Analysts are sounding the alarm for a possible bout of “stagflation” in Europe, and the European south is more at risk.

The possibility of prolonged stagflation in Greece has become a concern in international and domestic reports and economists are trying to fathom what may happen in the coming months.

In the “Greek Panel of Economists” for July published by the Center for Liberal Studies – Markos Dragoumis – a total of 26 Greek economists responded – and 27% consider a prolonged stagflation in Greece rather unlikely in the coming months, while 31% consider it possible. Economists and governments note the uncertainty that characterizes the international environment today. In the new reality, interest rates are going to increase in Greece as well and the course of international energy prices is unknown.

One scenario sees a multi-year period in which inflation remains higher than in recent decades, while real GDP growth remains lower, at or near zero. As Moody’s Investors Service reports in its analysis, southern Europe is more exposed to a stagflation scenario. Greece and Romania appear to be less exposed to a sustained inflation scenario, yet counter-cyclical policy capacities are among the weakest in the Union.

Moody’s emphasizes that although inflation is not its main scenario for the EU, if it happens it will be credit negative for the countries. The Russian invasion of Ukraine has increased the risk of stagflation, but the degree of exposure varies by country. A growth-supportive fiscal-monetary policy mix could increase the risk of a stagflation scenario.

Towards recession and ECB action

Goldman Sachs sees a worsening and technical recession in the eurozone with a contraction of -0.2% in the fourth quarter before growth returns in 2023. Among the countries that will go into recession are Germany and Italy in the second half and notes in its new report that the risks of a deep recession exist in the interruption of natural gas flows. Global growth momentum is weakening as the Eurozone PMI showed and the Goldman Sachs index is at 0.6% and -1.6% in Germany. S&P Global estimates that GDP in Italy, Spain and the Netherlands contracted in the second and third quarters of the year. High gas prices will hurt the competitiveness of Germany and industrialized countries. The Eurozone is forecast to slow from 5.4% in 2021 to 2.5% in 2022 and 1.2% in 2023.

It is noted that in the forecasts published by the European Commission for Greece in July, it estimates that in 2022 inflation will hit 8.9% from the 6.3% predicted in the Spring, to begin to decline gradually in 2023 and reach 3 .5% in 2023 versus a forecast of 1.9% in May. At Eurozone level, it is estimated that inflation will rise to 7.6% this year and 4% in 2023.

The European Central Bank is on the way to new interest rate hikes, but it is “slowing” down as it treads the challenging path of a recession. Traders estimate that it has already “walked” a third of the way in the context of the tightening of its monetary policy, and their estimates are linked to the rapid deterioration of the data across the Eurozone, which is fueling the scenarios even of a recession. Money markets are now betting that the ECB will raise interest rates by an additional 100 basis points, roughly half of what they predicted as recently as late July. In fact, at some point during the session today, estimates fell below the 100 point mark.

How can it happen?

The countries, according to Moody’s, that have the highest probability of seeing price increases become permanent are Malta, Cyprus, Portugal, Slovenia and Croatia. Italy, France and Spain are less vulnerable to a persistent inflation scenario, although already high debt levels, increased interest rate exposure and 12-month principal and interest payments increase risks. The international agency estimates EU GDP growth of 2.5% in 2022 and 1.3% in 2023 and inflation slowing to 4.4% in 2023 from 6.8% in 2022. It expects sluggish growth and inflation higher than the average over the next two to three years.

According to the Moody’s, for a stagnation scenario to occur price dynamics could be sustained due to, for example, higher and longer-lasting energy prices and spillover effects,” the report said, adding that this could further slow economic activity. It also emphasizes that for the EU to enter a scenario of stagnation, price increases could be observed due to higher and long-term energy prices and secondary effects.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

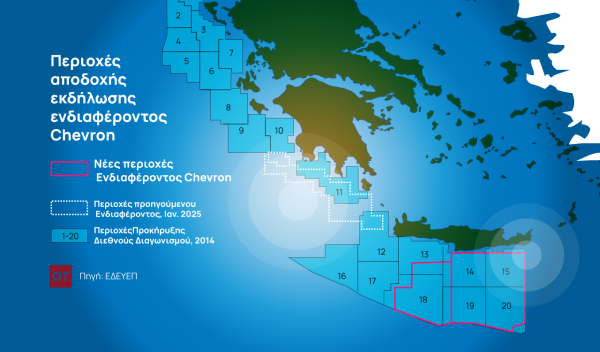

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης