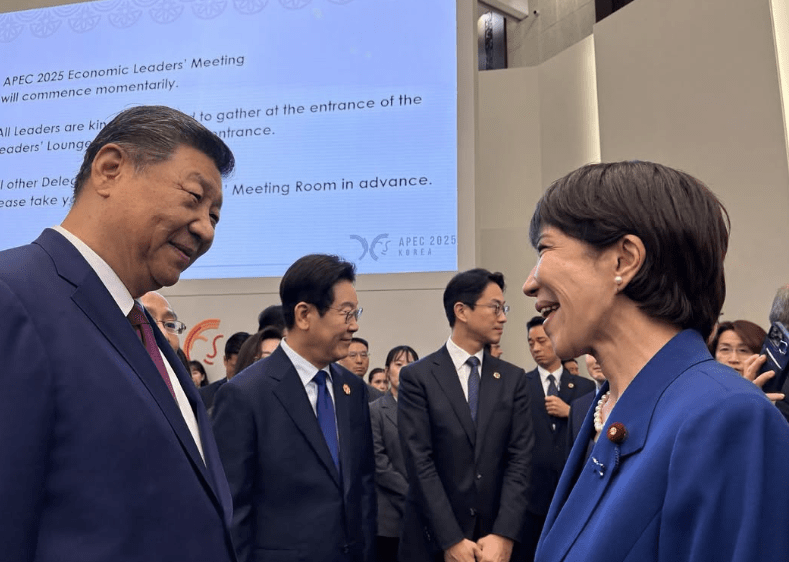

A few hours after another fruitless meeting of the finance minister with the bankers, the government is sending a message to the banks this time through the mouth of the prime minister himself. Kyriakos Mitsotakis, during the regular monthly meeting he had at the Presidential Palace with the President of the Republic, Katerina Sakellaropoulou, referred to the issues of the economy and called on the banks to “assume their responsibility”.

In particular, he asked financial institutions to support vulnerable households and prevent the creation of a new generation of “red loans”.

As he said, banks “need to support vulnerable households as a whole, as they are highly profitable, so that we prevent a new generation of bad loans”.

At the same time, the prime minister referred to the issue of low interest rates on deposits, but also the high commissions in some transactions.

Kyriakos Mitsotakis expressed the hope that the discussions will lead to an agreement.

“I am confident that we will reach a positive solution for borrowers and depositors but also for the same banks that have been heavily supported,” he said.

The Prime Minister considers that the measures to be taken should be paid for by the banks’ profits and not by the budget, that is, the Greek taxpayer.

This new intervention is part of the controversy that has recently broken out between the government and the banks, with the political leadership of the Ministry of Finance seeming determined to come into conflict with the bankers, in a critical – socially, economically and politically in view of elections – period.

The rift with the bankers is now open as the government wants to proceed with borrower relief moves that are consistent, but without fiscal costs. Which, after all, could not be undertaken since the Commission would not accept it.

In the Ministry of Finance they want there to be measures but the bankers should shoulder the burden. That is why yesterday the meeting “wrecked” and in 15 days the banks’ side must submit new proposals.

The entire background of this meeting was given today by ot.gr through the inside story column where the very bad climate between the government and the banks was described.

Leaks

It is no coincidence that after “accusations” were hurled by both sides, via leaks, for the lack of agreement to support vulnerable borrowers, the ministry…struck again.

Circles of the Ministry of Finance have made public a list of banking transactions, which burden Greek society, through high commissions, continuing the conflict that has erupted – during the last 15 days – between the two sides. This specific move seems to further fuel the poisonous climate in view of the new meeting, which is expected to take place in 2 weeks from today.