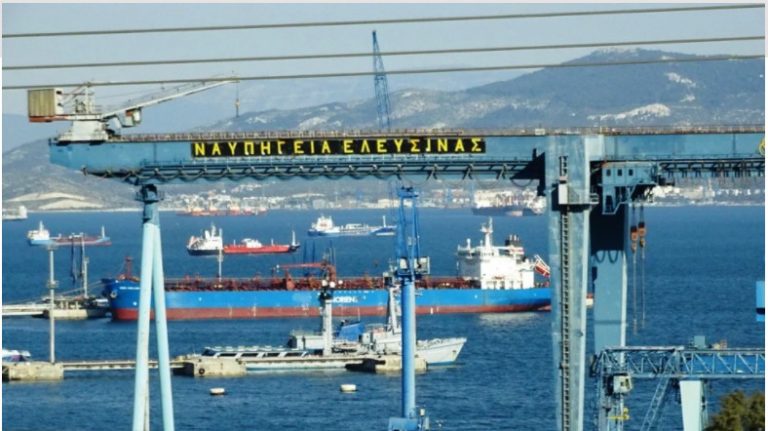

Today is the deadline for the public consultation on the draft bill entitled “Reorganizing the Elefsina Shipyards”, which the Minister of Development and Investments, Mr. Adonis Georgiadis, is pushing for a vote in the Parliament.

The reorganization plan of the Elefsina Shipyards (NBEE) forms a sustainable model for the restart of the Elefsina Shipyards as it foresees an immediate investment of 100 million dollars, safeguarding 600 jobs, compensations of 13.4 million euros for the repayment of 100% of the remaining debts to employees, the creation 1,400 new jobs within 3 years, additional revenue of 1.1 billion euros for the Greek State (direct and indirect taxes, insurance contributions) over the next 25 years and finally strengthening the Greek Economy with more than 1.6 billion euros which will be directed to domestic suppliers and the Greek Industry.

In more detail, according to the relevant informative text, the Elefsina Shipyards Consolidation Agreement provides for:

The revival of the Shipbuilding Industry, through the restart, consolidation and upgrading of the Elefsina Shipyards significantly strengthening both the Economy and the geopolitical position of Greece, as the Elefsina Shipyards will be a pillar for the National Defense Industry.

The Agreement gathers the almost unanimous support of the workers at the Elefsina Shipyards (percentage 99.7%), as well as the most important stakeholders and organizations (Elefsina Municipality, EBEP), which confirms its mutually beneficial nature.

The restart of the Elefsina Shipyards, through the Agreement, will give a significant boost to employment and the economy of the wider region of Western Attica.

The Agreement provides a sustainable solution to the huge problem of the accumulated debts of the Elefsina Shipyards. The American Development Bank’s (DFC) decision to financially support the project is a strong vote of confidence in the Agreement and the prospects of the Elefsina Shipyards.

The Strategic Agreements secured by the ONEX Shipyards & Technologies Group, as well as the significant investments it will make in equipment, Research and Development will bring Elefsina Shipyards to the forefront of the Shipyard Repair Sector, worldwide.

Key points of the Resolution Agreement

Creation of two new companies (“COMMERCIAL” and “DEFENSE” or “NEW COMPANIES”) following the ratification of the reorganization agreement, which will take over the transferred assets and liabilities of the shipyard.

In the COMMERCIAL company (ONEX ELEFSIS Shipyards Industries) to which a significant part of the NBEE Assets will be transferred, it is expected that funds up to the total amount of 170,000,000 euros will be invested after the transfer. In the Commercial company, ONEX Elefsis financing is based on DFC ($102 million) as well as ONEX Group equity (€20-80 million), while it can be increased according to needs, in a second phase.

In the DEFENSE company (ONEX ELEFSIS Naval Maritime), the activity to be developed will concern the construction of warships and other floating equipment, both on behalf of the domestic defense industry and foreign customers. Financing will be provided by Fincantieri, Italian financial institutions and ONEX with whatever capital is required to ensure the smooth execution of the company’s programs.

Debts

Based on the NBEE balance sheet of dated 30.09.2021, its total debts of all kinds amount to 432,686,301.67 euros (419,288,880.32 euros general debts + 13,397,491.35 personnel compensations), of which 211,899. 550.24 euros will be transferred to the NEW COMPANIES. The amount of the Transferred Liabilities includes an amount of 142,337,077 euros to the Hellenic Navy.

Total debts amounting to 220,786,751.43 euros remain with the COMPANY, as non-transferable Liabilities and are satisfied by the liquidation product of the Non-Transferable Assets.

The total value of the Transferred Assets of NBEE in case of bankruptcy, only amounts to 28,278,157.94 euros, with minimal recovery for creditors.

The remainder of the Non-Transferable Assets and Non-Transferable Liabilities of NBEE will remain with NBEE and the Non-Transferable Assets will be liquidated by the court appointed Special Trustee. The product resulting from the liquidation of the Non-Transferable Assets will further satisfy the Company’s creditors for their claims included in the Non-Transferable Liabilities, while in case of non-satisfaction, the said claims will be completely written off.

Hellenic Navy

Transfer/Transfer to DEFENSE of all the obligations of the NBEE dated 30.09.2021 to the Navy or 142,337,077 euros. This amount will be repaid after the Transfer Completion Date over a period of 30 years withholding flows

The Navy undertakes that immediately after the ratification of the Restructuring Agreement and by the Completion Date of the Transaction it will return to ALPHA BANK all the Letters of Guarantee held in its hands, exempting NBEE from any responsibility for them as they relate to projects which, on the one hand, are not transferred to the NEW COMPANIES and, on the other hand, the claims it maintains due to these are regulated in the reorganization agreement. It is noted that, of remaining missile boat projects, FAC(M) No.6 has been delivered since 6/2020, while FAC(M) No.7 has already been completed by 90%.

Employees

Transfer to Defense of NBEE of all the obligations to employees, dated 30.09.2021, or 27,041,925.10 euros, as well as their severance payments of 13,397,491.35 euros, which it undertakes to repay through equity or intra-party facilities and bonds.

In particular, regarding the payment of severance compensation, it will be paid to each of the EMPLOYEES, in accordance with the provisions of the relevant legislation.

Note: In the context of a bilateral agreement between employees & ONEX, the payment of 30% of the accruals with the decision of the court and the remaining 70% with the completion of the transfers and the transfer of the Shipyard to ONEX is provided as insurance coverage for the employees, and in the event of any delays in the conclusion of defense programs.

It is particularly emphasized that for the second time ONEX (initially in Neorio) will pay accruals of previous ownership before the formal completion of the transfer process.

Greek State

Social security and pension fund EFKA in case of forced liquidation will receive 4,039,604 euros, while with the consolidation plan it will receive 5,760,938 euros.

- The Greek State in case of forced liquidation will receive 1,367,883 euros, while with the consolidation plan it will receive 1,894,773 euros.

- Employees (total and with compensation) from 40,439,346 euros in case of forced liquidation will receive 2,015,531 euros, while with the reorganization plan they will receive 40,439,346.

- The Hellenic Navy from 142,337,077 euros in case of forced liquidation will receive Euro 1,579,517, while with the consolidation plan it will receive Euro 142,337,077.

- The Other Insurance Institutions in case of forced liquidation will receive 218,048 euros, while with the reorganization plan they will receive 327,024 euros

Cost of non-approval of Agreement

The non-approval of the Elefsina Shipyards Consolidation Agreement, combined with their particularly negative financial position, and the multitude of problems they face are expected to pose a direct risk to their continued operation, with particularly negative effects on the national economy (due to the size of the industry), national security (due to their involvement with the Navy’s defense programs), but also the local community (as it has determined the economic model of the region, and is directly linked to the economic survival of the wider region). At the same time, the loss of debts for the Greek government, insurance funds, employees, and the rest of the parties involved will be almost total if the company enters a forced liquidation regime.

Benefits for the Greek Economy

In addition to NBEE’s existing obligations to the Greek State and the insurance funds, for which the reorganization plan foresees repayment, according to ERNST YOUNG it is estimated that the restart of the activity will bring the Greek State additional revenue from direct and indirect taxes as and from employee insurance contributions, totaling more than 1.1 billion euros over the next 25 years.

The Elefsina Shipyards are expected to employ 600 workers during their first 6 months of operation under the new regime (i.e. after the validation of the consolidation agreement by the competent court), while by the end of the 3rd year of operation, the total number of workers is estimated to rise above 2,000 (1,000 in the commercial and 1,000 in defense company). In total, over the next 25 years, this employment is estimated to bring benefits of more than 800 million euros to employees.

Beyond the direct jobs and the fiscal positive sign, the restart of the Elefsina Shipyards is estimated that over the next 25 years it will further strengthen the Greek economy, channeling to domestic suppliers and the wider Greek industry funds amounting to 1.6 – 1, 8 billion euros.

Through the transaction, the operation of an important industry restarts, which, in addition to creating high corporate value, redefines the productive dynamics of Greece in important sectors such as defense and shipbuilding.

Regarding the programs of the Defense Company, such as e.g. that of corvettes there is a huge possibility of flexible and long-term financing programs through Italian financial state organizations that ensure solutions for the Greek government. These can be further analyzed during specialized discussions, and have already been included in Fincantieri’s proposal for the Corvette program.

Latest News

First Step Towards New Audiovisual Industry Hub in Drama

The project is set to contribute to the further development of Greece’s film industry and establish Drama as an audiovisual hub in the region

Airbnb Greece – Initial CoS Ruling Deems Tax Circular Unlawful

The case reached the Council of State following annulment applications filed by the Panhellenic Federation of Property Owners (POMIDA)

Mitsotakis Unveils €1 Billion Plan for Housing, Pensioners, Public investments

Greek Prime Minister Kyriakos Mitsotakis has announced a new set of economic support measures, worth 1 billion euros, aiming to provide financial relief to citizens.

Alter Ego Ventures Invests in Pioneering Gaming Company ‘Couch Heroes’

Alter Ego Ventures' participation in the share capital of Couch Heroes marks yet another investment by the Alter Ego Media Group in innovative companies with a focus on technology.

Corruption Still Plagues Greece’s Driving Tests

While traffic accidents continue to claim lives on Greek roads daily, irregularities and under-the-table dealings in the training and testing of new drivers remain disturbingly widespread

Pope Francis Died of Stroke and Heart Failure Vatican Confirms

As news of the official cause of death spread, tributes poured in from across the globe. The 1.4 billion-member Catholic Church is united in grief, remembering a pope who championed inclusion, justice, and compassion

Increase in Both Museum Visits, Revenues for 2024

As expected, the Acropolis was the top archeological site in the country, followed by Sounion, Mycenae, the ancient theater of Epidaurus, and Vergina in northern Greece

Where Greece’s Tourists Come From: A Look at 2025’s Top Visitor Markets

The United Kingdom continues to hold the top spot as the largest source of incoming tourism, with 5.6 million seats booked for Greece this summer — up 2.2% from last year. This accounts for 20% of all international air traffic to Greece

Pope Francis: A Pontiff Who Reshaped the Papacy and Sparked a Global Conversation

His first words from the balcony of St. Peter’s Basilica—“Brothers and sisters, good evening”—set the tone for a pontificate that would challenge norms, favor mercy over dogma, and bring the papacy closer to the people.

When Blue Skies was Unmasked as ND’s Political ‘Slush Fund’

The fact that so many top New Democracy (ND) party cadres were paid by the firm Blue Skies, owned by Thomas Varvitsiotis and Yiannis Olympios, without ever citing this publicly, raises very serious moral issues, regardless of the legality

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Ξενοδοχεία: Μεγάλο το ενδιαφέρον για επενδύσεις στην Ελλάδα – Η θέση της Αθήνας [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/03/Athens-hotels-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης