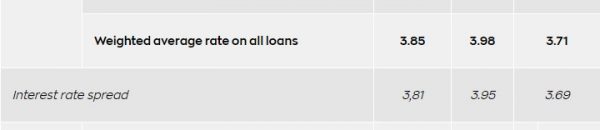

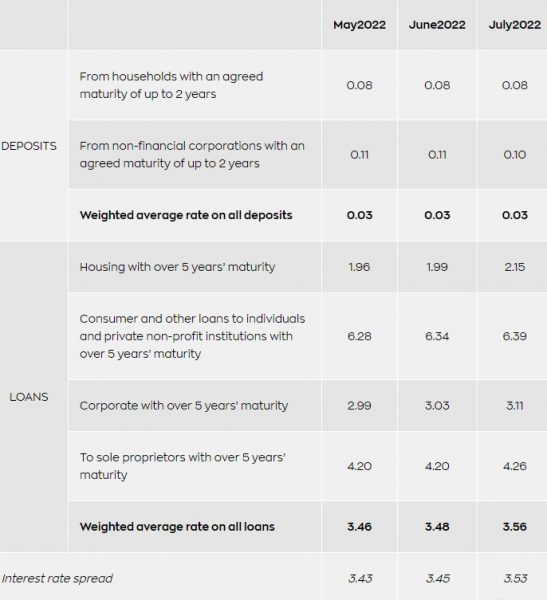

The weighted average interest rate on new deposits remained almost unchanged at 0.02% in July 2022, according to the new data released by the Bank of Greece. However, the weighted average interest rate on new loans decreased to 3.71%, and, at the same time, the interest rate spread between new deposits and loans decreased to 3.69 percentage points.

In particular:

1. Interest rates on euro-denominated new deposits and loans

New Deposits

The weighted average interest rate on new deposits remained almost unchanged at 0.02%.

In particular, the average interest rate on overnight deposits placed by households remained unchanged at 0.03%, while the corresponding rate placed by non-financial corporations remained almost unchanged at -0.01%. The average interest rate on deposits from households with an agreed maturity of up to 1 year remained almost unchanged at 0.13%, compared with the previous month.

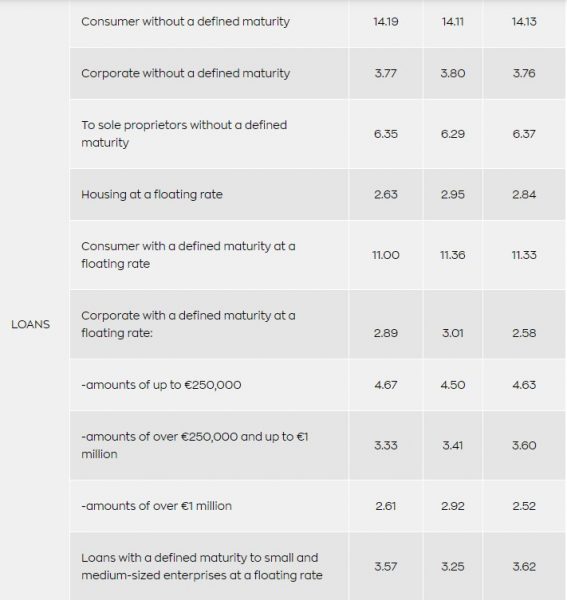

New Loans

The weighted average interest rate on new loans to households and non-financial corporations decreased by 27 basis points to 3.71%.

More specifically, the average interest rate on consumer loans without a defined maturity (a category that comprises credit cards, revolving loans and overdrafts) remained almost unchanged at 14.13%.

The average interest rate on consumer loans with a defined maturity at a floating rate remained almost unchanged at 11.33%. The average interest rate on housing loans at a floating rate decreased by 11 basis points to 2.84%.

The average interest rate on new corporate loans without a defined maturity decreased by 4 basis points to 3.76%. The corresponding rate on loans to sole proprietors increased by 8 basis points to 6.37%.

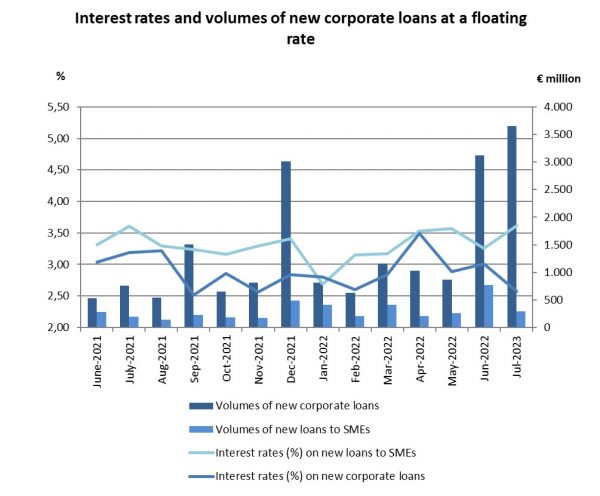

In July 2022, the average interest rate on corporate loans with a defined maturity at a floating rate decreased by 43 basis points to 2.58%. The average interest rate on loans with a defined maturity at a floating rate to small and medium-sized enterprises (SMEs) increased, compared with the previous month, by 37 basis points to 3.62%.

