The PPC will be taking up a strategic position in the Balkans once the deal with the Italian Enel for the acquisition of all its assets in Romania is completed.

The public Greek company is very close to achieving its first exit beyond the Greek border through an acquisition of the Italian energy giant’s majority holdings in power supply companies and distribution networks as well as the total RES portfolio. The search for opportunities in the Southeast European market was announced by the president and managing director Giorgos Stassis last year, when PPC was proceeding to increase its share capital by raising 1.35 billion. euro.

Thus, PPC announced yesterday that it signed an Exclusivity Agreement with Enel S.p.A. (“Enel”) for the possible acquisition of all Enel Group holdings in Romania. This means that the Greek company managed to exclude two large funds, as OT had written on November 23, Canadian fund Brookfield and British fund Amber Infrastructure from the competition and enter the final phase of the acquisition. By the end of January 2023, PPC will have completed the negotiations after first proceeding with the due diligence of the companies it aims to acquire.

The portfolio

The Italian group Enel had entered the Romanian market in 2005.

It gradually acquired the majority package of public shares in three of the total eight distribution companies.

These are:

1. E-Distribute Muntenia Sud, which electrifies the Muntenia region including Bucharest,

2. E- Distribute Banat with distribution networks in the area of the same name where the country’s industrial zone is located

3. E-Distribute Dobrogea, distributes electricity in the homonymous tourist area

If PPC acquires these three distribution companies then it will control a network of 130,000 km that provides electricity to approximately 3 million residents.

The acquisition of the two leading electricity and natural gas providers, Enel Energie and Enel Muntenia, is also under negotiation. As well as Enel X which provides electrification, smart meters and energy efficiency services.

The acquisition of the 13 operating RES projects with a total capacity of 534 MW, belonging to Enel Green Power, is also under negotiation.

A Balkan PPC

PPC’s move to claim the assets of the international energy giant Enel comes at a time when the energy crisis triggered by the war in Ukraine is essentially rewriting the energy map of Europe.

The Greek company is positioned, as its sources report to OT, strategically in an area located on the so-called Southern Corridor for the transfer of energy resources to the Balkans. The possible acquisition of the power distribution network makes the Greek PPC a strong player in the region that will control the transfer of electricity to and from the Balkans.

The specific Southern Corridor is being built from Alexandroupolis with the development of FSRUs for the transport of natural gas which will be directed mainly to the production of electricity in the Balkan countries.

At the same time, the announcement of PPC’s possible deal with the Kopelouzo group and DEPA Emporias for the development of a natural gas power plant in Alexandroupolis makes PPC an electricity exporter through its own infrastructure.

The exit of PPC to the Balkans effectively re-establishes Greece as a strong geostrategic player in the region.

Cheap energy

PPC, however, with its possible placement in Romania, accelerates the green transition to energy as it acquires RES projects with a capacity of 534 MW.

The production of cheap and clean energy and then the import of quantities into the Greek market creates competitive electricity costs for Greek businesses.

In addition, PPC with the aforementioned asset is rapidly growing its green portfolio to over 700 MW given that it already has over 250 MW in Greece.

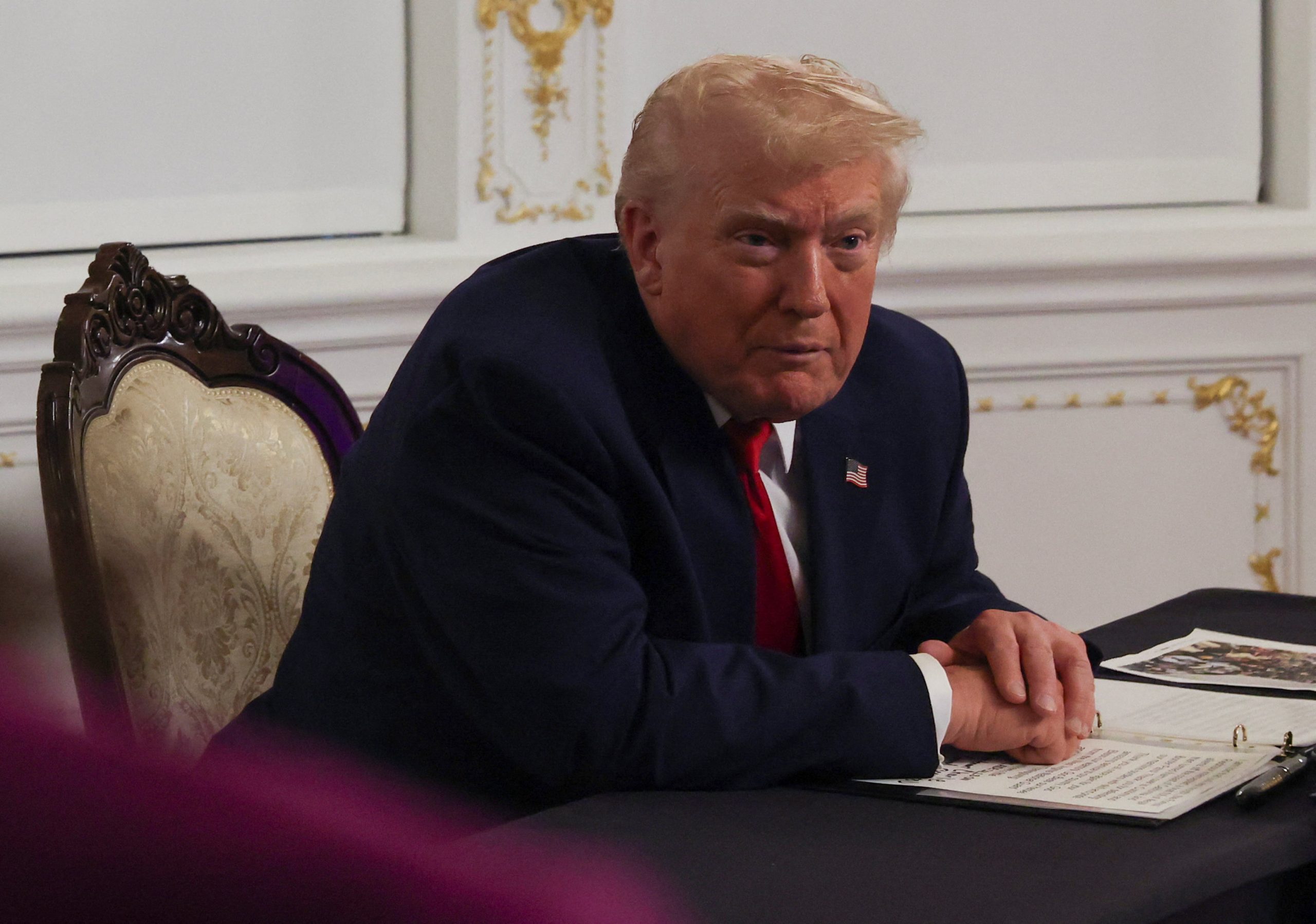

Stassis

The business activity of PPC is attributed to the president and managing director of the company, George Stassis.

Before taking the helm of the Greek business he held the management position at Enel Green Power in Romania and Southeast Europe.

He is knowledgeable about the market and the assets he managed until his return to Greece.

The launch and completion of the increase in PPC’s share capital with the entry of investors to 66% of the company brought the required liquidity for its expansion abroad.

Giorgos Stassis, in his three years of office, managed to stop the bankruptcy of the country’s largest company, to bring it to a permanent operating profitability of 800 million euros, but also to take the next step, which is its expansion outside the borders.