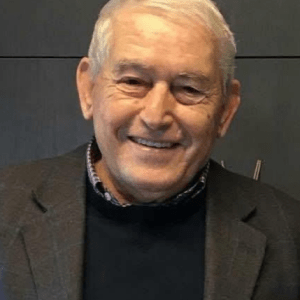

With the flow of natural gas declining, the European Union is at the beginning of a difficult period that will last 12-24 months and will test solidarity between member states noted at the Economist conference Paolo Scaroni, deputy chairman of the Rothschild Group, chairman of AC Milan and former CEO of Italian energy giant ENI.

Even if the EU makes every effort to meet demand, the price of gas will be more than double compared with that of the US and Asia, he added.

Moreover, he pointed out that addressing the energy crisis could jeopardize the European plan to achieve zero net carbon emissions by 2050.

Paolo Scaroni’s speech

“When I started to prepare my speech for today, a couple of weeks ago, the issue we had to face was whether Europe might have to do without Russian gas, and what we might have to do to prepare for this occasion.

Cutting off the flow of Russian gas just as we were heading into winter seemed to be the worst case scenario. Of course, that is exactly what happened. We are now in a scenario of full economic warfare, in which we will have to do without Russian gas for the foreseeable future.

The question is how. In a world without Russia, will we able to access enough energy? At what price? Will the energy crisis force us to let go of our decarbonization objectives?”

On the first question, Paolo Scaroni did not “mince his words” as to the difficulties we have to face:

“The answer is that over the next 12-24 months things will be tight. Russia accounted for around 150 billion cubic meters of gas, out of the 500 billion cubic meters bcm) of European consumption (I am always giving numbers of the European Union only). How could we substitute all this quantity directly?

LNG is the first candidate and in the EU we have some regasification capacity to be able to receive something around 40-50 bcm.

Secondly, we need to fill up existing import pipelines which means Algeria, Norway and Azerbaijan, and can be calculated at something around 20 bcm.

Thirdly, we have the opportunity to switch fuels so that we consume less gas. Running coal plants at full capacity might reduce demand by roughly 40 billion cubic metres.

None of these are easy to do, and even if we do them all of them together, we could probably be able to replace 110-120 bcm of the 150 bcm of gas we currently import from Russia.

And we should take into account three things. Firstly, demand for gas is highly seasonal, so any shortfall should be concentrated in the winter months. Secondly, we should hope that the coming winter will not be very cold, because a very cold winter would mean 20-30 billion cubic meters in Europe. And thirdly, we should bear in mind that, whatever the shortage, it will bite hardest at those areas that are most reliant on Russian gas – Germany and Eastern Europe.

This will test the concept of solidarity in the EU. Will those who are less dependent on Russian gas take a cut in supply to help those who are more reliant on Russian gas? The next year or two look very challenging, but I think we will manage the situation, as long as we do not have problems with some other suppliers. Let’s hope so.

This talk about a tight market brings me to the second question. What prices should we pay for energy?

As of yesterday gas prices at the TTF, the main trading hub, were around 200 Euros per MWh, more than 10 times higher than used to be. This is a problem for the European continent as a whole; it is also a problem for industry, which is forced to shut down. Initial signs point to a decline of gas use for industrial use between 10 and 20 per cent. Hardly a day goes without a manufacturer announcing that they are suspending production.

It is also a drama for consumers, whose energy bills are rising at a time when inflation is already cutting into what they can afford to buy. No wonder the EU is considering price caps on gas, measures to decouple the price of electricity from that of gas, and big subsidies for industries and consumers.

These may not be “market orthodoxy”, but we are currently in a war economy.

What is perhaps less understood is that even if the situation normalizes, say in the mid 2020s – if Europe increases its LNG import capacity and we solve most of the problems – we will end up with a price for gas 2-3 times higher than the price in the US, and possible twice the price that will be paid in China.

Having high energy costs will be a big issue for the European Union, considering the many energy-intensive companies need to relocate to the US and the Middle East.

One way of reducing energy prices in Europe would be to increase supply through other pipelines, including maybe Nabucco, the Eastern Mediterranean pipeline. But we would also have to put commercial pressure on producers that are tied to us as we are on them. The list includes North African countries and NATO members, such as Norway, which benefits from the current situation but should extend its solidarity to other NATO members.

Increasing gas supply requires investment in gas production and infrastructure with a payback period of decades, at a time when Europe is trying to reduce its reliance on fossil fuels.

And this brings me to the third question I asked. Will the energy crisis force Europe to let go of its decarbonisation efforts?

In theory there is an near perfect convergence between decarbonisation and supply security. The more solar panels, wind farms, grids, batteries and electrolyzing we can done, the more we will cut reliance on Russian gas. This suggests that European Union should decarbonize as fast as it can, which is of course true. However, it is not as straightforward as its sounds.

The first point to note is that in the immediate aftermath of the energy crisis we will have actually recarbonized our economy. Coal use in the EU has gone up by 30%. Secondly, accelerating investment in renewables, batteries, grids, hydrogen, etc. requires government money that may be needed to subsidise energy bills. And thirdly, to ensure supply security, we need to provide long-term return visibility for upstream and midstream fossil fuel projects, starting now. And this creates a risk of lock-ins with regard to fossil fuels, which may impair the take-up of renewable energy sources.

That said, I believe that the energy crisis will be a net positive for the EU decarbonisation strategy. As we search for alternative ways to accessing energy, it will force governments and the private sector to think outside the box, which is positive for new nuclear, hydrogen, synthetic methane and carbon capture and storage. These are key pieces of the decarbonisation puzzle, accounting for around half of the energy we will consume in a net zero world.

Going green can also be a way we will overcome our structural disadvantage compared to gas-producing regions of the world. It will be hard for the EU to match the US in gas price, but in a fully decarbonised world there is no reason to believe that our sunlight will be more expensive than theirs.”

![Ελβετικό φράγκο: Τι πρέπει να ξέρουν οι δανειολήπτες [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/12/ot_swiss_Francs25-1024x668-1-1.jpg)