As regards the structure of interest rates according to the size of loans granted, the average rate on loans of up to €250,000 increased by 13 basis points to 4.63%, on loans of over €250,000 and up to €1 million increased by 19 basis points to 3.60% and on loans of over €1 million decreased by 40 basis points to 2.52%.

2. Interest rates on outstanding amounts of euro-denominated deposits and loans

Deposits

The weighted average interest rate on outstanding amounts of deposits (including overnight deposits) remained unchanged at 0.03%.

In particular, the average interest rates on outstanding amounts of deposits with an agreed maturity of up to 2 years placed by households remained unchanged at 0.08%, while the corresponding rate by non-financial corporations remained almost unchanged at 0.10%.

Loans

The weighted average interest rate on outstanding amounts of loans increased by 8 basis points to 3.56%.

In particular, the average interest rate on outstanding amounts of housing loans with over 5 years’ maturity increased by 16 basis points to 2.15%. The corresponding rate on consumer and other loans to individuals and private non-profit institutions increased by 5 basis points to 6.39%.

The average interest rate on corporate loans with over 5 years’ maturity increased by 8 basis points to 3.11%. The corresponding rate on loans to sole proprietors increased by 6 basis points to 4.26%.

Table 1: Average interest rates on new euro-denominated deposits and loans (percentages per annum)

Table 2: Average interest rates on outstanding amounts of euro-denominated deposits and loans (percentages per annum)

Notes:

1. The interest rate spread is the difference between the weighted average rate on all loans and the weighted average rate on all deposits.

2. For the calculation of the weighted average interest rate on all outstanding deposits the overnight deposits are also taken into account.

3. Loans at a floating rate comprise also loans with an initial rate fixation period of up to one year.

4. New business refers to new contracts that were agreed during the reference month and not actual loan disbursements.

Latest News

Mitsotakis Unveils €1 Billion Plan for Housing, Pensioners, Public investments

Greek Prime Minister Kyriakos Mitsotakis has announced a new set of economic support measures, worth 1 billion euros, aiming to provide financial relief to citizens.

Alter Ego Ventures Invests in Pioneering Gaming Company ‘Couch Heroes’

Alter Ego Ventures' participation in the share capital of Couch Heroes marks yet another investment by the Alter Ego Media Group in innovative companies with a focus on technology.

Corruption Still Plagues Greece’s Driving Tests

While traffic accidents continue to claim lives on Greek roads daily, irregularities and under-the-table dealings in the training and testing of new drivers remain disturbingly widespread

Pope Francis Died of Stroke and Heart Failure Vatican Confirms

As news of the official cause of death spread, tributes poured in from across the globe. The 1.4 billion-member Catholic Church is united in grief, remembering a pope who championed inclusion, justice, and compassion

Increase in Both Museum Visits, Revenues for 2024

As expected, the Acropolis was the top archeological site in the country, followed by Sounion, Mycenae, the ancient theater of Epidaurus, and Vergina in northern Greece

Where Greece’s Tourists Come From: A Look at 2025’s Top Visitor Markets

The United Kingdom continues to hold the top spot as the largest source of incoming tourism, with 5.6 million seats booked for Greece this summer — up 2.2% from last year. This accounts for 20% of all international air traffic to Greece

Pope Francis: A Pontiff Who Reshaped the Papacy and Sparked a Global Conversation

His first words from the balcony of St. Peter’s Basilica—“Brothers and sisters, good evening”—set the tone for a pontificate that would challenge norms, favor mercy over dogma, and bring the papacy closer to the people.

When Blue Skies was Unmasked as ND’s Political ‘Slush Fund’

The fact that so many top New Democracy (ND) party cadres were paid by the firm Blue Skies, owned by Thomas Varvitsiotis and Yiannis Olympios, without ever citing this publicly, raises very serious moral issues, regardless of the legality

Greek Women’s Water Polo Team Top in the World after 13-9 Win Over Hungary

The Greek team had previously defeated another tournament favorite, the Netherlands, to reach the final.

S&P Raises Greek Rating; BBB with Stable Outlook

S&P’s decision raises the Greek economy to the second notch of investment grade ladder, at BBB with a stable outlook.

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Ξενοδοχεία: Μεγάλο το ενδιαφέρον για επενδύσεις στην Ελλάδα – Η θέση της Αθήνας [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/03/Athens-hotels-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης