A new analysis by the environmental think tank The Green Tank explores the possibilities for Greece to limit natural gas consumption within the next eight months in order to contribute to the common European effort.

On 20 July 2022, the European Commission recommended that all EU-27 Member States reduce fossil gas consumption during the August 2022-March 2023 eight-month period by 15%, as compared to the average consumption recorded during the respective time-periods of the previous five years (2017-2021). The primary aim of this proposed plan is to prepare the European Union for what will be the most uncertain winter in recent years due to Russia’s war against Ukraine. However, certain member states, including Greece, have asked for and have received derogations that allow them to contribute less to the common European effort.

The new analysis by the Green Tank titled “Reduction of fossil gas consumption in Greece: Scenarios and recommendations” attempts to quantify the actual potential Greece has to reduce its total domestic consumption of fossil gas over the period in question. It focuses on the electricity generation sector, as the latter accounts for more than two thirds of the total inland gas consumption. The main conclusions of the analysis are summarized below:

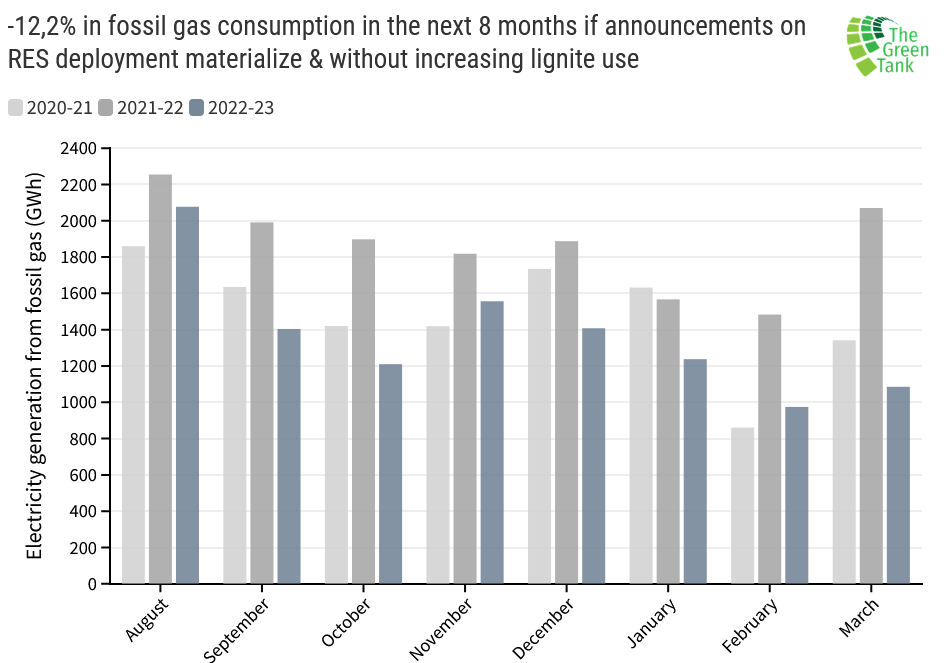

- The mere implementation of the government’s announcements to install 2 GW of renewables in 2022 and to continue at the same rate during the first quarter of 2023 (500 MW) can reduce domestic fossil gas consumption by 12.2%, as compared to the average consumption of the past five years’ (2017-2021) respective eight-month periods. In fact, this reduction can be achieved without the need to increase lignite production – compared to the previous eight-month period (August 2021-March 2022) – or to save fossil gas in the residential and industrial sectors – compared to the respective average of the last five-years’ eight-month periods.

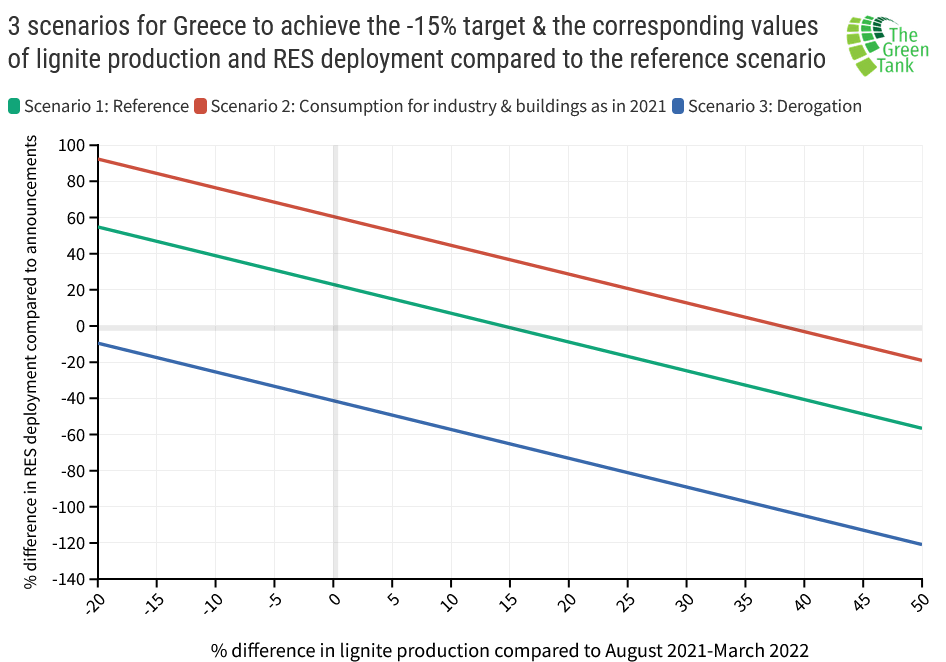

- Greece can increase its gas savings from -12.2% to -15% as set by the European Commission either by exceeding the government’s renewables deployment target by 23%, or by increasing lignite-fueled electricity generation by 14.4%, as compared to the levels of last year’s corresponding eight-month period in conjunction with a renewables deployment rate which complies with the government’s announcements.

- The reduction in gas consumption in the buildings and industrial sectors compared to last year’s increased levels can contribute significantly towards achieving the -15% target. In the case however, it is decided to not impose any measures in these sectors, meeting the -15% target will require increasing the use of lignite in electricity generation by 38%, as compared to the August 2021-March 2022 period, while conforming to the renewables deployment schedule announced by the government. Even in this adverse scenario, the required contribution of lignite does not double; in fact, it is clearly far from +100%, which was the proposed increase that was re-affirmed by the government at the last Council of Energy.

- If Greece chooses to invoke the derogation that allows it to keep total consumption at approximately the average level of the previous five years’ eight-month periods, then the country’s formal obligation can be met with a much lower deployment rate of renewables (-9.5% compared to the government’s announcements) and a significant reduction in lignite-fueled electricity generation (-20% compared to the previous eight-month period). Therefore, opting for this derogation contradicts the government’s announcements on both the deployment of renewables and the doubling of lignite’s share in the electricity mix.

“Greece has every potential to make a substantial contribution to the European effort to reduce dependence on fossil gas in the next eight months without the use of derogations, by accelerating the deployment of properly sited renewables, curbing gas consumption in the residential and industrial sectors, and using lignite at levels that do not exceed those of the previous year. This path protects the climate and shields the citizens and the economy from high energy costs, more than any other currently under consideration”, said Nikos Mantzaris, Senior Policy Analyst at The Green Tank.

The full text of the analysis is available here.