The question of whether the 60% rally of Greek banks on the stock market will continue occupied the HSBC conference held in London over the previous days.

The answer is clearly positive, given that, as the bank points out, the analyst consensus does not seem to reflect a favorable outlook for net interest income (NII) due to continued ECB interest rate hikes, low deposit costs and growing title books.

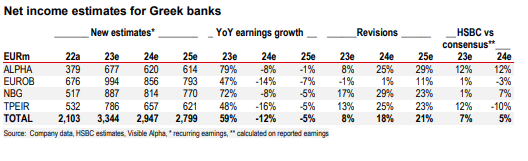

HSBC raises its 2023-2025 earnings estimates by 8%, 18%, and 21%, on average, adjusts price targets and reiterates Buy ratings for all four banks. These revisions place HSBC above the consensus of 7% and 5% for the years 2023-2024, with the highest difference being found in the case of Alpha Bank, which is emerging as a preferred choice.

According to Bloomberg, 70%-80% of sell-side analysts have Buy ratings on the Greek banks surveyed by HSBC, however, the average target price does not suggest a significant upside. This implies a wave of revisions from analysts in either direction in the short term, the bank believes.

Target prices

The target values are set as follows:

Alpha Bank at 2.20 euros per share from 1.45 euros before and an upside of 45%.

Eurobank at 1.95 euros per share from 1.60 euros before and an upside of 28%.

National Bank at 7.95 euros from 6.95 euros before and a 36% upside margin.

Piraeus Bank at 4 euros per share from 3.35 euros before and a 37% upside margin.

Strong earnings for the next two quarters, reviews and elections

The bank maintains its position on net interest income, which was expressed in recent rounds of earnings, and that Net Interest Income-NII is likely to peak in the second half of this year due to repricing of loans, but will decline in 2024 due to repricing of deposits. However, the 400 m.v. HSBC’s estimate of the ECB rate (previous estimate 350bps) suggests that the peak for the NII is higher. Also, lower-than-expected deposit betas so far and growing bond portfolios suggest the decline in 2024 will not be as steep.

Overall, it raises NII forecasts and now expects recurring earnings to grow 59% this year (from 47% previously forecast), followed by a 12% decline in 2024 (from 19% previously).

“We see further upside in Greek bank stocks despite a significant rise over the past six months amid NII storm, market-friendly outcome of first round election and hopes for an upgrade of the sovereign’s credit rating to investment grade. Despite these strong performances, however, Greece is still the only banking system in the Global Emerging Markets-GEM coverage to trade below book value for a positive risk-adjusted ROTE. Additionally, Alpha and Piraeus still appear to be undervalued in both GEM and Europe, although they no longer appear as the cheapest GEM stocks on P/BTV.”

“Alpha Bank is becoming our preferred choice. Its underperformance has put its valuation below domestic peers and at the lower end of our coverage of emerging market banks. However, we foresee a resilient NII outlook relative to domestic banks leading to some replenishment of the ROTE ratio. This does not appear to be reflected in analyst estimates, as we are 12% above consensus for both this year’s earnings and 2024. The plans for cost forecasts and operating expense (opex) targets set in the 2022 business plan -2025 are upside risks. We also highlight Alpha Bank’s relative value to Piraeus Bank, with the former having a 5% discount on P/TBV for this year, despite a similar capital-adjusted ROTE ratio and higher CET-1 capital ratio,” notes British bank.

Among other things, it believes that the strong momentum National Bank has in net interest income over the past two quarters has been underestimated.

Finally, he sees absolute value in Eurobank this year at a 0.79x P/TBV ratio for around 15% ROTE and reckons trading in line with European large-cap peers with similar ROTE but a lower cost of capital profile could to create some overlap for its valuation.

Latest News

Istanbul Earthquake – Greek Prof. Concerned Major Quake Yet to Strike

Responding to concerns over whether a potential major quake in Istanbul could affect Greece, Papazachos was reassuring: “The fault extends as far as Lemnos and the Northern Sporades, but it doesn’t rupture all at once. An earthquake in Istanbul doesn’t have the capacity to directly affect Greek territory.”

Greece 4th Most Popular Summer Destination for Europeans

Southern Europe remains the top choice for Europeans at 41%, though down 8% from last year, likely due to rising temperatures and climate concerns.

Easter Sales Performance and the Source of €4–5 Million in Losses

Easter retail sales were relatively weak this year, with the only "real winners" being the livestock farmers who had lambs to sell.

Hotel Foreclosures Continue to Plague Greece’s Islands

A surge in hotel foreclosures across Greece’s islands threatens small tourism businesses, despite booming visitor numbers and record-breaking travel in 2024.

Athens Launches Task Force to Safeguard Historic City Center

The new municipal unit will ensure compliance to zoning laws, curb noise, and address tourist rental issues starting from the Plaka district.

WTTC: Travel & Tourism to Create 4.5M New Jobs in EU by 2035

This year, international visitor spending is set to reach 573 billion euros, up by more than 11% year-on-year

IMF: US Tariffs Shake Global Economy, Outlook Downbeat

IMF slashes global growth forecast to 2.8% as U.S. tariffs create uncertainty and ‘negative supply shock

First Step Towards New Audiovisual Industry Hub in Drama

The project is set to contribute to the further development of Greece’s film industry and establish Drama as an audiovisual hub in the region

Airbnb Greece – Initial CoS Ruling Deems Tax Circular Unlawful

The case reached the Council of State following annulment applications filed by the Panhellenic Federation of Property Owners (POMIDA)

Mitsotakis Unveils €1 Billion Plan for Housing, Pensioners, Public investments

Greek Prime Minister Kyriakos Mitsotakis has announced a new set of economic support measures, worth 1 billion euros, aiming to provide financial relief to citizens.

![Accor: Η βιωσιμότητα «κλειδί» για την ανάπτυξη και ανθεκτικότητα του ελληνικού τουρισμού [έρευνα]](https://www.ot.gr/wp-content/uploads/2025/04/thumbnail-90x90.jpg)

![Accor: Η βιωσιμότητα «κλειδί» για την ανάπτυξη και ανθεκτικότητα του ελληνικού τουρισμού [έρευνα]](https://www.ot.gr/wp-content/uploads/2025/04/thumbnail-600x400.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης