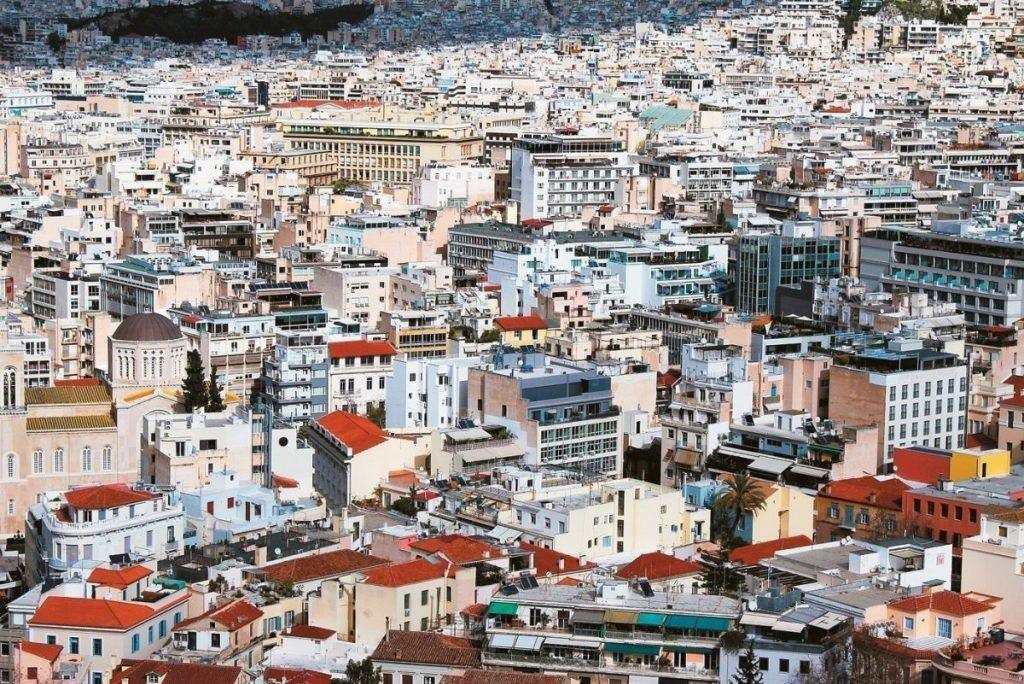

Vivid memories of the Greek pre-memorandum period are brought back by the current account deficit soaring to close to 10% of GDP in 2022, with some economists worried about the course of developments regarding the Greek economy. The main question that arises is whether the current situation resembles that of 2008, when there was a corresponding jump in imports. IOBE proceeded with an analysis of the situation in order to draw conclusions. Let’s take the things from the beginning.

As recorded in the analysis, after 1994 and the liberalization of capital movements, the gradual rise of globalization and the decline of competitiveness, the Greek economy showed a significant expansion of the deficit in the Current Account, which peaked in 2008 at €36.5 billion, at current prices (15.1% of GDP). This deficit was mainly fueled by the goods balance, with a deficit of €44 billion in 2008, at 18.3% of GDP. After the decline that followed the following years, in 2022 the deficit in the Balance of goods returned to the same level as a percentage of GDP, at 18.4% (€38.4 billion). In absolute terms, exports of goods were €21.2 billion in 2008, against €65.5 billion in goods imports, while in 2022 the corresponding amounts were €54.7 billion and €93.0 billion. respectively.

Between 2008-2022

The Greek economy faced significant challenges during this period (2008-2022), initially due to the global financial crisis of 2008, but also recently due to the pandemic and the energy crisis that followed. However, the most important change in the Greek economy came from the implementation of the adjustment programs after 2010, in an effort to shrink the twin deficits (fiscal and commercial), improve competitiveness and change the productive growth model.

The return of the deficit to the levels of 2008 raises the question of whether Greece has evolved during the previous years, whether the production model has changed, and whether the return of the deficit is a seasonal or a structural phenomenon.

What happened before the memoranda

The analysis concerns the year 2008, i.e. the peak year of the external deficit before the Greek crisis, 2019, as a year after the adjustment programs and before the impact of the pandemic, as well as 2022, in order to highlight possible changes brought about by pandemic and the energy crisis.

Between 2008 and 2019 a stable share is recorded in the category of consumer goods, close to 28% of total imports, but with a decline until 2022, close to 22%. This reduction comes mainly from non-durable and semi-durable consumer goods, as well as food and beverages.

A significant share of imports is occupied by intermediate goods, which include industrial supplies, components and fuels, with the relative share in 2008 being 54.5%, i.e. more than half of imports by value, while an increase is recorded until 2019 to 61, 2% and a further corresponding jump by 2022 to 68.4%. A boost from 2008 to 2019 was provided by the fuel and industrial supplies subcategory, while by 2022 only the share of fuel increased further, with a slight decline in the share of supplies.

In capital goods the relative share in import value decreased from 16.6% in 2008 to 10.5% in 2019, with a further weakening in 2022 to 9.6%. The decrease between 2008 and 2019 came from the large decline in transport equipment for industry but also the decrease in the share of capital goods (machinery, etc.). The decline in the share of imports in machinery continued until 2022, while on the contrary, an increase was observed in transport equipment.

Exceptions

In all of the above, the fact that the category of passenger cars is not included, with a strong presence in imports and correspondingly a significant drop in this period, as they cannot be categorized into passenger cars for consumers or others

vehicles.

Without the fuel category included in the intermediate goods, between 2008-2019 consumer goods registered an increase in share, due to food and semi-durable goods, with a significant decline until 2022, however, due to all categories and mainly non-durable consumer goods. A significant rise is recorded in intermediate goods until 2019, due to

of the strengthening of industrial supplies, while further strengthening is recorded until 2022 from the same category and the increase in the share of machine parts.

In capital goods, there is a strong decline in share by 2019 in transport equipment for industry, with a slight decline in capital, while by 2022 the share in the transport equipment category increases, resulting in a rise in the category overall, to 15.1%.

On the export side, the share of consumer goods remained stable between 2008 and 2019, but declined in 2022 to 28.5%. The drop came from non-durable goods mainly, while a decrease was also recorded in semi-durable goods and food.

In intermediate goods, an increase in share is recorded until 2022, mainly due to fuel. Between 2008 and 2019, the share remained almost constant, but with an internal reclassification of individual categories, as a significant drop in share was recorded in the industrial supplies export category, which was offset by an increase in the refined fuel category.

Further growth up to 2022 is due to crude fuels. A decline in share is recorded in exports of capital goods since 2008, to 6.3% in 2019 and a further decrease in 2022 to 5.6%. By 2019, a decline was recorded in the share of transport equipment exports for industry, which was partially offset by an increase in the share of capital goods, while by 2022 a slight decline was recorded in both categories.

The image excluding fuel

Excluding fuels, which to some extent distort the relative shares due to their volatile prices, as figures are recorded in value, the share of consumer goods is clearly higher, at 42.4% in 2022, down from 2019 , following the rise between 2008-2019. The rise to 2019 was due to strengthening non-durable goods and food, while the weakening to 2022 came mainly from non-durable and semi-durable goods, with further growth in food.

In intermediate goods, there was a decline until 2019 with a return in 2022 close to 2008 levels. The initial decline came from the decrease in the share of industrial supplies exports, while until 2022 a small or large increase is recorded in almost all subcategories and mainly in industrial supplies. Finally, capital goods show a gradual decline with a decrease in the share of transport equipment and partially offset by the rest, while until 2022 a marginal decrease is recorded in both categories.

Conclusion

The structure of the Greek economy and its size lead to the conclusion that it still imports a large part of goods, both for consumption purposes and for the operation of domestic activity, while the question remains as to whether the mix of these goods changes over time.

Summarizing the above results, there is a drop in the share of imports of consumer goods from 2008 until today, but also of the share of capital goods, with a corresponding increase in the category of intermediate goods, while excluding fuels, a recovery of the share of capital goods is recorded after 2019.

In the export segment, a fall in the share of consumer goods and a strengthening of intermediate goods is recorded, which is, however, largely due to fuels. In exports excluding fuel, the shares in 2022 are similar to those in 2008, following an increase in the share of exports of consumer goods (especially non-durable goods and food) during the adjustment programmes.

In conclusion, in the last 15 years, the Greek economy has reduced the shares of consumer and capital goods trade flows, especially in imports, while strengthening the share of trade flows in intermediate goods. Possibly, these trends reflect a progressively stronger presence in global value chains, importing and producing intermediate goods, with the prospect of the Greek economy increasing its added value in the process.

![Χρυσές λίρες: Πόσες αγόρασαν και πούλησαν οι Έλληνες το 2025 [πίνακες]](https://www.ot.gr/wp-content/uploads/2026/01/ot_gold_lires_26_2-300x300.png)

![Χρυσές λίρες: Πόσες αγόρασαν και πούλησαν οι Έλληνες το 2025 [πίνακες]](https://www.ot.gr/wp-content/uploads/2026/01/ot_gold_lires_26_2.png)