As Moody’s reminds, after the full disposal by the State HFSF of its shares in Eurobank, the bank will no longer be subject to Law 3864/2010 and the special rights it must grant to the HFSF, including the provision of its consent and monitoring of her business plans. Consequently, Eurobank will become the first domestic systemically important bank (D-SIB) without any government participation in its share capital.

In addition, Eurobank’s liquidity will improve, making it more attractive to potential private investors and allowing the bank to raise capital as needed. The new funds would support the bank’s growth and ability to provide new loans to the real economy. The deal also reflects the bank’s significantly improved financials over the past three years, Moody’s said.

The role of the HFSF

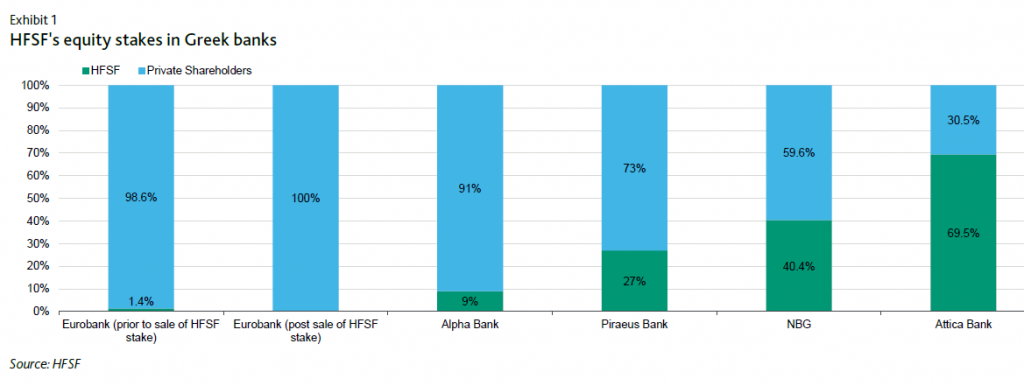

According to the rating agency, the HFSF played a vital role in recapitalizing the banking system and restoring financial stability following Greece’s 2012-15 fiscal and financial crisis. Over the past decade, the HFSF has invested new capital in all four systemic banks – as well as the much smaller Attica Bank.

HFSF made a strategic decision earlier this year to divest all of its current holdings in the four systemic banks by the end of 2025. Although HFSF is fully committed to achieving this goal, in the event that it is unable to sell these shares until that time, it will have to agree with the government and the European Stability Mechanism to create a successor entity to take over these holdings.

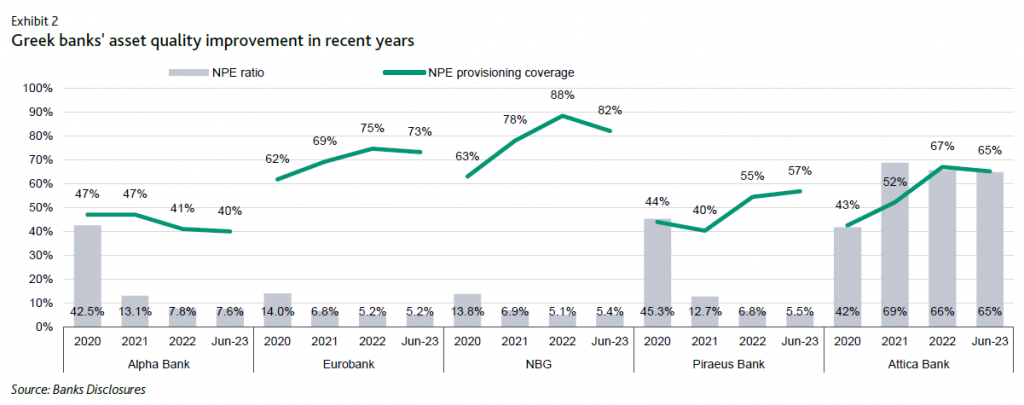

The four banks’ improving asset quality, reduced non-performing exposures (NPEs) and increased NPE provisions in recent years, combined with recent improvements in recurring earnings and bottom line profitability will help the HFSF implement its divestment strategy , according to Moody’s.

Although the HFSF accumulated fair value losses of €38.6 billion in September 2022, Moody’s estimates that it could recover €3-4 billion based on current share valuations, reducing the bank’s overall recapitalization and stabilization costs government system.

The challenges

According to Moody’s, the sale of the HFSF shares to National Bank and Piraeus Bank could be more difficult than the Eurobank transaction, because it has significantly higher holdings (40.4% and 27%, respectively), while its stake in Alpha Bank (9%) would be easier to divest.

But he reckons the HFSF favors strategic investors for these important equity stakes, such as internationally recognized financial institutions and long-term investment funds – including any credible existing shareholders – that could help improve the banks’ ability to adapt and deal with new market challenges.

Latest News

Easter Sales Performance and the Source of €4–5 Million in Losses

Easter retail sales were relatively weak this year, with the only "real winners" being the livestock farmers who had lambs to sell.

Hotel Foreclosures Continue to Plague Greece’s Islands

A surge in hotel foreclosures across Greece’s islands threatens small tourism businesses, despite booming visitor numbers and record-breaking travel in 2024.

Athens Launches Task Force to Safeguard Historic City Center

The new municipal unit will ensure compliance to zoning laws, curb noise, and address tourist rental issues starting from the Plaka district.

WTTC: Travel & Tourism to Create 4.5M New Jobs in EU by 2035

This year, international visitor spending is set to reach 573 billion euros, up by more than 11% year-on-year

IMF: US Tariffs Shake Global Economy, Outlook Downbeat

IMF slashes global growth forecast to 2.8% as U.S. tariffs create uncertainty and ‘negative supply shock

First Step Towards New Audiovisual Industry Hub in Drama

The project is set to contribute to the further development of Greece’s film industry and establish Drama as an audiovisual hub in the region

Airbnb Greece – Initial CoS Ruling Deems Tax Circular Unlawful

The case reached the Council of State following annulment applications filed by the Panhellenic Federation of Property Owners (POMIDA)

Mitsotakis Unveils €1 Billion Plan for Housing, Pensioners, Public investments

Greek Prime Minister Kyriakos Mitsotakis has announced a new set of economic support measures, worth 1 billion euros, aiming to provide financial relief to citizens.

Alter Ego Ventures Invests in Pioneering Gaming Company ‘Couch Heroes’

Alter Ego Ventures' participation in the share capital of Couch Heroes marks yet another investment by the Alter Ego Media Group in innovative companies with a focus on technology.

Corruption Still Plagues Greece’s Driving Tests

While traffic accidents continue to claim lives on Greek roads daily, irregularities and under-the-table dealings in the training and testing of new drivers remain disturbingly widespread

![Accor: Η βιωσιμότητα «κλειδί» για την ανάπτυξη και ανθεκτικότητα του ελληνικού τουρισμού [έρευνα]](https://www.ot.gr/wp-content/uploads/2025/04/thumbnail-90x90.jpg)

![Accor: Η βιωσιμότητα «κλειδί» για την ανάπτυξη και ανθεκτικότητα του ελληνικού τουρισμού [έρευνα]](https://www.ot.gr/wp-content/uploads/2025/04/thumbnail-600x400.jpg)

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης