A high-profile opinion piece by Bloomberg, entitled “With Grexit Averted, Guess Whose Debt Outperforms?” on Thursday heaps praise over what it calls Greece’s stronger than expected economic recovery, with the sub-head adding: “Greece’s economic recovery is ratified in its low cost of borrowing, which is below the average for investment-grade borrowers anywhere in the world.”

According to the opinion writer, Bloomberg news editor-in-chief emeritus Matthew Winkler, continues: “Remember Grexit? It was 2015 and unlike Brexit a year later, the pejorative for Greece is a fading figure of speech coined by London news media,” the article begins, noting that even “former Federal Reserve Chairman Alan Greenspan told the British Broadcasting Corp. that ‘it was just a matter of time’ before Greece abandoned the monetary union and the euro disintegrated.”

The opinion piece continues and first recounts what was possibly the lowest point in the country’s history since the restoration of democracy in July 1974, namely, the “annus horribilis” entailed in 2015:

“Just about everyone back then said the newly elected government of Prime Minister Alexis Tsipras would default after promising to end five years of reduced government spending during a depression while securing the final $8.7 billion bailout from resistant EU creditors. Former Federal Reserve Chairman Alan Greenspan told the British Broadcasting Corp. that “it was just a matter of time” before Greece abandoned the monetary union and the euro disintegrated. George Soros, the billionaire chairman of Soros Fund Management, said in an interview with Bloomberg Television around the same time that “Greece is going down the drain.” Marcel Fratzcher, the Oxford- and Harvard-educated former head of policy analysis at the European Central Bank and president of the German Institute of Economic Research, called Greece a “political and economic catastrophe.”

“Grexit never happened because the bond market said so,” going on to outline the history of fluctuations in the yield of benchmark Greek debt from its April 2012 low to being the “favored sovereign debt” of investors.

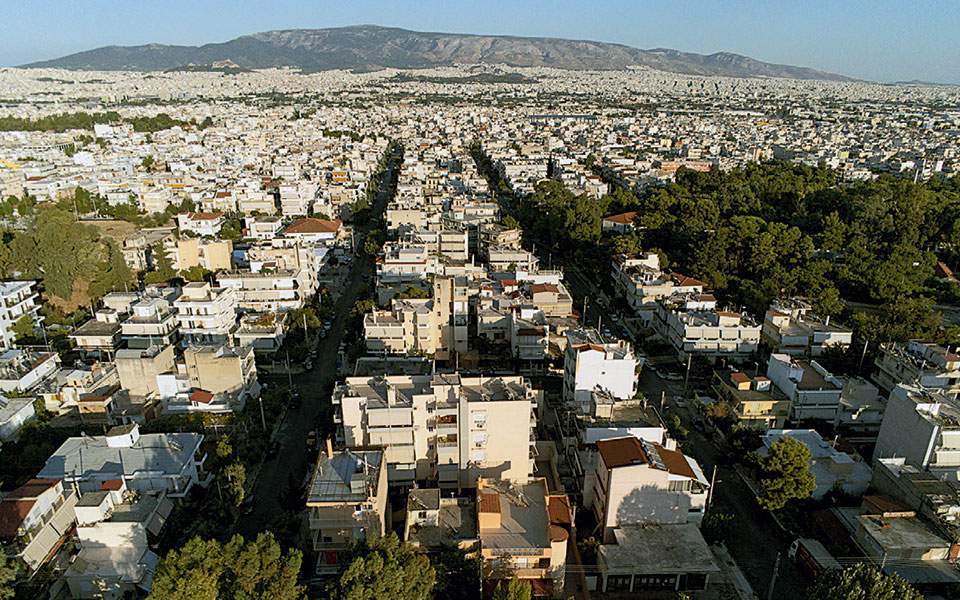

“The nation of 10.3 million, contrary to every credit rating, has been an investment-grade economy since December 2021 based on favorable trends in its inflation rate, per capita gross domestic product, GDP growth, non-performing loans and political stability, according to data compiled by Bloomberg. In the bond market, Greece is trading at least three grades above what investors consider high-risk, high-yield debt and soon enough should reclaim the investment-grade rating last conferred by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings in 2008.

“Since Prime Minister Kyriakos Mitsotakis was elected into the Maximos Mansion in 2019, the nation’s per capita GDP expanded 7%, outpacing major economies, including Germany (1%), France (1%), Italy (2%), Spain (-2%), UK (1%) and the US (4%), according to data compiled by Bloomberg. Non-performing loans as a percentage of total loans for Greek banks, the measure of banking sector health, fell to 6.8% from 47% in 2017 and the lowest since 2011. The non-performing loan ratio was reduced by at least 32 percentage points, a magnitude of improvement unsurpassed by the banking industry anywhere, according to data compiled by Bloomberg,” the article said

The article also notes that Greece is currently outperforming many European countries in terms of its political risk score, which has improved 25 pct since Prime Minister Kyriakos Mitsotakis took office, as well as the Greek prime minister’s own statement that Greece is now “the second-fastest growing economy in the Eurozone” with robust tourism and “record foreign direct investment”.

“The country’s economic recovery is ratified in its low cost of borrowing, which declined to 3.9% from 15% in 2015 and 63% in 2012, according to data compiled by Bloomberg. Greece today can obtain loans at a cost that is 10 basis points lower on average than investment-grade borrowers. Its debt last traded so favorably in 2005 when the nation was rated “A,” the sixth-highest investment-grade rating and five levels above what is considered high-risk, high-yield debt,” the article said. The combination of declining yields and a strengthening economy made Greek bonds “the best performers worldwide”, it concluded, with anyone who bought Greek debt in 2013 getting “an unapproachable 214% return for a developed economy” and shares of the 60 Greek companies traded on the Athens Stock Exchange “proving to be world beaters this year with a return of 12%.”