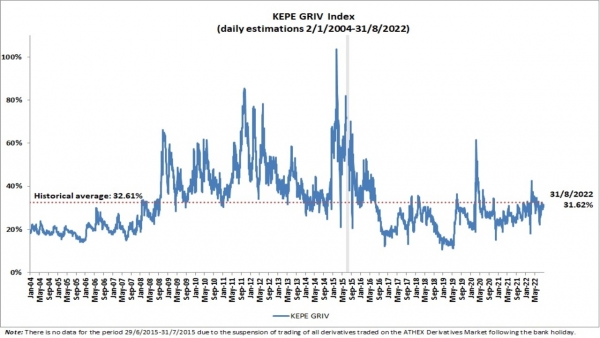

The uncertainty of the participants in the derivatives market about the expected short-term course of the Greek market, calculated on the basis of the prices of the options of the FTSE/X.A. Large Cap index, is reflected in the evolution of the “fear” index of the Centre of Planning and Economic Research (KEPE).

In particular, the KEPE GRIV index reached 31.62% on 31/8/2022 from 28.19% on 29/7/2022.

In addition, the average daily value of the index increased in August 2022 reaching 31.16% from 26.93% in July 2022.

The index remained below its historical average level (since January 2004) for the Greek market, which stands at 32.61%.

The evolution of the index indicates an increase in uncertainty for the expected short-term course of the Greek market compared to the end of the previous month

The Composite Leading Indicator (CLI) of KEPE

Αccording to the most recent observation for May 2022, the CLI recorded an increase, following the marginal decrease of the preceding period of reference, moving around levels that are the highest for the total period of investigation. The respective development seems to be an extension of the generally rising course of the CLI from 2020 onwards.

On these grounds, it is assumed to reflect the ongoing formation of positive expectations and assessments by agents involved in economic activity, offering leading indications for the preservation of an overall favourable economic environment. At the same time, it indicates that the adverse impact from inflationary pressures and the energy sector crisis associated with the pandemic and the war in Ukraine is not predominant.

In any case, under the specific conditions that prevail, it becomes necessary to re-estimate the CLI with the aim to acquire additional evidence. The inclusion of new data is expected to demonstrate the continuation or interruption of the observed trends regarding the course of future domestic economic activity.

Latest News

When Blue Skies was Unmasked as ND’s Political ‘Slush Fund’

The fact that so many top New Democracy (ND) party cadres were paid by the firm Blue Skies, owned by Thomas Varvitsiotis and Yiannis Olympios, without ever citing this publicly, raises very serious moral issues, regardless of the legality

Greek Women’s Water Polo Team Top in the World after 13-9 Win Over Hungary

The Greek team had previously defeated another tournament favorite, the Netherlands, to reach the final.

S&P Raises Greek Rating; BBB with Stable Outlook

S&P’s decision raises the Greek economy to the second notch of investment grade ladder, at BBB with a stable outlook.

Greek Tourism Optimistic About Demand from American Market

A recent survey by MMGY Global, conducted from April 3–5 with a sample of 1,000 U.S. adults, found that 83% of Americans still intend to take leisure trips over the next 12 months, a slight drop from 87% in late February

New Exposé by Domumento Reveals Nefarious Triangular Link of ‘Black Money’ with New Democracy, Blue Skies, & Truth Team

The latest exposé by the Documentonews.gr news site lays bare what appears to be a surreptitious path of indirect financing of ND through the business sector—transactions that, as widely understood, rarely occur without expectations of reciprocal benefit

PM Meloni Meets Vice President Vance in Rome Signalling Optimism on Ukraine Talks

Meloni emphasized the strength and strategic value of the Italy-U.S. partnership.

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![Χρυσές λίρες: Φρενίτιδα χωρίς τέλος – Πόσες πούλησαν και αγόρασαν οι Έλληνες [πίνακες]](https://www.ot.gr/wp-content/uploads/2022/12/xrises-lires-600x300.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης