Τhe Ministry of Environment and Energy (MoE) has green lighted the initiation of the organization of the Decarbonization Fund, with the selection of the contractor who will undertake to assist in its management as well as the establishment of a monitoring mechanism for the implementation of the planned actions. The relevant electronic tender was finally awarded to PricewaterhouseCoopers (PwC) which, if there are no objections, will start work immediately.

The Fund was established about a year and a half ago and it is expected that, within the next spring, the final agreed upon actions and resources will pass through the approval of DG CLIMA (Directorate General for Climate Action) and the European Investment Bank (EIB), so that projects can begin. The idea of a Fund for the islands started from the country’s right to claim resources, asking the Commission to auction 25 million unused pollution rights.

It will collect the funds from the auctions of the unused allowances, which are estimated to range between €1.8 billion and €2 billion, with an allowance price of €72/tonne to €80/tonne (prices of pollutants have fluctuated at these levels in the last two months). In fact, with a leverage of 50%, it is estimated that around 4 billion euros will be directed to projects and actions for the decarbonization of the islands’ economy.

The actions

As for the actions that can be supported with the Fund’s resources, they first of all concern the change of energy model on non-interconnected islands with the continental electricity transmission system. Hybrid power generation systems will be promoted on those islands that remain non-interconnected, i.e. units that combine Renewable Energy Sources (RES) and energy storage, while RES projects will be supported on those that are interconnected. Also, as well as energy saving projects, the fastest electrical interconnection will be financed i.e. “Save” type programs only for the islands.

Part of the funds of the Decarbonization Fund will be used to finance electrical interconnection projects of the islands in order to speed up the implementation of the Independent Power Transmission Operator’s planning, but also in energy saving projects. As regards the actions of the “GR-eco Islands” initiative _ which will include the financing of waste management projects, water, energy production through energy communities, etc. These will be financed by a 100 million euro fund secured by the NSRF, but in the second year the Decarbonization Fund will also participate in funding, alongside the private sector. Projects have already begun with the participation of large companies to transform Astypalaia and Halki into green islands, while others will follow, with priority on the small islands of the Aegean, where polluting energy production units operate and which meet the criterion of double insularity – i.e. access to them is not direct, but through another island.

Latest News

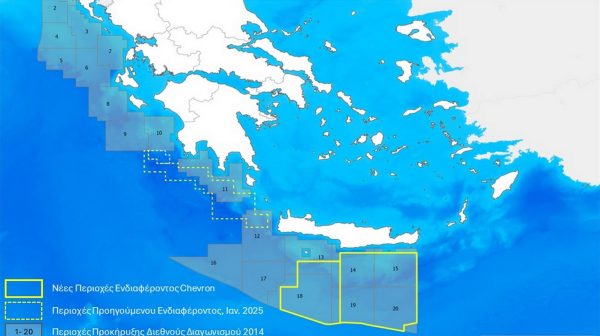

PM Mitsotakis Highlights Chevron’s Interest in Greek EEZ in Weekly Review

“The interest from Chevron is important because a leading American multinational chooses to invest in Greek maritime plots, thus practically recognizing Greece's EEZ in the area,” the prime minister said.

PM Mitsotakis Visits Israel for Talks on Defense, Energy, and Stability

According to sources, the meetings will cover bilateral collaboration as well as regional developments, particularly in the Eastern Mediterranean and Syria.

Pyatt stresses major Greek role in regional energy map, importance of ongoing Greek-Turkish talks

The former US Assistant Secretary of State foe Energy Resources passionately underlines importance of NATO and America's Global Alliances for US security

Applications for Child Benefit Open Again

The electronic platform for submitting Child Benefit applications, A21, will re-open at 08:00 on Monday, March 31, 2025.

Ellinikon Redevelopment Advances: Key Projects on Track

Spanning 17,000 square meters, the shopping center has already leased out 75% of its space, with an average rental price of 85 euros per square meter.

Aid Arrives as Myanmar Struggles with Earthquake Aftermath

Aid is starting to arrive after the powerful 7.7-magnitude earthquake which struck central Myanmar on Friday, causing widespread devastation and claiming over 1,000 lives.

Over 60% Greeks Own a First Home, 39% a 2nd Home: European Report

The responses from 20,000 European adults who participated in the “RE/MAX European Housing Trend Report 2024,” conducted by Opinium Research for RE/MAX Europe, highlight the evolving expectations for residential spaces

Europe’s Economic Outlook Brightens, But Caution Remains, Says Citigroup

Citi forecasts a slight increase in growth from 0.8% in 2024 to 1% this year, with further acceleration slightly above potential in 2026-27.

Greece Fast-Tracks Chevron’s Offshore Entry, Eyes Third Player

Chevron has formally expressed interest in the offshore area "South of the Peloponnese" and, as of March 26, also for blocks "South of Crete I" and "South of Crete II."

‘MEGA NEWS’ – MEGA’s New 24-Hour Channel Debuts March 31

MEGA NEWS will be available via MEGA Play, the website www.megatv.com, and from May 1 on COSMOTE TV

![Τουρκία: Μεγάλες βλέψεις για παραγωγή ηλεκτρικών οχημάτων [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/03/ot_turkish_autos-90x90.png)

![BYD: Ποιος είναι ο Γουάνγκ Τσουανφού που χτίζει τα όνειρα της Κίνας [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/03/ot_BYD_Ceo_CHUANFU-90x90.png)

![Ξενοδοχεία: «Τσίμπησαν» οι τιμές το 2024 – Πόσο κόστισε η διανυκτέρευση [πίνακας]](https://www.ot.gr/wp-content/uploads/2025/03/hotels-90x90.jpg)

![ΕΛΣΤΑΤ: Αυξήθηκε η οικοδομική δραστηριότητα κατά 15,6% το Δεκέμβριο [πίνακες]](https://www.ot.gr/wp-content/uploads/2025/03/DSC9655-2-1024x569-1-90x90.jpg)

![Τουρκία: Μεγάλες βλέψεις για παραγωγή ηλεκτρικών οχημάτων [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/03/ot_turkish_autos-600x352.png)

![Ξενοδοχεία: «Τσίμπησαν» οι τιμές το 2024 – Πόσο κόστισε η διανυκτέρευση [πίνακας]](https://www.ot.gr/wp-content/uploads/2025/03/hotels-600x420.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης