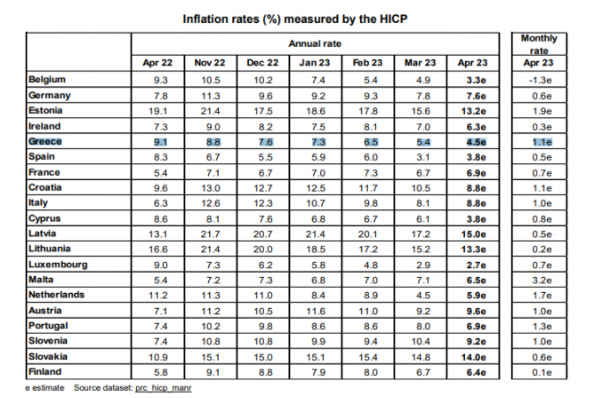

Eurozone inflation reached 7% in April 2023, from 6.9% in March, according to Eurostat’s emergency estimate. Inflation in Greece shrank to 4.5% in the month of April, according to Eurostat’s provisional data. This is the fifth lowest inflation among the Eurozone member states.

It is recalled that inflation in Greece reached 5.4% in March 2023 (from 6.5% in February), while 6.9% is the corresponding rate at the Eurozone level, according to Eurostat’s final data for the previous month.

Looking at the main components of euro area inflation, food, alcohol and tobacco are expected to have the highest annual rate in April (13.6%, up from 15.5% in March), followed by non-energy industrial goods (6 .2%, compared to 6.6% in March), services (5.2%, compared to 5.1% in March) and energy (2.5%, compared to 0.9% in March).

Small drop in structural inflation

Excluding volatile food and fuel prices, core inflation slowed to 7.3% from 7.5%, while an even narrower measure, which excludes alcohol and tobacco, slowed to 5.6% from 5. 7%, short of forecasts for 5.7% and is the first decrease since last June.

In a hopeful development for the ECB, inflation for processed food, alcohol and tobacco slowed by a full percentage point to 14.7%, suggesting that the long-awaited turnaround in food prices may now be taking place.

The small surprise on core inflation comes as the ECB’s quarterly survey of bank lending points to an unusually large fall in credit demand amid tighter lending criteria, bolstering the case for a smaller rate hike.

The ECB has raised interest rates by at least 50 basis points at each of its last six meetings.

The image in Germany, France and Spain

German inflation unexpectedly eased in April after economic difficulties in early 2023. Consumer prices rose 7.6% year-on-year, down from 7.8% in March, a rate economists had expected to hold.

The country’s statistical office attributed the slowdown to goods and services.

Inflation in the eurozone’s second-largest economy unexpectedly accelerated to 6.9% in April, driven by energy and services costs.

It had risen 6.7% in March, more than the average estimate in a Bloomberg survey of economists, which expected France to remain flat

In Spain, inflation rose to 3.8% year-on-year in April, from 3.3% in March.

Fed and ECB moves

The FED is expected to raise interest rates again by 25 basis points on May 3rd, while a day later, on May 4th, the ECB is expected to make its own increase ranging from 25 to 50 basis points. For the FED, market factors estimate that it may then hit the brakes for this year, while the ECB may continue the hikes at least for June and July as well. But everything is still fluid as both central banks have put inflation under the microscope, since this will be the key factor that will determine their decisions.

What central bankers are saying

Some policymakers, including French central bank chief Francois Villeroy de Galhau, have argued for a more measured move this month, arguing that the ECB has already raised borrowing costs sharply enough to constrain the economy.

But others, including board member Isabel Schnabel, said a 50-basis-point move should remain among the options because rate hikes are proving sticky, raising the risk of flatlining above the ECB’s 2 percent target.

Almost all 26 members of the Governing Council appear to agree that more policy tightening is needed after a record 350 basis points in rate hikes since July.

Stability Program and scenarios for Greece

It is worth noting that inflation to 4.5% for this year and de-escalation to 2.4% in 2024 and 2% in the years 2025 and 2026, includes among others the Greek Stability Program for the years 2023-2026 submitted by the Greek government in Saturday, April 29 at the Commission.

The program is also accompanied by a sensitivity analysis concerning a monetary shock scenario, in accordance with the Commission’s instructions for the country’s programs. In this context, it examines the effects on economic activity and public finances of adverse developments in inflation and interest rates.

Specifically, the analysis examines a type of the following alternative scenarios:

A rise in oil, gas and commodity prices through 2023, leading to 0.5% higher overall inflation for the current year (Scenario A).

A monetary shock that raises interest rates by 50 basis points in 2023 relative to the baseline scenario (Scenario B).

Latest News

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Green Getaway Ideas for Easter 2025 in Greece

Celebrate Easter 2025 in Greece the sustainable way with eco-farms, car-free islands, and family-friendly getaways rooted in nature and tradition.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης