A large participation was manifested by the Greek banking system, in order to immediately start the implementation of the 4 new programs of the Hellenic Development Bank-HDB that support, with low interest financing, small and medium entrepreneurship.

Financial products

The 4 new flexible financing products (3 co-financed and 1 Guarantee) ensure particularly favorable financing conditions for small and medium-sized enterprises.

1. The Guarantee Fund “Development Law Financial Instrument” (DeLFI), provides guarantees for obtaining long-term and short-term loans in order to implement the investment proposals submitted to the new development law N.4887/2022. DeLFI provides a guarantee of 80% per loan and a total of 500 million Euro loans will be made available.

12 banks responded to the invitation of the Hellenic Development Bank-HDB and requested loans with a total budget of €932 million, an amount that is currently twice the available resources.

ü It is worth noting that the funds of DeLFI come from the returns of funds of the Entrepreneurship Fund I (TEPIX I).

This highlights the importance of the operation of financial tools as a revolving financing mechanism with a multiple positive effect on the economy, as NSRF 2007-2013 funds, after financing a significant number of businesses, return to the market to support new businesses.

2. The Co-financing Portfolio Fund (named Business Growth Fund) leverages public resources, in cooperation with the European Investment Bank (EIB) and through the participation of Banking Institutions, increases the available loan funds to more than 2 billion euros.

The first phase of the implementation of the Portfolio Fund has already been activated with the publication of an invitation to the Banks for three (3) New Funds to channel into the market investment loans and working capital of up to 1.35 billion euros, while additional resources of 35 million euros are expected to cover interest subsidy of the loans provided.

ü It will be important to ease the cost of borrowing for businesses through these programs, since each loan will be co-financed by 40% from the public resources of these Funds, and will be provided interest-free, while for the remaining 60% that the Bank will finance the financing costs will be reduced by 3% for the first 2 years of the loan with the application of the partial interest rate subsidy (subject to conditions).

This results in a total reduction in borrowing costs that can exceed 75% in some cases

There was great interest from Credit Institutions in their participation in these 3 new programs, since 13 Banks submitted their expressions of interest proposals with competitive interest rate offers and reduced collateral requirements.

Their participation in the loan funds in this first phase of the programs is expected to reach 800 million euros.

The 3 immediately available programs

In detail, the 3 new immediately available co-financing programs will provide:

I. Green Co-Financing Loans with a total available loan capital of up to €500 million for financing investment purposes in SMEs that implement energy upgrading investments, development of green service providers, development of low-emission technology car charging networks (electric or hydrogen) as well as investments in renewable energy sources, with the ultimate goal of reducing emissions and protecting the environment. The duration of the loans will be from 2 to 10 years and their amount will vary from €80,000 to €8,000,000. It is possible to use a grace period for the first 2 years.

II. Digitalization Co-Financing Loans (Digitalization Co-Financing Loans) with total available loan funds of up to €250 million for investment financing in SMEs, for the implementation of digitization investments and digital upgrading of their operations/activities, with the aim of increasing productivity them, their enlargement and the creation of new jobs with high added value. The duration of the loans will be from 2 to 10 years, and their amount will be from €25,000 to €1,000,000. It is possible to use a grace period for the first 2 years.

III. Liquidity Co-Financing Loans with total available loan funds of up to €600 million for working capital financing in SMEs. The interest rate subsidy applies exclusively to businesses that have not received a subsidy to be financed/aided by an HDB programme. The aim of the loans is to facilitate the smooth operation of the trading circuit of businesses as well as to deal with increased energy costs under the current extraordinary market conditions (increase in energy costs, raw material prices, inflationary pressures) and to protect jobs, so that successfully cope with the challenges of modern entrepreneurship. The duration of the loans will be from 2 to 5 years, and the amount of the loan amounts from €10,000 to €1,500,000. It is possible to use a grace period for the first 2 years.

Latest News

Airbnb: Greece’s Short-Term Rentals Dip in March Amid Easter Shift

Data from analytics firm AirDNA shows that average occupancy for short-term rentals dropped to 45% in March, down from 49% the same month last year.

Easter Week in Greece: Holy Friday in Orthodoxy Today

At the Vespers service on Friday evening the image of Christ is removed from the Cross and wrapped in a white cloth

Meloni and Trump Meet in Washington, Vow to Strengthen Western Ties

“I am 100% sure there will be no problems reaching a deal on tariffs with the EU—none whatsoever,” Trump stressed.

ECB Cuts Interest Rates by 25 Basis Points in Expected Move

The ECB’s Governing Council opted to lower the deposit facility rate—the benchmark for signaling monetary policy direction—citing an updated assessment of inflation prospects, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

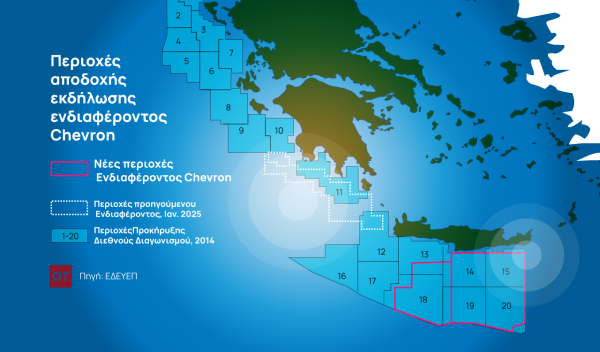

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-90x90.jpg)

![ΙΟΒΕ: Πώς το δημογραφικό υπονομεύει την ανάπτυξη – Τι συμβαίνει στις ελληνικές περιφέρειες [γραφήματα]](https://www.ot.gr/wp-content/uploads/2025/04/dimografiko-600x375.jpg)

![Airbnb: Πτωτικά κινήθηκε η ζήτηση τον Μάρτιο – Τι δείχνουν τα στοιχεία [γράφημα]](https://www.ot.gr/wp-content/uploads/2024/07/airbnb-gba8e58468_1280-1-600x500.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης