September has come with low expectations and high obligation for retailers precisely setting the tone for a shopping period, which is traditionally considered one of the good times of the year (opening of schools, new students, moving, etc.).

Retail businesses that are enjoying the beneficial tourist wave are the exception, as tourism is steadfast, as was shown by the course of the summer sales. But this is the exception that proves the rule, especially in light of a “bad” June.

Based on the data of Hellenic Statistical Authority-ELSTAT, in June clothing and footwear stores recorded a decrease in both the value and the volume of sales by 7.9% and 11.6% respectively. The picture is similar in department stores, where turnover fell by 4.6% and sales volume by 8.9%.

The durability of the clothing – footwear sector

With prices 8-15% higher than last year, clothing and footwear stores have changed shop windows to launch autumn collections, while businessmen are keeping in mind the arrivals of new foreign brands, but above all the effects of inflation on consumer income, as the latter are re-testing the strength of the industry.

The most expensive back-to-school is gobbling up a share of the clothes and shoes “pie” which is estimated to exceed 150-160 million euros, .

This week and next, by which time the first school bell will ring, are decisive as to how the month will unfold, as there are massive purchases of school supplies, which this year are trading at 20-30% markups.

Partly inflation that has distorted family budgets, partly clothes recycling, a movement which is increasingly gaining ground, either by choice or by necessity, result in diminished optimism fof professionals as concerns the outcome of the season that is just beginning.

“Consumers are now making very targeted purchases and this is even recorded in supermarket items”, say executives of Greek clothing companies.

According to them “some mobility is expected to be registered with the start of the school year, mainly in children’s clothing, however no one expects to see the turnovers of the past”.

Small firms under pressure

The biggest problem is faced by small and medium-sized entrepreneurs, as they have to deal with a “mountain” of obligations at the same time, more difficult to manage compared to the “fat” that the bigger players have.

According to a recent survey by The Small Businesses Institute-IME GSEVEE, in the first half of 2022, the following increased on average:

– energy costs by 76%,

– the cost of procurement of raw materials and goods by 43.5%,

– vehicle fuel costs by 57.8%,

– the cost of supplying equipment and machinery by 26.2%.

More than one in three small and very small businesses (37.1%), in fact, declared that they have zero cash available (27.8%) or cash that is sufficient for less than a month (9.2%), with the biggest problems located among smallest firms, based on the number of employees and turnover.

The debut of low-cost chains

The Greek market is becoming a field of glory for low-cost retailers.

Pepco

Adhering to the timetable announced last November by the Polish chains, it will officially debut on the Greek market in October.

The first Pepco store, which will sell clothes for the whole family, fashion accessories, cosmetics, toys and home equipment and decoration items, opens in Piraeus Retail Park, sealing its strategic partnership with Trade Estates AEEAP, a Fourlis group company.

In addition to Attica, Pepco stores are to be opened immediately in Thessaloniki, with the chain having recently published job ads for staff, while further expansion will follow in the rest of the country, with Larissa being among the first choices.

In total, the Polish chain plans to open 12 stores in Greece with an area of 350 to 650 sq.m.

Sinsay

In addition to the Pepco, the Polish “Zara” is also close by, as OT wrote, that is, the LPP group, one of the largest “fast fashion” retailers in Poland.

In Greece, at first, it will come under the Sinsay brand, with the first stores opening in 2023, in Athens and Heraklion, Crete. The chain has clothing at affordable prices (infant, children, youth, women’s, men’s), cosmetics, as well as home and decoration items. The group has already launched and operates the Sinsay online store in Greece.

The Polish group, which sports a total of five brands (Sinsay, Reserved, Cropp, House and Mohito), is active in 25 countries.

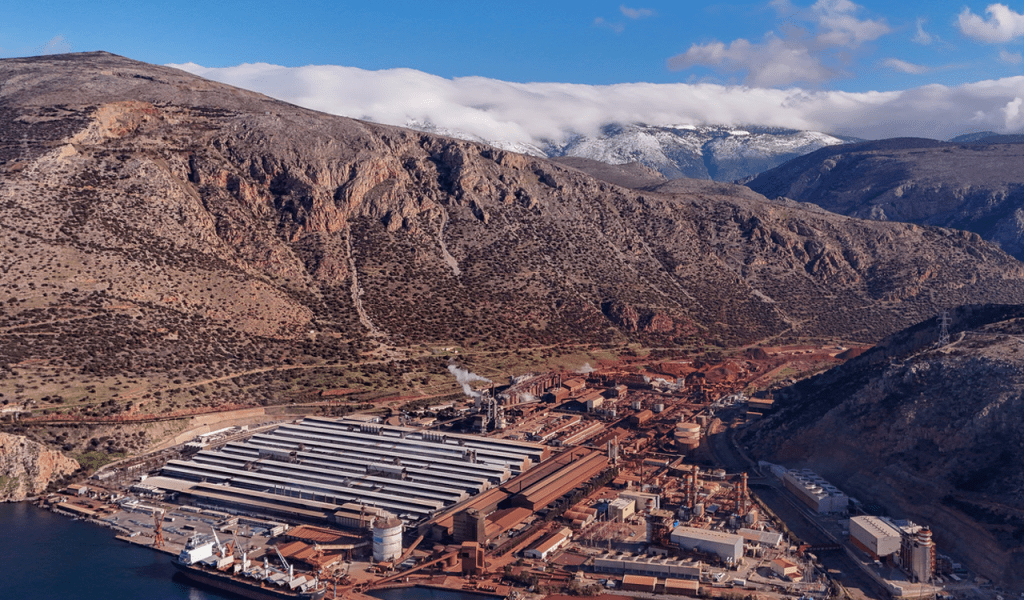

LC Waikiki

LC Waikiki, the largest Turkish chain in the field of clothing, already has 9 stores in the Greek market, aiming for its fastest expansion within the walls.

Vakko and Terminal X

The latest “arrival” that has been announced does not concern a discount chain, but the Turkish group of luxury clothing products Vakko, which has even proceeded to establish a company in Greece, planning development in our country.

At the same time, the entry of the Israeli clothing and footwear e-commerce platform Terminal X into the Greek market is also being prepared, as the establishment of the company Terminal X Monoprosopi S.A. has already progressed. It is worth noting that it is the first foreign e-commerce company in the field of clothing that will invest in facilities and staff in Greece

Technology and furniture

For technology products, the year did not start with the best omens due to inflationary pressures, while as it seems it continues without any spectacular improvement.

With chains covering gaps from the sales of other products and especially air conditioners and white appliances (due to the government’s “Recycle – Swap the appliance” program), the market moves without flare-ups.

At the moment, furniture and home equipment companies are looking to boost their turnovers, both through seasonal demand (first-year students, an increased wave of house movers, etc.) and through increased investment in short-term rentals.

In general, shortages in stocks have subsided, while the big ones have renewed and enlarged the stock in their stores.

Based on the data of Hellenic Statistical Authority-ELSTAT, turnover in June in the furniture – electrical goods – home equipment stores increased by 13.5% and the sales volume by 8.3%.