Scopes Ratings believes Greece (BB+/Stable) has staged a strong recovery from the Covid-19 crisis. Last month, the agency revised up the 2022 growth forecast to 4.9% from an 4.6% estimate at the start of the year – the economy grew 8.3% last year – though Scopes revised down the 2023 forecast to 2.1% from 2.5%.

The robust rebound in tourism in Europe this summer, which led to better-than-expected Q2 growth in Spain and Italy, might also ensure Greece’s Q2 GDP comes in higher than a 0.25% quarter-on-quarter increase we assume. Conversely, any correction of recent significant inventory build-up would present downside risk. Greece is due to release Q2 GDP figures on 7 September.

Political stability under Prime Minister Kyriakos Mitsotakis’ New Democracy and strong monetary and fiscal assistance are furthermore underpinning the economy.

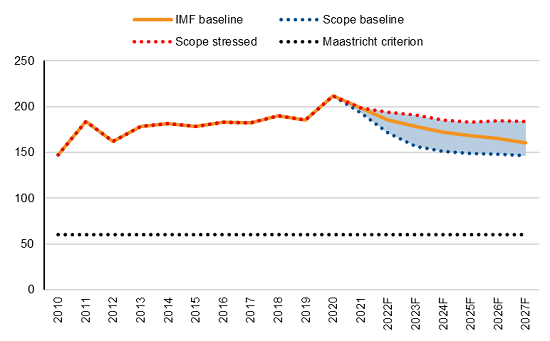

Figure 1. Better-than-anticipated debt trajectory

Greece general government debt, % GDP

Source: IMF World Economic Outlook, Scope Ratings forecasts.

Non-investment grade status no longer rules out Eurosystem support

ECB support has stabilised Greek debt markets. Together with the first line of defence of the central bank’s Pandemic Emergency Purchase Programme (PEPP) reinvestments, the new Transmission Protection Instrument (TPI) helps Greek creditworthiness in three important ways.

First, there is Greece’s very inclusion in the TPI despite non-investment grade credit ratings. Secondly, there is programme capacity for unlimited purchasing of Greek bonds, even as purchases are sterilised so avoid conflict with forward guidance for tighter monetary policy. Thirdly, the ECB will purchase bonds considering euro area countries’ specific circumstances rather than be bound by the capital key.

Read also – Eurogroup – Greece: “Green light” for end to enhanced surveillance regime for Greek economy

Furthermore, eligibility criteria requiring fiscal and macroeconomic sustainability ought to, to a degree, incentivise responsible policy setting – especially crucial with the end of the Greek Enhanced Surveillance programme this month and associated post-programme policy uncertainty.

However, the vague activation criteria for TPI – leaving significant discretion to the ECB Governing Council about which bonds are bought and when – leave unclear how the ECB would define what an “unwarranted” rise of yields is, which could constrain use and effectiveness of the facility. In addition, the lack of definition leaves the programme vulnerable to future legal challenge.

TPI presents potentially durable monetary backstop for Greek bonds

Scope’s September 2021 rating announcement, referred to the reinforcement of Eurosystem support for Greece after the Covid-19 crisis as crucial for any further ratings upside from a BB+ credit rating. Recent Eurosystem announcements such as i) reinforcement of PEPP reinvestment; ii) extension of a Greek waiver under the ECB repo framework to around end-2024; and, crucially, iii) announcement of the TPI are steps in the right direction.

More generally, central bank action since 2020 has marked a sharp pivot from Greece’s pre-pandemic exclusion from ECB monetary operations due to speculative grade credit ratings. Specifically, the TPI presents potentially provision of a permanent programme backing Greek markets, which we stated as crucial for the future ratings trajectory during our September 2021 rating upgrade.

The TPI provides a permanent ECB purchase facility for Greece that does not include elevated activation hurdle(s) of Outright Monetary Transactions. Such a durable Eurosystem backstop for periphery markets is especially relevant as there remains meaningful risk of a regional debt crisis as the ECB raises rates with possibility of a winter energy crisis.

Debt-to-GDP could decline below 150% by 2027

Greece’s 10-year government bond yields rose to 4.7% mid-June, before easing significantly to 3.0% by time of writing – although still about double an estimated 1.5% weighted average cost of debt for 2022.

We expect a headline budget deficit of only 3.5% of GDP and primary deficit of 0.75% this year, better than government objectives of 4.4% and 2% respectively, before a balanced primary account is reached over 2023-27, with a headline deficit of around 2.7% of GDP in those years.

The aggregate debt ratio is seen declining much faster than previously expected, supported by elevated inflation of 12.1% YoY in June, above-potential real GDP growth and fiscal consolidation. Debt-to-GDP will fall from a 206.3% peak in 2020 to 171.3% by end-2022, dropping below the 180.7% recorded pre-crisis in 2019, before potentially further moderating to 146.5% by 2027.

Latest News

IMF: US Tariffs Shake Global Economy, Outlook Downbeat

IMF slashes global growth forecast to 2.8% as U.S. tariffs create uncertainty and ‘negative supply shock

First Step Towards New Audiovisual Industry Hub in Drama

The project is set to contribute to the further development of Greece’s film industry and establish Drama as an audiovisual hub in the region

Airbnb Greece – Initial CoS Ruling Deems Tax Circular Unlawful

The case reached the Council of State following annulment applications filed by the Panhellenic Federation of Property Owners (POMIDA)

Mitsotakis Unveils €1 Billion Plan for Housing, Pensioners, Public investments

Greek Prime Minister Kyriakos Mitsotakis has announced a new set of economic support measures, worth 1 billion euros, aiming to provide financial relief to citizens.

Alter Ego Ventures Invests in Pioneering Gaming Company ‘Couch Heroes’

Alter Ego Ventures' participation in the share capital of Couch Heroes marks yet another investment by the Alter Ego Media Group in innovative companies with a focus on technology.

Corruption Still Plagues Greece’s Driving Tests

While traffic accidents continue to claim lives on Greek roads daily, irregularities and under-the-table dealings in the training and testing of new drivers remain disturbingly widespread

Pope Francis Died of Stroke and Heart Failure Vatican Confirms

As news of the official cause of death spread, tributes poured in from across the globe. The 1.4 billion-member Catholic Church is united in grief, remembering a pope who championed inclusion, justice, and compassion

Increase in Both Museum Visits, Revenues for 2024

As expected, the Acropolis was the top archeological site in the country, followed by Sounion, Mycenae, the ancient theater of Epidaurus, and Vergina in northern Greece

Where Greece’s Tourists Come From: A Look at 2025’s Top Visitor Markets

The United Kingdom continues to hold the top spot as the largest source of incoming tourism, with 5.6 million seats booked for Greece this summer — up 2.2% from last year. This accounts for 20% of all international air traffic to Greece

Pope Francis: A Pontiff Who Reshaped the Papacy and Sparked a Global Conversation

His first words from the balcony of St. Peter’s Basilica—“Brothers and sisters, good evening”—set the tone for a pontificate that would challenge norms, favor mercy over dogma, and bring the papacy closer to the people.

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Ξενοδοχεία: Μεγάλο το ενδιαφέρον για επενδύσεις στην Ελλάδα – Η θέση της Αθήνας [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/03/Athens-hotels-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης