According to Reuters, Greece’s return to investment grade after more than a decade is considered a “done deal” by bond investors.

The country, which was rated “junk” by all three leading rating agencies, has been working since the end of the bailout in 2018 to regain favor with investors and the coveted rating – a seal of fiscal credibility.

Investors hope the New Democracy party – the clear winner of Sunday’s election, although it fell short of an outright majority – will stay in power after a run-off vote in June and continue reforms, paving the way for recovery of the credit rating from Greece.

The comparison with Italy

As Reuters points out: “Analysts at banks that deal in Greek government debt said that after this week’s sharp drop in borrowing costs, the bonds were already trading as investment-grade.”

Although Italy has investment-grade ratings from three major rating agencies, Greek 10-year bond yields of around 3.9% are currently trading about 50 basis points below Italy’s, the biggest decline since at least 1999, according to Refinitiv data.

“I would say the upgrade (of the rating) has been priced in. We don’t expect any significant movement after the upgrade,” said Jean-Christophe Machado, interest rate strategist at BNP Paribas, referring to the Greece-Germany bond spread.

Performances and ratings

According to Reuters, Greek 10-year bond yields fell nearly 15 basis points after Sunday’s election result. The additional spread paid by Greek bonds over safe Germany – reflecting their risk premium – is at its lowest level since 2021.

Greece has BB+ ratings from S&P Global and Fitch and a Ba3 rating from Moody’s. Since the bailout ended in 2018, Greece has regained market access, reduced its record public debt and growth is expected to continue to outpace the European Union average this year and next. Returning to the coveted investment grade would be more than symbolic for the country. It would make Greek debt eligible for government bond indices, attracting steady demand from a much larger pool of global investors.

First upgrade

A first upgrade could take place as early as October, when S&P Global Ratings is to review Greece’s rating. When ιτ gave a positive outlook in April, ιτ said Greece could be upgraded within the next year if a new government maintains fiscal discipline and the pace of reforms that unlock EU recovery funds, Reuters analysis said.

JPMorgan, which sees a “high chance” Greece will achieve an investment-grade rating by early 2024, expects the yield spread over German bonds to be at 165bps. by March 2024, about 20 bps higher than today.

BNP Paribas’ Machado expects Greece’s spread to be between 125 and 180 bp. with Germany, after it was given investment grade and indexed, compared to around 140 bp. at this time, indicating that further tightening will be limited.

Impact

Societe Generale strategist Sean Kou also expects little impact from an S&P Global upgrade in October, recalling what happened to Portugal in 2017. Portugal’s bond yields fell sharply after S&P upgraded it to investment grade Global Ratings in 2017, but that decision had surprised markets as the rating agency went straight from a BB+ rating to a stable outlook, rather than setting a positive outlook first – as is currently the case with Greece.

A subsequent upgrade by Fitch Ratings had much less of an impact. “One reason we think it’s already priced in is because now almost everyone expects it,” Kou said.

Commerzbank’s head of rates and credit research, Christoph Rieger, said he also sees ratings upgrades from other houses that will make Greek debt eligible for government bond indices, as it has already been priced.

According to Rieger, the sign of inclusion in the indices could attract buyers, but there could also be selling by fast-money investors such as hedge funds that had already bought Greek debt in anticipation of a move.

Latest News

Current Account Deficit Fell by €573.2ml Feb. 2025: BoG

The improvement of Greece’s current account was mainly attributed to a more robust balance of goods and, to a lesser extent, an improved primary income account

Hellenic Food Authority Issues Food Safety Tips for Easter

Food safety tips on how to make sure your lamb has been properly inspected and your eggs stay fresh.

Greek Kiwifruit Exports Smash 200,000-Ton Mark, Setting New Record

According to data by the Association of Greek Fruit, Vegetable and Juice Exporters, Incofruit Hellas, between September 1, 2024, and April 17, 2025, kiwifruit exports increased by 14.2%.

Easter Tourism Boom: Greece Sees 18.3% Surge in Hotel Bookings

Among foreign markets, Israel has emerged as the biggest growth driver, with hotel bookings more than doubling—up 178.5% year-on-year.

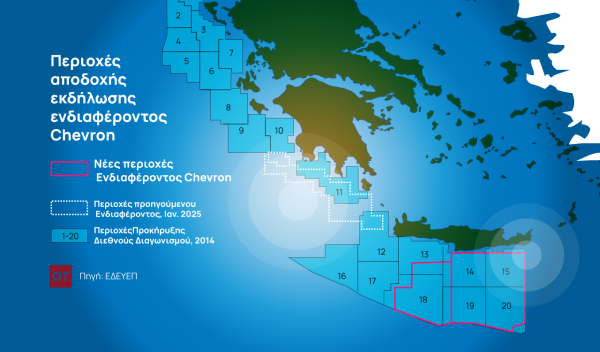

Greece to Launch Fast-Track Tender for Offshore Hydrocarbon Exploration

Last week, Papastavrou signed the acceptance of interest for the two Cretan blocks, while similar decisions regarding the two Ionian Sea blocks were signed by his predecessor

American-Hellenic Chamber of Commerce to Open Washington D.C. Branch

AmCham's new office aims aims to deepen U.S.-Greece economic ties and promote investment and innovation between the two countries

Why Greece’s New Maritime Spatial Plan Is a Geopolitical Game-Changer

This landmark development is more than just a bureaucratic step — it's a strategic declaration about how Greece intends to use, protect, and assert control over its seas

Eurozone Inflation Eases to 2.2% in March

Compared to February, inflation decreased in 16 member states, remained unchanged in one, and rose in ten.

Bank of Greece: Primary Gov. Surplus €4.1b Jan.-March 2025

The data released today by the Bank of Greece revealed that the central government’s overall cash balance recorded a surplus of €1.465 billion in the first quarter of 2025, compared to a deficit of €359 million in the corresponding period of 2024.

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

![Πλημμύρες: Σημειώθηκαν σε επίπεδα ρεκόρ στην Ευρώπη το 2024 [γράφημα]](https://www.ot.gr/wp-content/uploads/2025/04/FLOOD_HUNGRY-90x90.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης