With gains of 18.6% at the level of the General Index (+37% banks) and with Greek shares gaining more than 10 billion euros since the beginning of the year, the Athens stock market, after nine consecutive upward weeks, found itself on Friday in new 101-month highs, marking the world’s best performance so far this year. Based on data collected by Bank of America, in fact, with a dollar return of 20%, the Athens stock exchange has this year also the second strongest (after +46% of Bitcoin) rise among all assets worldwide.

With the Commission confirming that the Greek economy will continue to outperform against the Eurozone, the market starting to discount a positive outcome, i.e. the formation of a stable government (either independent New Democracy or a coalition under NHew Democracy) in the spring elections, flows and foreign capital continuing, at a time when corporate results remain strong, alongside tension in the field of acquisitions and mergers, the domestic stock market appears to maintain its momentum. In the medium term the recovery of “investment grade”, possibly within the second half of 2023, and the recovery thereafter, within 12-18 months, of “developed market” status (after an intermediate category) for ATHEX by MSCI and FTSE Russell are expected to be the main catalysts for the Greek market. For Beta Securities, technically, the General Index continues its tour of overvalued zones. Nevertheless, the corrections that have been observed so far are relatively shallow and unstoppable. The market is awaiting a correction, but there is no potential turning point. Following the recent international stock rally, some international banking strategists are now cautious in the short term. Analysts at JPMorgan Chase, for example, expect a price correction and are even recommending that investors take advantage of the rally to reduce their equity positions while increasing their bond positions, predicting that the first quarter will prove to be the point at which stock markets will reach their peak. Morgan Stanley now also “sees” increased volatility in the stock markets, as it considers that the monetary policy conditions that supported the last rally are overturning and the “safety cushion” of low valuations is “deflating”.

What 299 fund managers foretell

In Bank of America’s latest (February) survey of market professionals, a total of 299 fund managers with $847 billion in assets under management have improved their expectations for the global economy, with only 24% of managers now “seeing” global recession over the next twelve months, up from 51% last month and 77% in November, while 83% predict further deceleration in inflation.

The majority (53%) of managers, after the recent rise in prices, nevertheless expect a correction in share prices in the next period, mainly as a result of monetary tightening, despite the fact that in the medium term 55% of managers remain bullish/ buyers/bullish for the stock markets.

Latest News

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

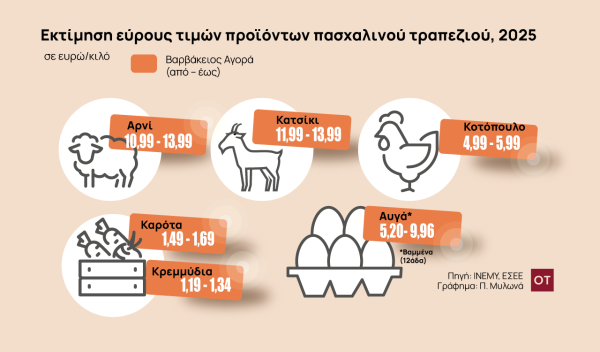

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης