The Ministry of Finance wants to scrutinize 221,000 professionals who appear at the Tax Office with zero income or with losses.

With the new bill presented at the next cabinet meeting, the government’s economic staff will attempt a strong blow to tax evasion, which in terms of VAT alone cost the state coffers 3.2 billion euros in 2021.

With myDATA as a key weapon, electronic invoicing, locked and pre-filled codes for income and expenses in income tax and VAT returns, the expansion of POS throughout the market and the interconnection of cash registers with POS, the financial staff aims to reveal of the real incomes of professionals and the self-employed.

The data

According to the data provided by the Minister of National Economy and Finance Kostis Hatzidakis, out of a total of 676,000 tax statements of self-employed professionals, 32.7% declare zero income, an additional 25.5% declare income up to 5,000 euros and there is also a rate of 20% which indicates incomes over 10,900 euros.

As stated by Kostis Hatzidakis, “we will not increase the tax rates for the self-employed” but in the ministry’s plans are changes in their taxation system with the aim of a “fairer system” that will allow the abolition of the profession fee while creating fiscal space for the reduction of the tax burden as a whole, over time.

As part of the fight against tax evasion, by the end of the year, a decision is expected to be issued on the sectors that must have a POS, which will stipulate that at the beginning of 2024 they will have to have a POS and accept card payments taxis, cinemas, street markets, kiosks, grocery stores, insurance companies, brokerage firms, concert venues.

The “VAT gap”

In the meantime, according to the Commission’s report on the “VAT gap”, Greece, in 2021, lost 17.8% of the VAT revenue it could have collected, or 3.231 billion. euros due to tax evasion and fraud. Although it is in third place among the EU countries. with the biggest VAT losses after Romania and Malta, Greece managed to close the “VAT gap” by 3.2 percentage points compared to 2020 which had formed at 21%.

The total gap in VAT at EU level decreased by approximately 38 billion euros as from 99 billion EUR in 2020 was limited to EUR 61 billion in 2021 with the percentage of losses forming at 5.3% from 9.6%.

With the interventions launched on the tax evasion front, the Ministry of Finance aims to reduce the “VAT gap” to 9% by 2026, which brings at least 2 billion euros annually to state coffers that will be used for new tax breaks.

Latest News

Greek Government Reissues 10-Year Bond Auction for €200 Million

The amount to be auctioned will be up to 200 million euros, and the settlement date is set for Friday, April 25, 2025 (T+5)

Greece Defines Continental Shelf Limits and Maritime Zones in Landmark EU Document

The Maritime Spatial Planning (MSP) framework represents a comprehensive approach to spatial planning and is crucial for the successful development of a blue and circular economy

EU Praises Greece’s RRF Progress as Revised Recovery Plan Nears Completion

Athens is preparing to submit its revised “Greece 2.0” Recovery and Resilience Plan after Easter, with a slight delay from the initial timeline but with the European Commission’s approval.

Greek €200M 10Y Bond to be Issued on April 16

The 3.875% fixed-interest-rate bond matures on March 12, 2029, and will be issued in dematerialized form. According to PDMA, the goal of the re-issuance is to meet investor demand and to enhance liquidity in the secondary bond market.

German Ambassador to Greece Talks Ukraine, Rise of Far Right & Tariffs at Delphi Economic Forum X

Commenting on the political developments in his country, the German Ambassador stressed that it was clear the rapid formation of a new government was imperative, as the expectations across Europe showed.

Athens to Return Confiscated License Plates Ahead of Easter Holiday

Cases involving court orders will also be excluded from this measure.

Servicers: How More Properties Could Enter the Greek Market

Buying or renting a home is out of reach for many in Greece. Servicers propose faster processes and incentives to boost property supply and ease the housing crisis.

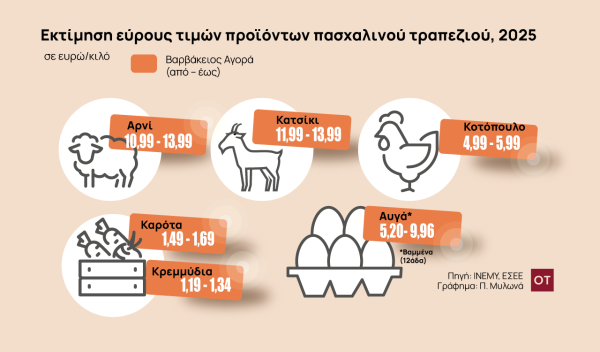

Greek Easter 2025: Price Hikes on Lamb, Eggs & Sweets

According to the Greek Consumers’ Institute, hosting an Easter dinner for eight now costs approximately €361.95 — an increase of €11 compared to 2024.

FM Gerapetritis Calls for Unified EU Response to Global Crises at EU Council

"Europe is navigating through unprecedented crises — wars, humanitarian disasters, climate emergencies," he stated.

Holy Week Store Hours in Greece

Retail stores across Greece are now operating on extended holiday hours for Holy Week, following their Sunday opening on April 13. The move aims to accommodate consumers ahead of Easter, but merchants remain cautious amid sluggish market activity.

Αριθμός Πιστοποίησης

Αριθμός Πιστοποίησης